John Gorlow

| Mar 14, 2018

Volatility roiled the markets in February. As the dust settled, the February employment report came out and it was golden: 313,000 new jobs were added to US payrolls, the greatest single-month gain since July 2016. So why is the market nervous? Many investors are eyeballing interest rates as the culprit. (Not to discount the unpredictable antics of the White House.) This month we look at the impact of rising rates on REITs, a particularly vulnerable sector. First, the February numbers.

February Market Report

All numbers in US Dollars

S&P 500

February was a difficult month for investors as intraday volatility increased, with four days posting at least a 4% spread between the high and low, compared with only two sessions with a swing like that over the past five years. The S&P 500 corrected 10% and then rebounded to finish February -5.5% lower from its January peak and off -3.9% for the month, making February returns the worst month since January 2016. Year-to-date, the index remained in positive territory returning 1.83%. For the three-month period, the index returned 2.96% and for the one-year period returns on the index remained a healthy 17.10%.

S&P Small Cap 600

The S&P Small Cap Index lost -3.97% in February after January’s 2.47% gain, finishing the month with a negative -1.44% year-to-date return. For the three-month period, the Small Cap Index returned negative -1.95%, outperforming its Large Cap brother. Over one year, however, Small Caps returned a positive 10.29%, underperforming large caps. Over the 10-year period, the Small Cap Index had an annualized return of 11.17%, the highest among the major domestic indices.

Global Markets

Global markets, which began to pull back in late January, continued declining in early February, ending a 15-month streak of positive monthly returns dating back to late 2016. For February, the MSCI All Country World Index, a barometer of stocks around the world, returned negative -4.20% after January’s 5.64% gain. Year-to-date, global markets were up 0.81%, including the US coming in above par at 1.83%, and still eking out a small 0.59% gain ex-US. For the three-month period, global stocks lagged domestic stocks returning 2.84% versus 2.96% for the US. For the one-year period, US stocks underperformed the rest of the world. Over one year, global markets returned 18.79%, but absent the 17.10% US return, global markets climbed 21.63%. Over the trailing three years, US stocks did better. The global three-year return was 8.34%, but absent the 11.14% US gain, the global ex-US three-year return was 6.24%.

Emerging Markets

After a January gain of 8.55%, emerging markets posted a broad -4.61% decline in February, producing a year-to-date return of 3.34%, the highest of the major categories. For the three-month period, emerging markets added 7.05%, for a one-year return of 30.51%. Over the three-year period, emerging markets underperformed developing markets, returning 8.97%.

Developed Markets

Developed markets fell -4.14 in February after gaining 5.28% last month. They were up 0.92% YTD, but off 0.31% ex-US. Developed markets were up 2.28% for the three-month period (1.48% ex-US), and they were up 17.36% for the one-year period (18.87% ex-US).

Yields, Rates, and Commodities

The 10-year US Treasury Bond closed at 2.86%, up from last month’s 2.72%. The 30-year US Treasury Bond closed at 3.13%, up from last month’s 2.94%. Gold closed at 1,318.90, down from last month’s 1,348.70. Oil moved down to close the month at $61.53 from last month’s $64.85. US gasoline prices increased, closing the month at $2.66, down from last month’s $2.72.

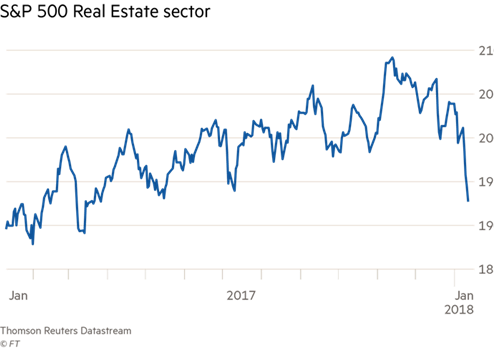

US Real Estate Stocks

Real estate stocks have tumbled since the start of the year as rapidly rising Treasury yields have rocked the rate-sensitive sector. The real estate sector of the S&P 500 dropped -7.2% in February, bringing its YTD decline to nearly -11% and making it the worst performer of the broader index.

………………………………………………………………

Feature: REITs, Rates, and What To Do Now

As strong economic data emerges from the US, Europe and Japan, banks are ending their accommodative monetary policies and bond yields are rising. Many investors believe this spells trouble for the real estate sector of the S&P 500, dominated by Real Estate Investment Trusts (REITs). REITs borrow money, and higher interest rates can increase the cost of that borrowing. That’s not good news. Investor worry about REITs is evident in this chart:

The numbers are the numbers. But looking ahead, what do they tell us about the direction of REITs? Depends on your perspective.

On one hand, the dire projections could be offset by a variety of factors. If interest rates are rising due to a strong global economy, this could be a net positive for the real estate sector, fueling strong consumer demand, lower vacancy rates, and higher rental income. Plus, many REITs are insulated from rising interest rates by fixed rate debt.

On the other hand, many real estate analysts see an ominous real estate glut that could drive down rents and property values in high-flying markets including Manhattan, Austin, San Francisco, Seattle and Los Angeles. Even the relatively high dividends of REITs may not be enough to offset the attractiveness of fixed income securities with less risk.

What’s an investor to do?

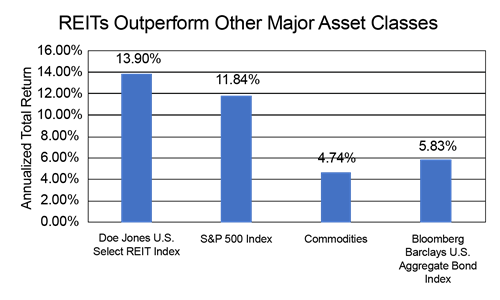

First, consider why REITs are a good investment. They enable investors to diversify in real estate without being a landlord. They provide strong long-term total returns, high dividend yields, and a hedge against inflation. REITs outperform other assets classes as shown in the following chart, which tracks 27 years of performance:

Source: S&P Dow Jones Indices LLC; Barclays Capital.

Data from Feb 28, 1991 to Feb 28, 2018.

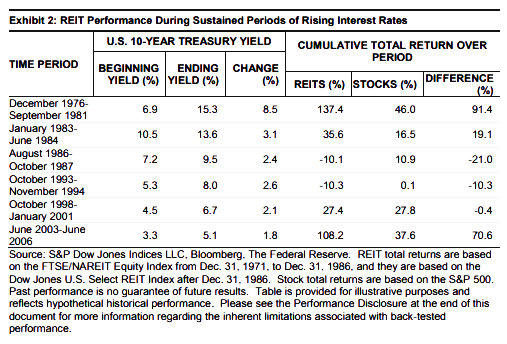

Second, while rising interest rates have an impact on the value of real estate and REITs, higher rates don’t necessarily lead to poor returns. According to the same report referenced above, (The Impact of Rising Interest Rates on REITs, Orzano & Welling): “Since the early 1970s, there have been six periods during which 10-Year US Treasury bond yields rose significantly. In four of those six periods, US REITs earned positive total returns, and in half of those periods, US REITs outperformed the S&P 500. In one of the periods, US REITs and the S&P 500 essentially posted identical performances, and in only two periods did the S&P 500 outperform US REITs.”

In other words, it’s difficult to make a connection between rising interest rates and REIT performance.

Bottom line from the S&P report: “Ultimately, whether interest rates are rising or falling does not seem to be the key driver of REIT performance over medium- and long-term periods.” Rather, it’s “the underlying factors that drive rates higher.” If the economy is heating up, growth is accelerating, and consumers are buying and renting, that could result in higher rents and higher REIT dividends. Time will tell.

Like all investments, REITs are not immune to sudden swings, especially when the Fed makes comments about interest rate hikes. But that’s nothing to be concerned about in a well-diversified, long-term portfolio. The market will always factor in expectations and news before investors do.

So what should you do right now? Don’t react. Be sure you are appropriately allocated for your investment targets. Rebalance if needed. Understand that investments swing up and down all the time, and day-to-day performance has nothing to do with following a sound and proven strategy. Here’s a link to a DFA article that nicely sums up the benefits of long-term thinking and a proven investment strategy. Read it and then go on enjoying your life.

https://us.dimensional.com/now-and-then

Do you have questions or concerns? Call me, I am here to help.