John Gorlow

| Sep 13, 2017

There’s a big anniversary coming up, and the financial press won’t let you forget it. It’s the tenth anniversary of October 9, 2007, the beginning of a ferocious two-year global bear market. It was a treacherous time for investors: Lehman Brothers collapsed, the S&P 500 lost half its value, and governments around the world rushed to prop up failing banks and markets. There was nowhere to hide. What would you have done differently?

In retrospect, “nothing” would be a good answer. But doing nothing during those two awful years required serious fortitude. Even the most well-diversified, buy-and-hold, long-term passive investors were hammered. Headlines like “Worst Crisis Since ‘30s” and “Markets in Disarray” offered no reassurance. It felt like falling into a bottomless pit.

Investors had various coping strategies. Some put on blinders and quit watching the financial news. Many quietly recalculated their retirement dates. Some tweaked their holdings as markets continued to fall. Others simply bailed out, not able to withstand the stress. But those who held on to the very bottom were rewarded with a bull market that ran from 2009 to 2015, then, after some bumps, defied the odds to climb to the current highs of 2017. “Bull trend strengthens, charting the approach of S&P 2,500” trumpeted Market Watch yesterday (September 12, 2017).

Ten years later, is there a whisper in your ear that it could happen again…soon? And when the next bear market arrives, will you be ready? Before you answer, remind yourself:

- Financial markets behave unpredictably in the short run, but in the long run capital markets reward investors.

- It’s difficult if not impossible to time the markets, though we’ll always have pundits and prognosticators who explain what happened or predict what’s about to happen. They’re often incorrect.

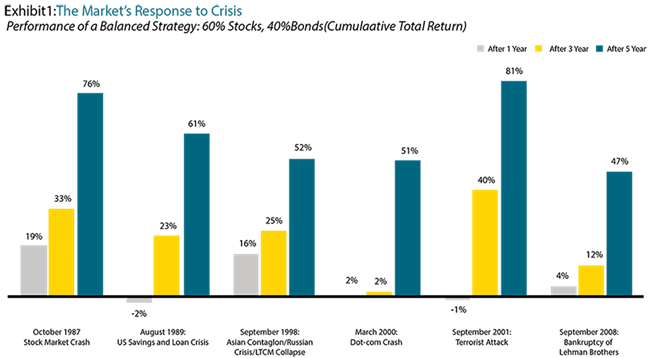

- Periods of substantial volatility have occurred throughout market history. These periods may be unpredictable, but they are not unusual. Volatility is part of investing; hanging on during volatility leads to rewards over time. This chart from DFA illustrates the point:

DFA notes: The exhibit shows the performance of a balanced investment strategy following several crises, including the bankruptcy of Lehman Brothers in September of 2008, which took place in the middle of the financial crisis. Each event is labeled with the month and year that it occurred or peaked. Although a globally diversified balanced investment strategy invested at the time of each event would have suffered losses immediately following most of these events, financial markets did recover, as can be seen by the three- and five-year cumulative returns shown in the exhibit

So, are you prepared for the next bear market?

- Yes, if you have a well-diversified investment portfolio that reflects your risk tolerance and personal timeline. Older investors may be less risk tolerant than younger investors with a 30- or 40-year investment horizon.

- Yes, if your portfolio is grounded in an investment philosophy that has withstood rigorous research and testing. Passively managed index investing, for example.

- Yes, if you are able to stick with your plan even in the face of a plummeting market. Over seventeen months from October 9, 2007 to March 6, 2009, the DJIA plunged 54%. Then it climbed, and climbed some more. And just as surely it will decline again. We just don’t know when.

There is no perfectly safe harbor for investors. Things happen to rattle or reassure the markets every single day. Witness the recent hurricanes that pummeled the Caribbean and Florida. All we can do is to be as prepared as possible, and to stay anchored in what we know to be true about how markets work.

Do you have questions or concerns? Call me. I am here to help.

Now let’s take a look at last month’s numbers.

AUGUST 2017 MARKET REPORT

(with thanks to S&P & DFA)

World Asset Classes

Global markets as measured by the MSCI All Country World Index (ACWI) managed a small gain in August, extending their streak to 10 consecutive months of positive returns. The US continued to be a sub-par performer, posting a 0.19% return versus 1.89% in the prior month. For the three-month period the ACWI returned 3.66%, and the US posted a 3% return, leaving the ACWI up 4.55% ex the US. Emerging Markets continued to do better than developed markets returning 2.23% after last month's 5.96%, bringing their one-year return to 24.53%. Their return over the two-year period was 18.01%, but their three-year return was only 2.38%, showing the volatility of developing markets. Developed markets returned 0.14% for the month but that turned to a negative -0.02%, excluding the U.S. The value effect was negative around the world. Small caps underperformed large caps in the US and emerging markets but outperformed in non-US developed markets.

US Stocks

The broad US equity market posted slightly positive returns for the month. Value underperformed growth indices in the US across all size ranges. Small caps underperformed large caps.

As of 08/31/17

|

|

|

|

|

|

|

Data Series

|

1 Mo |

YTD |

1 YR |

3Yrs* |

5 Yrs* |

10 Yrs* |

| Marketwide |

0.19 |

11.20 |

16.06 |

9.08 |

14.27 |

7.70 |

| Large Cap |

0.31 |

11.79 |

16.16 |

9.21 |

14.37 |

7.73 |

| Large Value |

-0.16 |

4.81 |

11.58 |

6.74 |

13.25 |

5.96 |

| Large Growth |

1.83 |

19.17 |

20.82 |

11.67 |

15.41 |

9.39 |

| Small Cap |

-1.27 |

4.42 |

14.91 |

7.67 |

13.15 |

7.38 |

| Small Value |

-2.46 |

-1.31 |

13.47 |

7.07 |

12.51 |

6.46 |

| Small Growth |

-0.12 |

10.78 |

16.39 |

8.20 |

13.75 |

8.21 |

| *Annualized |

|

|

|

|

|

|

International Developed Stocks

International developed markets underperformed the US equity and emerging market indices during the month. Looking at the broad market, the value effect was negative. Small caps outperformed large caps in non-US developed markets.

As of 08/31/17

|

|

|

|

|

|

|

Data Series

|

1 Mo |

YTD |

1 YR |

3Yrs* |

5 Yrs* |

10 Yrs* |

| Large Cap |

-0.02 |

16.15 |

17.14 |

2.24 |

7.90 |

1.59 |

| Small Cap |

0.84 |

20.52 |

20.50 |

6.37 |

11.59 |

3.99 |

| Growth |

0.57 |

19.09 |

14.46 |

3.81 |

8.35 |

2.32 |

| Value |

-0.61 |

13.43 |

19.80 |

0.60 |

7.38 |

0.78 |

| *Annualized |

|

|

|

|

|

|

Emerging Markets Stocks

In US dollar terms, emerging markets indices outperformed both the US and developed markets outside the US. Looking at broad market indices, the value effect was negative across emerging markets. Large caps outperformed small caps in emerging markets.

As of 08/31/17

|

|

|

|

|

|

|

Data Series

|

1 Mo |

YTD |

1 YR |

3Yrs* |

5 Yrs* |

10 Yrs* |

Large Cap

|

2.23 |

28.89 |

24.53 |

2.38 |

5.30 |

2.43 |

| Small Cap |

1.95 |

22.48 |

16.35 |

1.61 |

5.86 |

2.46 |

| Growth |

2.27 |

28.62 |

24.99 |

2.75 |

5.67 |

2.76 |

| Value |

2.14 |

22.22 |

21.80 |

-0.60 |

2.99 |

1.91 |

| *Annualized |

|

|

|

|

|

|

Real Estate Investment Trusts (REITs)

Non-US real estate investment trusts outperformed US REITs.

As of 08/31/17

|

|

|

|

|

|

|

Data Series

|

1 Mo |

YTD |

1 YR |

3Yrs* |

5 Yrs* |

10 Yrs* |

| Dow Jones U.S. Reit Index |

-0.79 |

1.48 |

-3.13 |

7.03 |

8.67 |

5.69 |

| S&P Developed Ex U.S. Reit Index |

0.11 |

9.75 |

0.42 |

1.60 |

6.21 |

0.87 |

| *Annualized |

|

|

|

|

|

|

Commodities

The Bloomberg Commodity Total Return Index managed to return 0.40% during August versus 2.26% for the prior month, bringing the three-month return on the index to 2.48%. Industrial Metals led the index higher, with Nickel returning 15.4%, and Zinc 12.6%. Agriculture was the worst-performing complex down 6.9%, with grains declining 8.50%.

Fixed Income

Interest rates fell across the US fixed income market during July. The yield on the 5-year Treasury note decreased 14 basis points (bps) to 1.70%. The yield on the 10-year Treasury note decreased 18 bps to 2.12%. The 30-year Treasury bond yield decreased 16 bps to finish at 2.73%. The yield on the 1-year Treasury bill held firm at 1.23%, and the 2-year Treasury note yield fell 1 bp to 1.33%. The yield on the 3-month bill decreased 6 bps to 1.01%. The yield on the 6-month bill decreased 5 bps to 1.08%. In terms of total returns, short-term corporate bonds gained 0.34% and intermediate corporates gained 0.88%. Short-term municipal bonds gained 0.22%, while intermediate muni bonds returned 0.66%. High Yield Corporate Bonds returned 0.12%.

As of 08/31/17

|

|

|

|

|

|

|

Data Series

|

1 Mo |

YTD |

1 YR |

3Yrs* |

5 Yrs* |

10 Yrs* |

| Barclays Municipal Bond Index |

0.76 |

5.20 |

0.88 |

3.40 |

3.23 |

4.73 |

| Barclays U.S. Aggregate Bond Index |

0.90 |

3.64 |

0.49 |

2.64 |

2.19 |

4.40 |

| Barclays U.S. Corporate High Yield Index |

-0.04 |

6.05 |

8.63 |

4.77 |

6.47 |

8.02 |

| Barclays U.S. Government Bond Index |

1.06 |

3.12 |

-0.84 |

2.12 |

1.37 |

3.76 |

| Barclays U.S. TIPS Index |

1.06 |

2.38 |

0.46 |

0.98 |

0.25 |

4.11 |

| BofA ML1-Year US Treas Note Index |

0.10 |

0.54 |

0.65 |

0.47 |

0.39 |

1.11 |

| BofA ML 3-Month US Treas Bill Index |

0.09 |

0.48 |

0.62 |

0.29 |

0.20 |

0.50 |

| Citi World Govt Bond Index 1-5 Years (hedged to US) |

0.34 |

1.24 |

0.95 |

1.40 |

1.37 |

2.39 |

| *Annualized |

|

|

|

|

|

|