John Gorlow

| Feb 10, 2018

January markets continued a year-long winning streak, racking up 10 record-breaking closings in just 13 trading days. Everything looked rosy as the year began: the US economy and global economy were picking up nicely, spurred by low interest rates and big corporate tax breaks. Then February arrived with a jarring 10% correction in just the first nine days of the month. Hold on to your seat. Volatility is back in both stocks and bonds.

As markets swing up and down, we want explanations. The pundits have plenty to offer. Those wild market swings? It’s the unintended consequences of the new tax law. It’s the Trump presidency and dearth of leadership. It’s the tightening of money and the prospect of faster interest rate hikes. It’s the US economy heating up too fast. It’s higher wages and pressure on profits. It’s the ballooning federal deficit.

It all seems plausible. But what if February’s volatility is the crack that busts open a nearly nine-year-old bull market? What if inflation and interest rates accelerate even more than expected? What if monetary tightening leads to an unexpected slow-down? What if the rosy consensus about growth isn’t real? What about all the unforeseen risks that are not yet priced into the market?

You know you have to be disciplined. Diversified. And have a strategy. And as a regular reader of our monthly reports, I hope you also understand that volatility is part of the big picture for long-term investors. It’s how markets work. It’s how markets have always worked.

Follow facts, not fear

Consider a few time-tested, research-backed facts. First, stocks always have an expected positive premium, whether markets are going up, down or sideways. This is true at the peak of a bull market and the deepest valley of a bear market. If it weren’t true, there would be no reason to invest in stocks; we’d all be in fixed income.

Second, market highs and lows are not predictive of future market behavior. DFA looked at monthly closing levels of the S&P 500 from 1926 through 2017. In one-third of these months—1,103 months in all—the index recorded new closing highs. DFA found little difference in future performance of the S&P 500 after new monthly closing highs compared to previous closes at all levels (up, down or flat). Over three years, the index rose about 84% of the time after a previous month’s closing high, and 83.5% of the time after any previous level; over five years, it rose 84.2% of the time after new highs, and 87.5% higher after any previous level. The average gains for the S&P 500 were similar too, with the greatest divergence at five years (89.2% gain after new highs and 85.0% at all levels). In other words, the expected positive premium of stock investing shows up in every kind of weather.

Third, even if your gut tells you markets will continue to fall, a substantial body of research demonstrates why it’s a bad idea to react. Market declines are common, and intra-year declines of greater than 10% have occurred about half the time since 1979. And yet calendar year returns were positive in 33 out of 39 of those years (research courtesy of DFA). Missing out on even a few of the best days of market returns can greatly damage long-term performance. If you were fully invested in the S&P 500 between 1990 and 2017—a period of huge price swings—you would have earned an annualized compound return of 9.81%. Missing the fifteen best days of those years would have shaved off roughly one-third of your return. Had you missed the 25 best days—less than one month in 27 years—your returns would be slashed by more than half, to just 4.35%. For comparison, T-bills returned 2.77%. Market timing is a fool’s game.

Remain invested at an appropriate risk level for your time and money, stay diversified, and ignore the news. Don’t act on fear. If you are concerned about your risk exposure, let’s evaluate where you stand. If something has changed, please let us know. We are here to keep you on course.

Now let’s look at market performance in the first month of 2018.

January 2018 Market Report

All numbers are total returns reported in US Dollars

All major market indexes turned in strong January performances with the exception of domestic small caps, which lagged with a one-month return of 2.53%. The MSCI Emerging Markets index raced to the lead with an impressive one-month return of 8.33%, while the S&P 500 delivered 5.73%. The MSCI All Country World Index posted its 15th consecutive month of gains, with a January return of 5.64%.

US Stocks

It was another high-flying month for US stocks. The S&P 500 recorded 14 new closing highs in January for a 5.73% return. It was the index’s best performance since January 1997 and its 15th consecutive winning month on a total return basis. The S&P 500 posted a three-month return of 10.18%, a one-year return of 26.41%, and a return of 35.22% since the November 8, 2016 election. Over ten years the S&P 500 returned 9.78%.

It was a different story for the S&P Small Cap 600 Index, which eked out a mere 2.53% in January. Small caps also lagged all other major indexes over three months (5.59%) and one year (16.56%). But the benefits of diversification are evident over the ten-year period, when small caps outperformed all major indexes including the S&P 500 (11.26% vs. 9.78%).

Global Markets

Global markets continued a winning pattern that began in November 2016, with shifting patterns in US and ex-US performance. The MSCI All Country World Index added 5.64% for the month, but fell to 5.57% ex-US. In contrast, over the trailing one-year period, global markets beat the US, returning 27.48% vs. a higher 29.68% ex-US. The US comes out on top again over three years, with global cumulative returns totaling 37.93%, and 32.37% ex-US.

Emerging markets were the top performer, returning 8.33% in January, while developed markets gained 5.28% (4.66% ex-US). Over one-year, emerging markets returned 41.01%, and developed markets returned 25.83% (26.24% ex-US).

Fixed Income

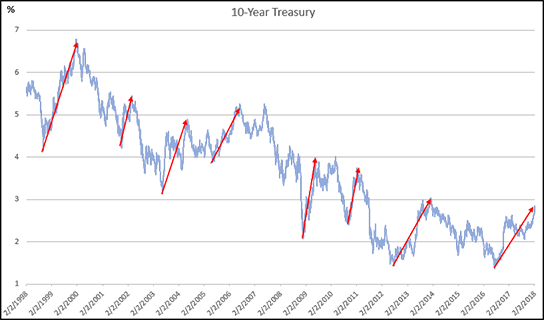

Fear is infecting not only stocks but bonds. The fear is that a 37-year bond bull market will come to an end, killed off by high inflation, high short-term interest rates, and decreased government bond purchasing. Maybe yes, maybe no. We've seen this before. In the chart below, red arrows indicate near-term reversals in 10-Year Treasury yields over a period of 20 years.

(courtesy Raymond James)

It’s true that yields have risen to new near-term highs, with the 2.9% yield on 10-year treasuries up 80 basis points since September and over 100 basis points since mid-2016. But just because everyone agrees on what comes next doesn’t mean it will. Inflation could be lower than expected, aging baby boomers with a glut of savings could keep rates low, or US growth could be slower than expected for a wide variety of reasons.

Rather than run for the doors, use bonds in your portfolio as you always have, as a less risky alternative to stocks. Invest in stocks higher total returns. For fixed income, stick with a laddered approach utilizing bond funds or individual maturities to mitigate interest rate risk while staying invested.

January 2018 Fixed Income Performance

In the US, interest rates increased across the yield curve as Treasury prices declined. The yield on the 1-month US Treasury bill increased 0.14% ending the month at 1.43%. The yield on the 2-year US Treasury note increased 0.22% to finish at 2.14%. The yield on the 10-year US Treasury note increased 0.26% to end at 2.72%. Long-term government bonds took a beating, falling 3.15% as the yield on the 30-year US Treasury bond increased 0.14% to end the month at 2.95%.

Do you have questions or concerns? Call me, I am here to help.