John Gorlow

| Sep 13, 2018

As the spread between long and short-term Treasuries flattens, three words are stirring fear on Wall Street: inverted yield curve. Is the long economic expansion that began in 2009 nearing its inevitable end? More to the point, how should you respond to worrisome noise about recessions and sinking stock prices? We’ll offer our perspective after a quick look at August market performance.

Global Markets

In August, global markets as measured by the MSCI All Country World Index returned 0.79%, but absent the 3.26% gain from the US, global markets were down -2.09% for the month. YTD the US returned a solid 9.94% as measured by the S&P 500, whereas the global markets ex-the US finished the period slightly in the red, down -3.53%. Zooming out for the trailing two years, global markets returned a robust 30.48% with the US and a healthy 22.66% without it, and for the trailing three years, global markets returned 39.93% with the US and a strong 26.24% ex the US.

US Equities

The S&P 500 Index registered its fifth consecutive month of gains in August, posting a 3.26% return after last month’s 3.72% increase, bringing its YTD return to 9.94% and its one-year return to 19.66%. The Russell 2000 Small Cap Index rose for the sixth consecutive month, adding 4.31%, bringing its YTD return to 14.26% and its one-year return to 25.45%. From a style perspective, growth continued to dominate across the entire spectrum of market caps.

International Equities

Turning to International Developed markets, the MSCI World Ex US Index posted a negative -1.89% return in August, dragging its YTD return down to negative -2.26% and reducing its trailing one-year return to positive 4.51%. Zooming out, International Developed markets returned 22.43% cumulatively over the trailing two years. International Small Caps, as defined by the MSCI World Ex US Small Cap Index, returned negative -0.69% for August, bringing its YTD return down to negative -1.56%. For the trailing one-year period, International Small Caps returned 7.03%. For the trailing two years, International Small Caps returned 28.97%.

Emerging Market Equities

Emerging Markets as measured by the MSCI Emerging Market Index continued to see volatility, posting a negative -2.70% return in August, negating the July gains. Excluding a strong January, Emerging Markets remain under pressure, losing -14.33% over the past seven months and slightly in the red for the trailing 12 months, down -0.68%. But zooming out for the trailing two years, Emerging Markets returned a healthy 23.68%.

Real Estate Securities

As measured by the Dow Jones US Select Reit Index, US Real Estate securities continued their winning ways for the sixth consecutive month, returning 2.98% in August and bringing the six-month return to 18.30%. International Real Estate securities, as measured by the S&P Global Ex-US Reit Index, mimicked the performance of International Developed equities, losing -1.18% in August and bringing the YTD return down to -1.46%, but remaining positive with a 3.83% return for the trailing 12 months.

Fixed Income Securities

The 10-year US Treasury Bond closed the month at 2.86%, down from last month’s 2.96%. Barclay’s US Corporate Bond High Yield Index added 0.74% for the period. Barclay’s US Aggregate Bond Index gained 0.64%. Barclay’s US TIP Index increased 0.72%. The US Three-Month T-Bill gained 0.18%. Oil increased to close at $69.92 per barrel. Gold continued its trend downward, closing the month at $1,205.30, a new monthly low for 2018.

Feature article

Curve Ball

Let’s start with a quick primer on the yield curve. In brief, the yield curve demonstrates the difference in interest rate returns on Treasuries with different maturity dates. A 2-year Treasury generally pays less interest than a 10-year Treasury, because investors expect to earn more for money that’s tied up for longer periods of time. The desired yield curve, then, should ascend like a gentle slope, rewarding long-term investors with higher interest.

When short and long-term rates become similar, it’s unsettling to investors. A common concern is that a transition from upward sloping to a flattening or inverted curve could signal a decline in equity markets. The curve has been flattening for some time now. One year ago, the spread between yields on the 2-year Treasury and 10-year Treasury was 79 basis points. Today it’s 24 basis points.

It’s even more troubling when the yield curve moves from flat to inverted (“an upside down turtle” is how one reporter describes it). Exactly how much worse is open to interpretation, but history suggests that an inverted yield curve signals a deteriorating economy, lack of investor confidence, a drop in equity prices, a recession in the near future, or all of the above.

But here’s where it gets interesting. A flat yield curve doesn’t always become inverted. And an inverted yield curve doesn’t always signal an imminent recession.

“An inverted yield curve has accurately predicted every recession going back to the mid-1960s, with only one false positive, in 1966,” writes Derek Horstmeyer (The Best Investments in Case of an Inverted Yield Curve, 9-Sept 2018, WSJ). And yet in the years before then, between 1926 and 1966, eight recessions occurred, and “only once did an inverted yield curve manifest within a year before a given recession,” he adds. So, while an inverted curve may predict a recession, we can’t know when it will arrive, how long it will last, how severe it will be, or how (and when) equity markets will negatively react.

That’s one reason it may be prudent to hold steady when other investors start running for the exits. Another is that even when the markets go south, it’s impossible to predict when they will turn positive again. Timing investments around the behavior of the yield curve is guesswork, driven by fear. A recent DFA study shows why this is not smart strategy.

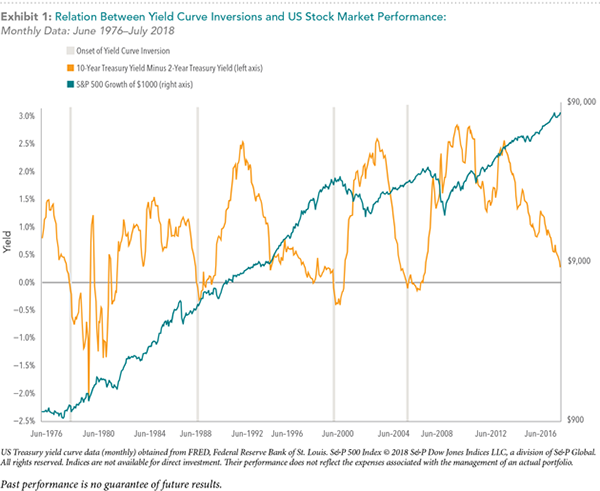

In an August 2018 research paper, DFA analyzed US stock returns during four periods of yield curve inversion between June 1976 and June 2016. The chart below shows what happened to a hypothetical $1,000 investment in the S&P 500 Index when plotted against the term spread (defined as the 10-year Treasury yield minus the 2-year Treasury yield). Let’s assume you had followed conventional wisdom and bailed out of stocks when the yield curve inverted in February 2006. Over the next 12 months, the S&P 500 generated a return of 11.97%. The yield curve then returned to positive territory in June 2007. A good time to get back in? No, that would be bad timing again, as the market turned down with a vengeance between October 2007 and February 2009. Investors who moved both out of and back into the market based on the inversion suffered substantial losses.

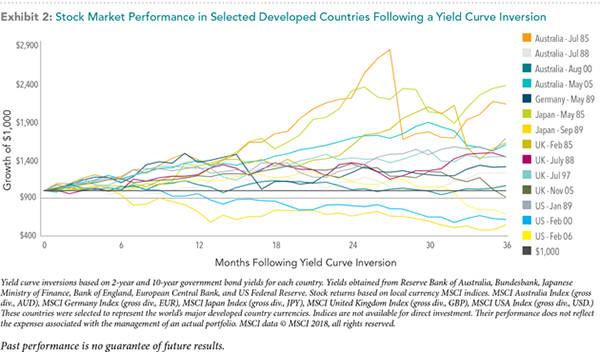

There have been relatively few yield curve inversions in the US over the past forty years. To increase the sample size, DFA looked at other countries, examining equity returns (as measured by MSCI local currency indices) following yield curve inversions. In the three years following an inversion, US stock returns were higher 66% of the time at the 12-month mark, but only 33% of the time 36 months later. But when all countries were included, the numbers improved to 86% of the time at the 12-month mark, and 71% of the time at 36 months. The takeaway: “It is difficult to predict the timing and direction of equity market moves following a yield curve inversion.”

Is It Different This Time?

“In general, inverted yield curves have always accompanied restrictive market conditions that were initiated to reduce inflationary excesses and to moderate economic activity,” notes Burton Malkiel in a recent WSJ editorial (30-July 2018). Malkiel, author of A Random Walk Down Wall Street, has spent a lifetime examining market conditions and equity prices. He points to the ferocious recession following the housing market bubble, when the “air was not let out gently” and economic activity collapsed across the board. Today, he argues, it is it far more difficult to interpret the yield curve simply due to globalized financial markets and Central banks in Europe and Japan that have “monetary policies opposite those of the US Fed.” Inflation is under control. The economy is not being fueled by frothy speculation as it was during the mortgage bust. Credit crunches seem unlikely.

Some think Malkiel is viewing the world through rose-colored glasses, and an inverted yield curve will spell trouble if and when it appears. But like many others assessing the current economic climate, Malkiel sees the risk of a trade war and punitive tariffs as a greater threat to the markets than a flat or inverted yield curve.

Advice for the Cautious

Without a doubt, an inverted yield curve is concerning. But let me reinforce the data: it is not a reliable indicator of when a recession will arrive or how severe it will be. Nor is it an indicator of when or how much the equity markets will decline. We’ve seen increasing volatility and losses, and some parts of the market are under intense pressure. You can read the numbers in this month’s market report. But bear in mind that recent losses follow on the heels of remarkable gains. Across markets, trailing two-year returns around the world remain in strongly positive territory.

Over many years of financial advising, I’ve witnessed investors trying to time the market, particularly when they’re worried about sinking stock prices. This runs counter to their own best interests. Even when markets turn down, trying to time the market is a hopeless endeavor that often results in losses that can never be recouped. Substantial evidence shows that missing the best day, the best week, or the best month in any given year has a profound impact on long-term gains (we’ve reported on this previously; ask if you’d like to see the data).

Here’s a better idea: review your portfolio and rebalance if needed to maintain your targeted stock/bond allocations. Revisit your goals and the likelihood of reaching them by sticking to your plan.

A recession may occur in 2019, 2020 or later, but that shouldn’t be cause for fear-based decisions. Don’t cut your equity holdings based on a gut feeling, op-ed pieces, daily stock data, or conversations with friends. When the waters get choppy, look downwind and tack to the next port. An inverted yield curve should not impact your confidence in the markets or how they work.

A Final Note: Standards of Conduct

Two other news items caught my attention this past week, neither of them related to the inverted yield curve. The first was coverage of Serena Williams’ meltdown during the Women’s US Open Finals. The second was a 9-Sept WSJ article, The Fiduciary Rule is Dead. What’s an Investor to Do Now?

For those not familiar with the incident, Williams managed to rack up three infractions that cost her a warning, a point, and a full game, in that order. Her on-court reaction to these penalties was angry, tearful and challenging. Both Serena and her coach pointed out that men get away with similar behavior all the time. Whether you agree that her treatment was unfair or not is beside the point. For me, it’s all about her comportment.

In the New York Times, tennis great Martina Navratilova wrote: “I don’t believe it’s a good idea to apply a standard of ‘If men can get away with it, women should be able to, too.’ Rather, I think the question we need to ask ourselves is this: What is the right way to behave to honor our sport and to respect our opponents?” (Serena’s opponent, by the way, was a composed and confident 20 year-old named Naomi Osaka.)

A standard is a principle or code of behavior that we set for ourselves and live by, regardless of how others behave. “If they can get away with it, I should be able to get away with it” is not a standard to live by.

That same week, the Wall Street Journal reported that Obama-era consumer financial regulations essentially have been gutted, warning investors, “Regulation is in flux, and different types of professionals are held to different standards…. So, it can be hard to know what you’re paying for.” I would call this an understatement. The previous administration estimated that conflicts of interest cost consumers approximately one percentage point in annual returns. Consider the magnitude of that giveaway over a life of investing.

When the Wall Street Journal has to remind readers that the names various investment advisors go by matter a great deal, that the standard of care is determined by where that advisor works, and that fee-based accounts at brokerage firms often have hidden conflicts of interest, what chance does the average consumer have? You’re back to swimming with the sharks on your own, Mr. and Mrs. Investor. Good luck.

I find both pieces of news—Serena’s meltdown and the demise of a consumer-friendly fiduciary rule—disheartening for the same reason. Standards of conduct appear to be missing. In their place are rules and requirements, loosely interpreted. The idea of comportment feels as old-fashioned as Jello salad at Thanksgiving.

At Cardiff Park we continue to support the values of integrity, honesty, dignity and self-respect. That includes how we work with each other in the office, and how we treat each client, regardless of wealth under management. It’s not what’s required. It’s what we stand for, and the right way to be.

Do you have questions or concerns? Call me. I am here to help.

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell

760.284.5550 Fax

jgorlow@cardiffpark.com