John Gorlow

| Mar 04, 2020

Stocks and bonds in the US, and in many other developed markets and emerging markets, generated strong returns in 2019. Global equities were up more than 25%, and fixed income added more than 8%. For some, this performance is tinged with worry. After all, the US bull market is a decade old, and current headlines hint at all kinds of potential catastrophes ahead. Globalization backlash, Brexit uncertainty, bitterly divisive politics, rising inequality and climate change, to name a few. But don’t let worry derail your investment strategy. It’s impossible to predict the future of the markets with certainty. Who can say what this year will bring, much less the next decade? The only certainty is that the future will be filled with surprises. This month we’ll consider the lessons of the past decade, and how they might guide us now. First, a review of fourth quarter results.

Quarterly Market Review

Fourth Quarter 2019 (Courtesy of DFA)

World Asset Classes

Equity markets around the globe posted positive returns in the fourth quarter. Looking at broad market indices, US equities outperformed non-US developed markets but underperformed emerging markets.

Value stocks underperformed growth stocks in all regions. Small caps outperformed large caps in the US and non-US developed markets but underperformed in emerging markets. REIT indices underperformed equity market indices in both the US and non-US developed markets.

|

World Asset Classes

|

QTD

|

|

MSCI Emerging Markets Index (net div.)

|

11.84

|

|

MSCI World ex USA Small Cap Index (net div.)

|

11.40

|

|

MSCI Emerging Markets Value Index (net div.)

|

9.94

|

|

Russell 2000 Index

|

9.94

|

|

MSCI Emerging Markets Small Cap Index (net div.)

|

9.52

|

|

Russell 3000 Index

|

9.10

|

|

S&P 500 Index

|

9.07

|

|

Russell 1000 Index

|

9.04

|

|

MSCI All Country World ex USA Index (net div.)

|

8.92

|

|

Russell 2000 Value Index

|

8.49

|

|

MSCI World ex USA Index (net div.)

|

7.86

|

|

MSCI World ex USA Value Index (net div.)

|

7.56

|

|

Russell 1000 Value Index

|

7.41

|

|

S&P Global ex US REIT Index (net div.)

|

4.44

|

|

One-Month US Treasury Bills

|

0.41

|

|

Bloomberg Barclays US Aggregate Bond Index

|

0.18

|

|

Dow Jones US Select REIT Index

|

-1.23

|

|

Fourth Quarter 2019 Index Returns

|

|

US Stocks (55% of total market)

US equities outperformed non-US developed equities but underperformed emerging markets stocks in the fourth quarter.

Value underperformed growth in the US across large and small cap stocks. Small caps outperformed large caps in the US.

REIT indices underperformed equity market indices.

|

Ranked Returns for the Quarter

|

%

|

|

Russell 2000 Growth Index

|

11.39

|

|

Russell 1000 Growth Index

|

10.62

|

|

Russell 2000 Index

|

9.94

|

|

Russell 3000 Index

|

9.10

|

|

Russell 1000 Index

|

9.04

|

|

Russell 2000 Value Index

|

8.49

|

|

Russell 1000 Value Index

|

7.41

|

|

Fourth Quarter 2019 Index Returns

|

|

|

Period Returns (%)

|

QTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

Russell 2000 Growth Index

|

11.39

|

28.48

|

12.49

|

9.34

|

13.01

|

|

Russell 1000 Growth Index

|

10.62

|

36.39

|

20.49

|

14.63

|

15.22

|

|

Russell 2000 Index

|

9.94

|

25.52

|

8.59

|

8.23

|

11.83

|

|

Russell 3000 Index

|

9.10

|

31.02

|

14.57

|

11.24

|

13.42

|

|

Russell 1000 Index

|

9.04

|

31.43

|

15.05

|

11.48

|

13.54

|

|

Russell 2000 Value Index

|

8.49

|

22.39

|

4.77

|

6.99

|

10.56

|

|

Russell 1000 Value Index

|

7.41

|

26.54

|

9.68

|

8.29

|

11.80

|

|

Fourth Quarter 2019 Index Returns

|

|

* Annualized

|

International Developed Stocks (33% of total market)

In US dollar terms, developed markets outside the US underperformed both the US equity market and emerging markets equities during the quarter.

Small caps outperformed large caps in non-US developed markets.

Value underperformed growth across large and small cap stocks.

|

Ranked Returns for the Quarter

|

%

|

|

MSCI World ex USA Small Cap Index (net div.)

|

11.40

|

|

MSCI World ex USA Growth Index (net div.)

|

8.09

|

|

MSCI World ex USA Index (net div.)

|

7.86

|

|

MSCI World ex USA Value Index (net div.)

|

7.56

|

|

Fourth Quarter 2019 Index Returns

|

|

|

Period Returns (%)

|

QTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

MSCI World ex USA Small Cap Index (net div.)

|

11.40

|

25.41

|

10.42

|

8.17

|

8.04

|

|

MSCI World ex USA Growth Index (net div.)

|

8.09

|

27.92

|

12.34

|

7.18

|

6.51

|

|

MSCI World ex USA Index (net div.)

|

7.86

|

22.49

|

9.34

|

5.42

|

5.32

|

|

MSCI World ex USA Value Index (net div.)

|

7.56

|

17.02

|

6.36

|

3.59

|

4.05

|

|

As of 12/31/2019

|

|

* Annualized

|

Emerging Markets Stocks (12% of total market)

In US dollar terms, emerging markets outperformed developed markets, including the US, in the fourth quarter.

Value stocks underperformed growth stocks.

Small caps underperformed large caps.

|

Ranked Returns for the Quarter

|

%

|

|

MSCI Emerging Markets Growth Index (net div.)

|

13.68

|

|

MSCI Emerging Markets Index (net div.)

|

11.84

|

|

MSCI Emerging Markets Value Index (net div.)

|

9.94

|

|

MSCI Emerging Markets Small Cap Index (net div.)

|

9.52

|

|

Fourth Quarter 2019 Index Returns

|

|

|

Period Returns (%)

|

QTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

MSCI Emerging Markets Growth Index (net div.)

|

13.68

|

25.10

|

14.50

|

7.45

|

5.20

|

|

MSCI Emerging Markets Index (net div.)

|

11.84

|

18.42

|

11.57

|

5.61

|

3.68

|

|

MSCI Emerging Markets Value Index (net div.)

|

9.94

|

11.94

|

8.57

|

3.67

|

2.08

|

|

MSCI Emerging Markets Small Cap Index (net div.)

|

9.52

|

11.50

|

6.70

|

2.97

|

2.95

|

|

Fourth Quarter 2019 Index Returns

|

|

* Annualized

|

Real Estate Investment Trusts (REITs)

US real estate investment trusts (REITs) underperformed non-US REITs in US dollar terms during the fourth quarter.

|

Ranked Returns for the Quarter

|

%

|

|

Dow Jones US Select REIT Index

|

-1.23

|

|

S&P Global ex US REIT Index (net div.)

|

4.44

|

|

Fourth Quarter 2019 Index Returns

|

|

|

Period Returns (%)

|

QTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

S&P Global ex US REIT Index (net div.)

|

4.44

|

23.59

|

9.79

|

5.65

|

7.74

|

|

Dow Jones US Select REIT Index

|

-1.23

|

23.10

|

6.95

|

6.40

|

11.57

|

|

As of 12/31/2019

|

|

* Annualized

|

Commodities

The Bloomberg Commodity Index Total Return increased 4.42% in the fourth quarter.

Coffee and soybean oil were the top performers, gaining 24.33% and 17.62%, respectively.

Nickel and natural gas were the worst performers, declining by 17.97% and 17.57%, respectively.

|

Period Returns (%)

|

QTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

Commodities

|

4.42

|

7.69

|

-0.94

|

-3.92

|

-4.73

|

|

As of 12/31/2019

|

|

* Annualized

|

Fixed Income

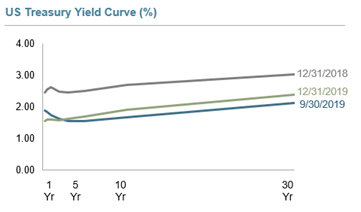

Interest rate changes were mixed in the US Treasury market during the fourth quarter. The yield on the 5-year Treasury note increased 14 basis points (bps), ending at 1.69%. The yield on the 10-year note rose 24 bps to 1.92%. The 30-year Treasury bond yield increased 27 bps to 2.39%.

On the short end of the yield curve, the 1-month Treasury bill yield decreased to 1.48%, while the yield on the 1-year bill dipped 16 bps to 1.59%. The 2-year note yield finished at 1.58% after a decrease of 5 bps.

|

Bond Yields Across Issuers

|

(%)

|

|

10-Year US Treasury

|

1.92

|

|

State and Local Municipals

|

2.73

|

|

AAA-AA Corporates

|

2.44

|

|

A-BBB Corporates

|

2.99

|

|

|

|

In terms of total returns, short-term corporate bonds gained 0.95%. Intermediate corporate bonds had a total return of 1.10%.

The total return for short-term municipal bonds was 0.84%, while intermediate-term munis returned 0.93%. General obligation bonds outperformed revenue bonds

|

Period Returns (%)

|

QTR

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

|

Bloomberg Barclays US High Yield Corporate Bond Index

|

2.61

|

14.32

|

6.37

|

6.13

|

7.57

|

|

FTSE World Government Bond Index 1-5 Years

|

1.01

|

2.43

|

2.40

|

0.74

|

0.19

|

|

Bloomberg Barclays US TIPS Index

|

0.79

|

8.43

|

3.32

|

2.62

|

3.36

|

|

Bloomberg Barclays Municipal Bond Index

|

0.74

|

7.54

|

4.72

|

3.53

|

4.34

|

|

ICE BofA 1-Year US Treasury Note Index

|

0.59

|

2.93

|

1.78

|

1.25

|

0.83

|

|

ICE BofA US 3-Month Treasury Bill Index

|

0.46

|

2.28

|

1.67

|

1.07

|

0.58

|

|

Bloomberg Barclays US Aggregate Bond Index

|

0.18

|

8.72

|

4.03

|

3.05

|

3.75

|

|

FTSE World Government Bond Index 1-5 Years (hedged to USD)

|

0.18

|

3.86

|

2.37

|

1.92

|

1.85

|

|

Bloomberg Barclays US Government Bond Index Long

|

-4.06

|

14.75

|

6.95

|

4.16

|

6.97

|

|

As of 12/31/2019

|

|

|

* Annualized

|

Global Fixed Income

Interest rates in global developed markets generally increased during the fourth quarter.

Longer-term bonds generally underperformed shorter-term bonds in the global developed markets.

Short and intermediate-term nominal rates are negative in Japan and Germany.

|

Changes in Yields (bps) since 09/30/2019

|

|

|

|

|

|

|

|

1Y

|

5Y

|

10Y

|

20Y

|

30Y

|

|

US

|

-17.20

|

12.70

|

25.40

|

29.30

|

24.10

|

|

UK

|

8.20

|

30.60

|

36.80

|

34.90

|

33.10

|

|

Germany

|

-1.40

|

32.20

|

40.90

|

42.70

|

40.30

|

|

Japan

|

16.90

|

23.80

|

19.60

|

7.00

|

3.90

|

|

Canada

|

3.00

|

29.00

|

33.70

|

22.70

|

21.00

|

|

Australia

|

13.70

|

27.40

|

36.20

|

36.70

|

35.30

|

|

As of 12/31/2019

|

|

|

|

|

|

Impact of Diversification

These portfolios illustrate the performance of different global stock/bond mixes and highlight the benefits of diversification. 1,2

Mixes with larger allocations to stocks are considered riskier but have higher expected returns over time.

|

Ranked Returns for the Quarter

|

%

|

|

100% Stocks

|

9.07

|

|

75/25

|

6.86

|

|

50/50

|

4.68

|

|

25/75

|

2.53

|

|

100% Treasury Bills

|

0.41

|

|

Fourth Quarter 2019 Index Returns

|

|

|

Period Returns (%)

|

QTD

|

1 Yr

|

3 Yrs*

|

5 Yrs*

|

10 Yrs*

|

10-Yr STDEV¹

|

|

100% Stocks

|

9.07

|

27.3

|

13.05

|

9.00

|

9.37

|

13.18

|

|

75/25

|

6.86

|

20.69

|

10.21

|

7.08

|

7.27

|

9.89

|

|

50/50

|

4.68

|

14.29

|

7.35

|

5.10

|

5.09

|

6.59

|

|

25/75

|

2.53

|

8.11

|

4.47

|

3.07

|

2.83

|

3.30

|

|

100% Treasury Bills

|

0.41

|

2.14

|

1.58

|

0.99

|

0.52

|

0.22

|

|

As of 12/31/2019

|

|

* Annualized

|

The 2010s: A Decade in Review

Feature Article (Courtesy of DFA)

On a total return basis, global stocks more than doubled in value from 2010–2019. The MSCI All Country World IMI Index, which includes large and small cap stocks in developed and emerging markets, had a 10-year annualized return of 8.91%. From a growth-of-wealth standpoint, $10,000 invested in the stocks in the index at the beginning of 2010 would have grown to $23,473 by year‑end 2019.

Despite positive annual market returns during most of the decade, investors had to process ever-present uncertainty arising from a host of events, including an unprecedented US credit rating downgrade, sovereign debt problems in Europe, negative interest rates, flattening yield curves, the Brexit vote, the 2016 US presidential election, recessions in Europe and Japan, slowing growth in China, trade wars, and geopolitical turmoil in the Middle East, to name a few.

The decade also brought technological advances in electronic commerce and cloud computing, the global embrace of the smartphone and social media, increased automation and enhanced artificial intelligence, and new products like electric cars and early iterations of self‑driving ones.

Looking back, you could conclude that the decade had its share of uncertainty—just like the decades before. But overall, the US equity market experienced moderate volatility compared with previous decades.

BENEFITS OF DIVERSIFICATION

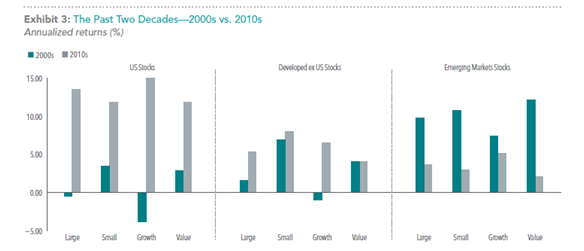

Investors who committed to global diversification and to areas of the market associated with higher returns—small cap stocks and value stocks (i.e., stocks trading at low relative prices)—were challenged over the past decade. As shown in Exhibit 3, during the 2000s, investors were generally rewarded for holding emerging markets stocks and developed ex US stocks. During the 2010s, the US market outperformed developed ex US and emerging markets.

The performance of value stocks vs. growth stocks (i.e., stocks trading at high relative prices), and small vs. large cap stocks, also varied between decades. Small cap and value stocks outperformed large cap and growth stocks in the 2000s, while the 2010s produced mixed outcomes. Small caps underperformed large caps in the US and emerging markets but outperformed in the developed ex US market. Value underperformed growth in all three market regions. Despite underperforming large cap and growth in the US, small cap and value delivered 11.83% and 11.71%, respectively, for the decade. 3

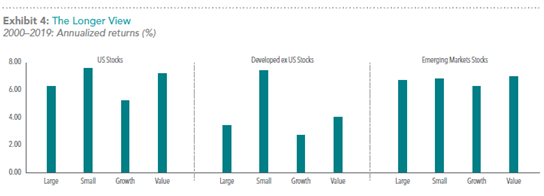

Exhibit 4 shows the cumulative investment experience over both decades, with small cap and value stocks outperforming large cap and growth stocks, respectively, across the US, developed ex US, and emerging markets. The annualized 20-year returns illustrate how diversification can help investors ride out the extremes to pursue a positive longer-term outcome. 4

Over the past decade, global fixed income also posted returns that may have surprised some investors. In 2010, investors looking at historically low interest rates may have expected rising rates as financial markets and economies recovered from the crisis. But over the decade, short-term rates increased while long-term rates decreased. Realized term premiums were positive, as long-term bonds generally outperformed shorter-term bonds. Realized credit premiums were also positive, as lower-quality bonds generally outperformed higher‑quality bonds. 5

Enduring Principles

This brings us to January 2020. By many metrics, last year was very good for investors. But it didn’t start out that way, after the S&P closed out 2018 with an 8% decline. The prevailing wisdom was that the long bull market was over; it was time to batten down the hatches and slash exposure to equities. But then a funny thing happened. Dire predictions of decline didn’t materialize. In 2019, global equities shot up more than 25%, and fixed income grew by more than 8%. Yes, some sectors of the markets experienced volatility and decline, but that is to be expected. Markets do not operate in lockstep. That’s why investors are wise to remain diversified.

Still, far too many people feel they should do something—like making a new year’s resolution. Change things up! So they make what they believe to be informed guesses and jump in or out of the market. It’s called market timing. I like David Booth’s thoughts on this (The Market Has No Memory, 3-Jan 2020). “Missing out on big growth has as much impact on a portfolio as losing that amount. How long does it take to make that kind of loss back? And how is someone who got out supposed to know when to get back in?” he asks.

The very idea that we know when to get in or out presumes that we have some special knowledge of the future. But that’s not knowledge. At best, it’s a hunch, aided by fear or hope. “Don’t try to figure out when to get in and when to get out—you’d have to be right twice,” Booth rightly concludes. And given how often the pundits and well-compensated analysts are wrong, how likely are you to be right twice?

Booth offers common sense about what we can learn from the previous decade and the many decades that came before it. The market has no memory. The future is unpredictable. Uncertainty is the norm, not the exception. And because these things are true, the fundamentals of successful investing endure while being constantly tested.

His advice (and mine): “Diversify across markets and asset groups to manage risks and pursue higher expected returns. Stay disciplined and maintain a long-term perspective. Take the daily news with a grain of salt and avoid reactive investment decisions based on fear or anxiety. Don’t try to predict future performance or time the markets. Instead, develop a sensible investment plan based on a strong philosophy—and stick with it. Investors who follow these principles can have a better financial journey in any decade.” 6

Do you have questions or concerns? Call me, I am here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell

760.284.5550 Fax

jgorlow@cardiffpark.com

1. STDEV (standard deviation) is a measure of the variation or dispersion of a set of data points. Standard deviations are often used to quantify the historical return volatility of a security or portfolio.

2. Diversification does not eliminate the risk of market loss. Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect expenses associated with the management of an actual portfolio. Asset allocations and the hypothetical index portfolio returns are for illustrative purposes only and do not represent actual performance. Global Stocks represented by MSCI All Country World Index (gross div.) and Treasury Bills represented by US One-Month Treasury Bills. Globally diversified allocations rebalanced monthly, no withdrawals. Data © MSCI 2020, all rights reserved. Treasury bills © Stocks, Bonds, Bills, and Inflation Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield).

3, 4. Past performance is not a guarantee of future results. Market segment (index representation) as follows: US Stocks—Large Cap (Russell 1000 Index), Small Cap (Russell 2000 Index), Growth (Russell 3000 Growth Index), Value (Russell 3000 Value Index); Developed ex US Stocks—Large Cap (MSCI World ex USA Index), Small Cap (MSCI World ex USA Small Cap Index), Value (MSCI World ex USA Value Index), Growth (MSCI World ex USA Growth Index); Emerging Markets Stocks—Large Cap (MSCI Emerging Markets Index), Small Cap (MSCI Emerging Markets Small Cap Index), Value (MSCI Emerging Markets Value Index), Growth (MSCI Emerging Markets Growth Index). Index returns are in US dollars, MSCI indices are net of withholding tax on dividends. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2020, all rights reserved. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio.

5. Dimensional Fund Advisors A Decade in Review (Jan 2020)

6. The Market Has No Memory, David Booth, Chairman Dimensional Fund Advisors (Jan 2020)