John Gorlow

| Sep 09, 2022

In August, stocks slumped and global bonds declined as tighter central bank policy, recession fears and high inflation spooked investors. July’s rally fizzled early in the month, and the S&P 500 ended August down 4%. Meanwhile, the U.S. dollar surged to a nearly 20-year high against a basket of global currencies. What does this steep climb portend for the global economy and your portfolio?

The dollar has been on a tear, rising 20% since January 2021. Several forces are contributing to its performance, notably Russia's war in Ukraine, soaring commodity prices, and the remarkable resilience of the U.S. economy following the global pandemic. U.S. Job growth in 2022 has been robust, driving unemployment to new lows, and corporate profits have been strong.

The Federal Reserve has further contributed to the dollar’s strength by raising interest rates more aggressively than other central banks, and accelerating the process to shrink its $9 trillion balance sheet. Meanwhile, China, Europe and Japan are facing downturns.

The dollar’s surge has created new issues for a global economy still struggling to regain its footing. By making U.S.-made goods more expensive for our trading partners and less competitive on world markets, it has wiped billions of dollars off corporate earnings, causing many companies to cut their guidance for the remainder of the year. The higher cost of U.S. goods has also resulted in inflationary ripples around the world, including in countries that don’t trade with the United States.

Winners and Losers

Back in May, Jeff Sommers of the New York Times pointed to a study by S&P Dow Jones Indices that found that S&P 500 companies with the least dependence on foreign revenue tended to perform well when the dollar was strengthening. That seems to be the case now.

A subindex of the S&P 500—the S&P 500 U.S. Revenue Exposure Index, filled with domestic-oriented companies like Berkshire Hathaway, UnitedHealth Group, Home Depot and JPMorgan Chase—returned negative 8.42% YTD. That's an impressive return compared with negative 16.14% YTD for the S&P 500 benchmark index. But don’t rush to remake your portfolio based on this comparison, because the dollar’s rise can’t continue forever.

Is a Turning Point Near?

Currency traders, S&P 500 company executives, economists and financial pundits are all watching the dollar and wondering how long the rally will continue. Many believe the dollar’s climb will extend well into 2023. Some, like Ruchir Sharma (Financial Times, 29-August 2022) believe the dollar is close to peaking.

Even as U.S. stocks fell in the dotcom bust, the dollar continued to rise before entering a period of decline in 2002 that lasted six years. A similar turning point may be near, Sharma believes. And this time, the U.S. currency’s decline could last even longer. His reasoning:

• The value of the dollar against other major currencies is now 20% above its long-term trend, and above the peak reached in 2001. Since the 1970s, the typical upswing in a dollar cycle has lasted about seven years; the current upswing is in its 11th year.

• Fundamental imbalances could eventually challenge the U.S. dollar’s momentum. According to Ruchir’s research, when a current account deficit (importing rather than exporting more to the rest of the world) runs persistently above 5 % of gross domestic product (GDP), it is a reliable signal of financial trouble to come.

• Currencies weaken when the rest of the world no longer trusts that a nation can pay its bills. The U.S. currently owes the world a net $18 trillion, or 73% of U.S. GDP, far above the 50% threshold that has often foretold past currency crises. Rising interest rates are a red flag that could trigger a problem.

• Finally, investors tend to move away from the dollar when the U.S. economy is slowing relative to the rest of the world. In recent years, the U.S. has been growing significantly faster than the median rate for other developed economies. It is likely to grow more slowly than its peers in coming years.

A Broader View

A key question for investors is how the dollar’s downswing—coming soon or not—might affect their portfolios. When the U.S. dollar is strong, as it has been for quite some time, the full benefits of international diversification may be overshadowed. Indeed, U.S. stocks have outperformed international securities by a wide margin over the last several decades, causing some to question whether international diversification is needed at all.

Recent research by Elroy Dimson, Paul Marsh, and Mike Staunton (Credit Suisse Global Investment Returns Yearbook 2022) suggests that it is. Their study examined data across 35 countries, including 23 with more than 122-year histories from 1900 to 2021. They concluded that the recent dominance of U.S. stock returns versus the rest of the world is an outlier.

Their research also reinforced that it is extremely difficult to accurately forecast which countries will perform best, or where and when domestic investment might beat global investment. In their words, there is no obvious reason to expect continued American exceptionalism. In fact, there are good reasons to expect just the opposite, as the U.S. faces mounting political division, inequality, inflation, a big debt overhang, declining workforce population, and other problems.

Surely, U.S. corporate superiority is by now mostly priced into stock prices. Prospectively, then, the advice to investors from all countries, including the USA, is to diversify internationally.

U.S. Stocks Don’t Always Outperform

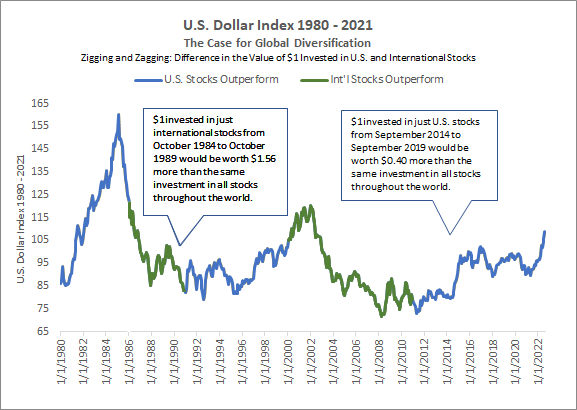

In the chart below, I separated U.S. and international stock return and compared their performance to that of all stocks throughout the world. Global portfolio returns are taken as the MSCI World Index.

While it's true the U.S. has outperformed for the last several years, international stocks led the way in prior periods, with outperformance often coinciding with periods of a weakening dollar.

The chart demonstrates that leadership between domestic and international regions can and has changed course, sometimes for extended periods. It's difficult to determine when one region will outperform another. That’s why investors are generally better off diversifying internationally, that is, across domestic, international and emerging market equities.

Last month I introduced the idea of focusing on outcomes rather than solely on returns. Your investment portfolio is constructed individually to solve for your needs, and diversification is essential for achieving the same returns for reduced risk. But patience is needed to achieve long-term desired outcomes. For investors outside the U.S., international diversification has worked well for the past few decades, but for U.S. investors not so much. Then tides change, shifts occur, economies rise and stumble, and the framework for diversification once again proves how it works. My advice is to remain diversified, even when returns are lower for sustained periods of time.

August Market Report

The S&P 500 Index dropped more than 4% for the month, as optimism faded in early August. Despite slowing inflation data, Fed Chair Jerome Powell insisted the Fed’s inflation-fighting work is far from over, dashing market hopes for a near-term Fed pivot.

Corporations generally reported stronger-than-expected Q2 earnings, yet most S&P 500 sectors declined in August. The energy and utility sectors delivered gains, while the information technology sector declined more than 6%.

Recent data pointed to continued economic weakness, especially in the housing market. However, job growth remained strong, fueling expectations for another 75 bps Fed rate hike in September.

U.S. inflation slowed to 8.5% (year over year) in July, compared with 9.1% in June. Amid a mounting energy crisis, European inflation rose to a record 9.1%, while U.K. inflation hit a new 40-year high of 10.1%.

Worries about recession and energy supplies contributed to broad losses for non-US developed markets stocks, which modestly underperformed US stocks. Conversely, a better outlook for many developing countries pushed the broad emerging markets index higher.

Expectations for additional Fed rate hikes drove U.S. Treasury yields higher in August, and bonds generally declined.

|

Index Return (%)

|

1 MO

|

YTD

|

1 YR

|

3 YR

|

5 YR

|

10 YR

|

|

U.S. Large-Cap Equity

|

|

|

|

|

|

|

|

S&P 500 Index

|

-4.08

|

-16.14

|

-11.23

|

12.39

|

11.82

|

13.08

|

|

U.S. Small-Cap Equity

|

|

|

|

|

|

|

|

Russell 2000 Index

|

-2.05

|

-17.16

|

-17.88

|

8.59

|

6.95

|

10.01

|

|

Intl. Developed Markets Equity

|

|

|

|

|

|

|

|

MSCI World ex USA Index

|

-4.67

|

-18.70

|

-18.56

|

2.98

|

2.08

|

4.95

|

|

Emerging Markets Equity

|

|

|

|

|

|

|

|

MSCI Emerging Markets Index

|

-0.25

|

-17.83

|

-20.09

|

0.90

|

0.95

|

2.84

|

|

Global Real Estate Equity

|

|

|

|

|

|

|

|

S&P Global REIT Index

|

-6.03

|

-18.90

|

-14.02

|

0.05

|

2.85

|

4.98

|

|

U.S. Fixed Income

|

|

|

|

|

|

|

|

Bloomberg U.S. Aggregate Bond Index

|

-2.83

|

-10.75

|

-11.52

|

-2.00

|

0.52

|

1.35

|

|

Global Fixed Income

|

|

|

|

|

|

|

|

Bloomberg Global Aggregate Bond Index

|

-2.61

|

-9.17

|

-9.99

|

-2.16

|

0.88

|

2.06

|

|

U.S. Cash

|

|

|

|

|

|

|

|

One-Month US Treasury Bills

|

0.19

|

0.37

|

0.39

|

0.49

|

1.04

|

0.59

|

|

As of August 31, 2022

|

|

|

|

|

|

|

U.S. Stocks

All major size and style categories declined in August and maintained steep year-to-date (YTD) losses.

Small-cap stocks fared better than large caps for the month, but they continued to trail large-cap stocks on a YTD basis.

In August, value stocks outperformed growth stocks in the large-cap universe but underperformed growth in the small-cap arena. YTD, value stocks retained their edge across capitalizations.

International Stocks

International developed markets stocks declined in August and remained sharply lower YTD.

Small caps fared modestly better than large caps for the month. YTD, large-cap stocks outperformed small-cap stocks.

Value stocks outperformed growth stocks across capitalizations in August. Value stocks also fared much better than growth stocks YTD.

Emerging Market Stocks

The broad emerging markets stock index increased slightly in August but declined sharply YTD.

Small-cap stocks advanced in August and outperformed large caps, which rose slightly. YTD losses were widespread, but small caps fared better than large caps.

Growth stocks outperformed value stocks across capitalizations in August. Across the board, YTD losses among growth stocks were larger than they were for value stocks.

Fixed-Income Returns

After declining in July, yields reversed course in August, and bonds broadly declined. Fed sentiment remained hawkish, and Treasury yields climbed higher across the yield curve.

The Bloomberg U.S. Aggregate Bond Index declined nearly 3% in August, as all index sectors posted losses.

Rising mortgage rates and slowing home sales weighed on the MBS sector, which was among the bond market’s worst performers. Despite modest spread tightening, corporate bonds also underperformed the broad bond index. High-yield corporates outperformed investment-grade corporates.

Municipal bond (Muni) yields tracked Treasury yields higher. Munis declined for the month, but they fared better than Treasuries.

Five- and 10-year inflation breakeven rates eased in August, and TIPS declined. TIPS underperformed nominal Treasuries, which declined but outperformed the broad bond index.

Amid ongoing rate-hike expectations, Treasury yields climbed higher in August. The 10-year Treasury yield jumped 54 bps to 3.19%, while the two-year Treasury yield rose 60 bps to 3.48%. Accordingly, the yield curve remained inverted.

Headline inflation moderated to 8.5% (year over year) in July. Although energy prices declined on a month-to-month basis, they were up 33% versus July 2021. Food prices rose 1.1% from June to July and 11% compared with a year earlier.

If you have questions or concerns about your asset allocation, or if your life circumstances have changed in ways that require a portfolio review, please contact me. I am here to help.

Regards

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell

760.284.5550 Fax

jgorlow@cardiffpark.com