John Gorlow

| Oct 12, 2022

There’s no way to sugarcoat this past quarter. Markets finished the month uniformly lower and ended September in retreat. In fact, it was the worst monthly drop since March 2020, when the rapid spread of Covid sent the economy into a full shutdown. Despite gloom in the markets, life was its usual mixed bag including moments of hope and joy.

September saw a powerful surge in Ukrainian resistance and big defeats for the invading Russian army. That’s one for the underdogs! Aaron Judge swung his way past Babe Ruth’s record of 60 home runs, two shy of Roger Maris’s single-season record, which he would go on to smash on October 4. That’s one for Number 99! In a life-mimicking-the-movies moment, NASA successfully smashed a small asteroid with a guided spacecraft, demonstrating how mankind one day might be saved from the same fate that befell the dinosaurs. That’s one for NASA and Planet Earth!

But looking to the markets, optimism was in short supply. The global battle against inflation continued with the most comprehensive tightening ever seen. Many more central banks have joined the inflation fight than in the Volcker era, though rate hikes have not been as steep. September saw the fifth rate increase of the year in the U.S., this time 75 basis points on the heels of another 75 basis-point increase in July. The rate hikes sent the dollar soaring, increased borrowing costs for consumers and businesses, unsettled the housing market, rocked the financial markets, and reduced demand across the global economy.

The Weakest Links

A recent piece in The Economist pointed to a question on many investors’ minds: what financial event might precipitate the next global meltdown (3-October, “Credit Suisse and the hunt for the weakest link in global finance”)?

In bear markets, even the best-run companies and governments are challenged by forces beyond their control. When cheap money runs out, the most misguided, high-risk decisions are hard to hide or outrun. History has many such examples. In the financial crisis of 1997-1998, Thailand’s economy imploded along with the highly-leveraged hedge fund Long-Term Capital Management (LTCM), which was ultimately bailed out with help from the Federal Reserve. In 2008, Lehman Brothers abruptly declared bankruptcy and closed its doors after being caught holding huge shares of subprime mortgages. That same mortgage crisis brought Iceland to its knees as banks collapsed and the government was forced to resign.

Today, The Economist notes, the country that is the poster child for bad decisions is Britain, “where the currency has fallen and the central bank has had to intervene in the bond market to bailout the pension system on account of overseers who had foolishly made vast bets on continued low volatility.” Within days of taking office, Prime Minister Liz Truss ignited a firestorm of market volatility that reverberated across the world. Some fear similar mayhem in other parts of the world as debt rises, growth stalls, and financial obligations increase.

On the institutional side, The Economist points to Credit Suisse as a weak link and potential bellwether of bad news from other quarters, noting that “shares have fallen by 55% this year and its credit-default swaps, which measure default risk, have risen.” And yet, in some mild reassurance, “Credit Suisse … does not look like an epicenter of a financial explosion in the way that Lehman, or AIG were.” In part, this may reflect a lesson learned during the last financial crisis: “Instead of rampant growth fueled by hubris, Credit Suisse’s balance sheet has shrunk continuously over the past decade in dollar terms, as it has downsized itself into the second tier of global finance.”

The Economist is one of many financial publications to suggest that additional unpleasant news may lie ahead. The United States is in its own tough spot, balancing the need to control inflation with the desire to avoid a recession. Most investors are betting on another 75 basis-point rate hike in November. Whether that happens may hinge on upcoming earnings reports and inflation news.

Expect Profit-Growth Slowdown

Corporate reporting season begins this week, and investors will be examining the impacts of inflation on costs and consumer demand, and how slower growth will affect hiring plans. Warnings about worsening economic trends are triggering rapid responses. FedEx shares dropped 21.4% on September 16, its biggest single sell-off on record, after warning investors that profits for its first fiscal quarter will likely fall short of forecasts.

Not all signs point downward. The number of negative trading updates over the past three months was less than the previous two quarters, while the number of positive updates was above the five-year average, according to the Financial Times. And a Goldman Sachs report shows that unfilled job openings fell sharply in August, eliminating almost half the gap between jobs and workers over the past few months. Meanwhile, supply-chain problems that disrupted the economy and raised inflation also show signs of resolving. In September 2021, the cost of shipping a container across the Pacific was $20,586. Today it has dropped to $2,265. Indicators like these tell us that Fed actions have already led to declines in inflation.

Got Plans for the Bear Market?

Many of us have seen this movie before. Things seem to be going well, then the bottom falls out. Markets are down. Prices are up for many essentials. Interest rates are rising, adding confusion to major financial decisions including whether to buy or sell a house.

Long-term investors accept that shocks will happen. There is fear of a recession, ongoing war in Ukraine, increased volatility and spiraling national debt. Lately you may have heard reference to a “doom loop,” a vicious cycle that is self-perpetuating. In this case, the doom loop leads to borrowing to pay interest, which generates yet more interest and yet more borrowing. Some economic analysts assert that as long as the economy is growing at a faster rate than the debt, the increase in the national debt doesn’t matter. But that certainly isn’t happening right now. Not only are interest rates driving up interest expenses dramatically, inflation is propelling growth in government Social Security and government healthcare spending. Naturally, if we do slip or plummet into a serious recession, federal income tax revenue will erode.

We don’t know whether we will reach this “doom loop” or just be mired in stagflation for a time. We also don’t know exactly what will cause the next shock or when it will occur. The only thing we can count is that it’s going to be a surprise, because if it weren’t, the market would have already priced that in.

Markets have a rhythm; from time-to-time, they need to cull the zombie borrowers and floundering businesses who live on only because the cost of borrowing is so low. In this way bear markets can be healthy because they make prices recalibrate so the cycle can turn for the better. There are few things worse for either a business or a national economy than an overhang of unpaid or unpayable bad debts that can lead to years of stagflation. At some point as unemployment rises and the economy weakens, inflation will come under control. By then, the Fed will decide that it needs to relieve the economy. Interest rates will start to drop and the markets will rejoice. People with long horizons are likely to prosper. While much of the damage in the markets is behind us, the economy is slowing and consequences for millions of people are still unfolding. Try to have enough cash to get through the disruptions.

If you’re stressed out about what is happening right now in the stock market and find yourself tempted to change course, please contact me for a review. I don’t like to tell people what to do, but I welcome the chance to share my perspective on investing with your personal context in mind. My aim is to guide you on a path with the greatest likelihood of meeting your goals.

As the inimitable Dave Booth recently wrote, “Our lives are the cumulative results of the decisions we make every day.” And while the right decision for most of us is to trust in the power of the market and ride out the storm, everyone is different. Different people can stomach different amounts of risk. That’s based on what our goals are, how our brains are wired, and what we have lived through. Right now is a tough time for many people. If your circumstances, goals or risk preferences have changed, then recalibrating the balance of your bonds and relatively riskier stocks could make sense and be in your best interest.

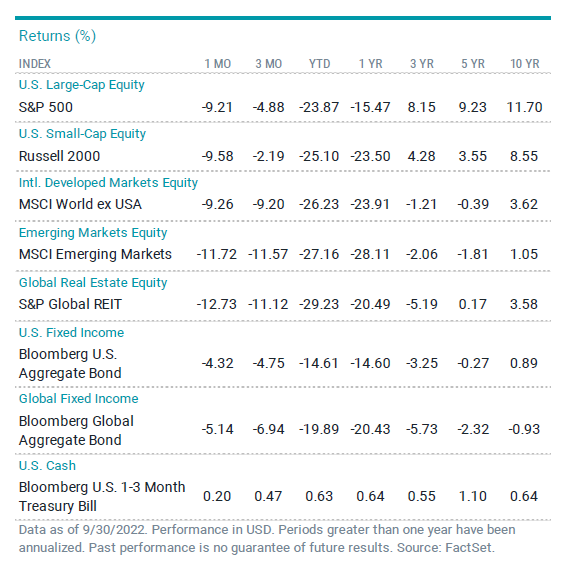

Now let’s take a look at Q3 market data.

The Big Picture: Pretty, Then Pretty Ugly

You may have forgotten that the quarter began on an optimistic note, with the S&P 500 Index rallying more than 9% in July amid hopes for a Fed policy pivot. But that hope faded, and stocks declined more than 4% in August, more than 9% in September, and nearly 5% for the quarter. Year to date, the S&P 500 lost 24%, finishing in bear market territory for the second consecutive quarter.

All sectors of the S&P 500 Index declined in September. Consumer discretionary and energy were the only sectors posting gains for the third quarter.

U.S. stocks (S&P 500) and other developed markets posted similar losses in September. However, U.S. stocks fared better on a quarterly basis. Emerging markets stocks underperformed developed markets for both time periods.

U.S. inflation eased slightly in August, while core inflation rose. Following the Fed’s aggressive interest rate increases, central banks in Europe and the U.K. also raised rates amid soaring inflation. In late September, the Bank of England launched a temporary bond-buying program in an effort to rescue U.K. bonds and the pound.

U.S. Treasury yields continued to climb, leading to widespread monthly and quarterly losses for bonds.

Third quarter 2022 Index Returns

U.S. Stocks

All major size and style categories declined for the third quarter and posted much steeper losses for the year-to-date period.

Small-cap stocks fared better than large-cap stocks in the quarter. Year to date, the broad large-and small-cap indices each were down 25%.

Style performance broadly favored growth stocks over value stocks for the quarter, and small-cap growth stocks delivered a fractional gain. Year to date, style losses were severe, more significantly among growth stocks.

International Developed Stocks

International developed markets stocks declined sharply for the third quarter and the year-to-date period.

Large-cap stocks fared slightly better than small-cap stocks in the quarter. Year to date, declines were widespread, with small caps falling more than large caps.

Growth stocks generally fared better than value stocks in the third quarter. For the year-to-date period, growth stocks declined at a notably faster pace than value stocks.

Emerging Markets Stocks

The broad emerging markets stock index declined and underperformed developed markets indices for the quarter and the year-to-date period.

Small-cap stocks fared better than large-cap stocks for the third quarter and year to date.

From a style perspective, losses among growth stocks outpaced value stock losses for the quarter and the last nine months. The disparity was more significant for the year-to-date period.

Real Estate Investment Trusts (REITs)

U.S. real estate investment trusts outperformed non-U.S. REITs during the quarter.

Commodities

The Bloomberg Commodity Total Return Index returned -4.11% for the third quarter of 2022.

WTI Crude Oil and Unleaded Gas were the worst performers, returning -21.51% and -20.53% during the quarter, respectively.

Natural Gas and Corn were the best performers, returning +24.49% and +8.01% during the quarter, respectively.

Fixed Income

U.S. Treasury yields climbed to multiyear highs amid persistently high inflation and aggressive Fed tightening. U.S. bonds posted negative returns for September and the third quarter, led by corporate bonds and mortgage-backed securities.

The Bloomberg U.S. Aggregate Bond Index declined 4.3% in September, and the index declined 4.8% for the third quarter.

Volatility reigned, and in late September, the yield on the 10-year U.S. Treasury note topped 4% for the first time in more than 10 years. The yield ended the month at 3.83%, 82 bps higher than June 30. The two-year Treasury yield rose 132 bps to 4.28%, leaving the yield curve with an inverted slope.

Easing energy costs led to a modest decline in annual headline inflation from 8.5% in July to 8.3% in August. Meanwhile, annual food costs rose 11.4%, the largest increase since 1979, and shelter costs jumped 6.2%, the biggest gain since 1984.

The Fed maintained its aggressive tightening campaign, raising rates 75 bps in July and again in September. At quarter end, fed futures contracts anticipated another 75-bps increase in November and a 50-bps hike in December.

Municipal bond (muni) yields also rose, and munis lagged Treasuries in September. However, for the quarter, Treasury yields rose more than muni yields, and munis fared better than Treasuries and the Bloomberg U.S. Aggregate Bond Index.

Inflation break-even rates eased in the quarter as growth expectations softened. TIPS were among the worst-performing fixed-income sectors for the three-month period.

Global Fixed Income

Interest rates generally increased within global developed markets for the quarter. Realized term premiums were negative in global developed markets. In Japan, short-term nominal interest rates remained negative. In Canada, the short-term segment of the yield curve inverted.

If you have questions or concerns about your asset allocation, or if your life circumstances have changed in ways that require a portfolio review, please contact me. I am here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell

760.284.5550 Fax

jgorlow@cardiffpark.com