John Gorlow

| Dec 14, 2022

It has been one of those years with no place to hide; a bad-news year for stock investors, bond investors, and just about anyone invested in crypto. But except for crypto, where problems continue to deepen, November delivered a measure of hope to those who held steady. Stocks and commodities rose for the second month, and the bond market reacted positively to news of lessening inflation. Not only that, the Dow managed to climb out of bear territory. READ MORE

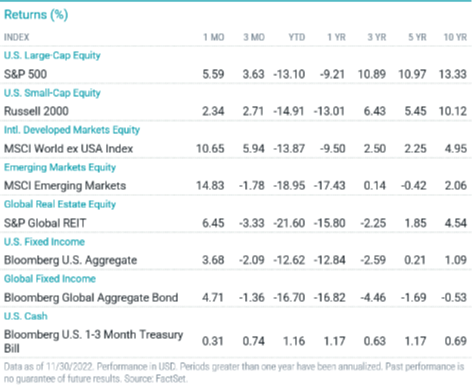

Markets staged a broad rally after Federal Reserve Chairman Jay Powell suggested that the central bank might ease up on aggressive rate hikes. Despite ongoing volatility, the two months ending 30-November saw a shift. The S&P 500 climbed 5%, the European Stoxx 600 rose 7%, and the MSCI World index surged 14.63% including dividends. News that China would ease its draconian zero-Covid policy caused a jump of nearly 27% in the Hang Seng Index, the steepest climb since 1998.

In a year like this, a long-term perspective is useful. As of November 30, the S&P is down 13%. That’s bad, but it doesn’t come close to the 37% loss that the index suffered in 2008. The Nasdaq has shed 26% over the same 11 months, but this follows blistering gains from 2019 through 2021 (37%, 45% and 22%, respectively). Of course, the year isn’t over, and more surprises may be in store.

But for now, we can be grateful for a few good months and hopeful that the trend continues.

As always, if you have questions or concerns about your portfolio or asset allocation, call me. I am here to help.

Now let’s take a look at November markets.

November Market Review

Courtesy of Avantis Investors

Expectations for a slowdown in the pace of central bank tightening contributed to a second consecutive monthly gain for global stocks. Additionally, bonds bounced back amid a slowdown in the inflation rate and a decline in Treasury yields.

As expected, the Fed hiked interest rates another 75 bps in early November. The following week, data showed inflation moderated in October. This news, combined with mounting recession risks, led to growing expectations that the Fed and other central banks might slow their rate-hike campaigns.

In this environment, the S&P 500 Index rallied nearly 6% in November, even as year-over-year corporate earnings and earnings outlooks generally weakened. Non-U.S. developed markets stocks rose even higher, delivering double-digit monthly gains.

All sectors of the S&P 500 Index advanced in November. The materials sector was the strongest, up nearly 12%, while consumer discretionary was the weakest, up 1%.

With inflation topping 11%, the Bank of England raised interest rates 75 bps in November. This was the central bank’s largest rate hike since 1989.

Emerging markets outperformed their developed markets peers, largely due to equity gains in China and easing global commodity prices. Despite widespread protests against the Chinese government’s strict COVID-19 policies and lockdowns, stocks rallied amid expectations for new economic stimulus measures.

U.S. inflation eased in October to 7.7%, and core inflation dipped to 6.3%. Against this backdrop, U.S. Treasury yields declined in November, and bond returns rallied.

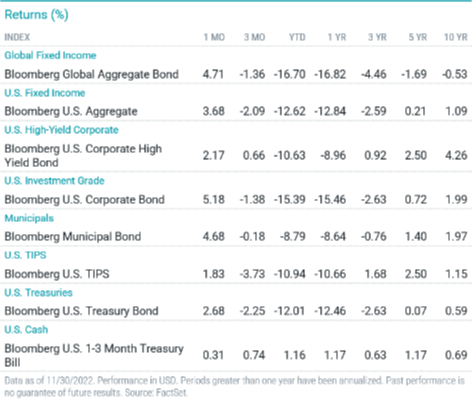

Fixed-Income Returns

Treasury yields retreated in November, aided by moderating inflation and tempered rate-hike expectations. U.S. bonds rallied for the month, even as the Fed delivered another 75 bps rate hike.

The Bloomberg U.S. Aggregate Bond Index advanced 3.7% in November, as all index sectors posted positive returns.

Narrowing credit spreads and declining yields helped corporate bonds advance more than 5% to outperform Treasuries and Mortgage-Backed securities. Meanwhile, high-yield corporates posted gains but underperformed investment-grade corporates.

Municipal bonds rallied for the month and outperformed Treasuries and the broad U.S. investment-grade bond index.

Although five- and 10-year inflation breakeven rates declined in November, TIPS gained nearly 2%, benefitting from the broad Treasury market rally. TIPS underperformed nominal Treasuries, which gained nearly 3%.

Softer inflation data and expectations for the Fed to slow its tightening pace pushed Treasury yields lower. The 10-year Treasury yield fell 44 bps to 3.61%, while the two-year Treasury yield dropped 15 bps to 4.34%. The yield curve remained inverted.

Annual headline inflation (as measured by the Consumer Price Index) eased from 8.2% in September to 7.7% in October. Key index components, including food (up 11%), energy (up 18%) and transportation services (up 16%), continued to contribute to the high inflation rate.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell