John Gorlow

| Feb 14, 2023

After a disappointing 2022, investors searched for rays of economic sunshine in January. And they got what they wanted when new data showed cooling inflation and better than expected growth in the final quarter of 2022, despite the pressure of high interest rates and widespread fears of a looming recession.

The news drove markets higher on hopes that the Federal Reserve would scale back or end interest rate increases earlier than expected. Not so fast, warned Chairman Jay Powell, noting that the Fed is still very much in a wait-and-see mode and willing to move aggressively if needed. Still, there’s reason to cheer declining inflation and rising rates. We’ll offer our perspective following a look at January numbers.

January Market Report

The first reading of fourth-quarter U.S. GDP showed that the U.S. economy expanded at a 2.90% annual pace from October through December, ending 2022 with momentum despite the pressure of high interest rates and widespread fears of a looming recession.

This estimate from the Commerce Department showed that the nation’s gross domestic product —decelerated last quarter from the 3.2% annual growth rate it had posted from July through September. Most economists think the economy will slow further in the current quarter and slide into at least a mild recession by midyear.

U.S. inflation data released in January showed the rates of headline and core CPI slowed in December to 6.5% and 5.7%, respectively. Inflation also moderated in Europe and the U.K. but remained notably higher than U.S. inflation.

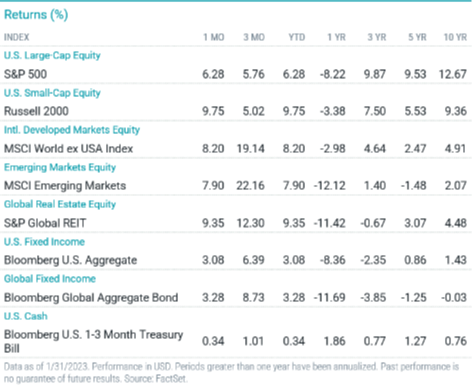

After declining in December, the S&P 500 Index bounced back in January with a gain of 6.28%, despite generally weaker corporate earnings. Non-U.S. developed markets stocks outperformed U.S. stocks and emerging markets stocks.

Most sectors of the S&P 500 Index advanced in January. The consumer discretionary sector was the strongest, up more than 15%, while the utilities sector was the weakest, down 2%.

In the U.S., small-cap stocks generally outperformed large-cap stocks, and growth stocks outpaced value stocks. Outside the U.S., large-cap stocks outperformed, and the growth style outpaced value in most capitalization categories.

Against a backdrop of moderating inflation and slowing growth, U.S. Treasury yields declined for the month. Bonds posted strong monthly gains.

Fixed-Income Returns

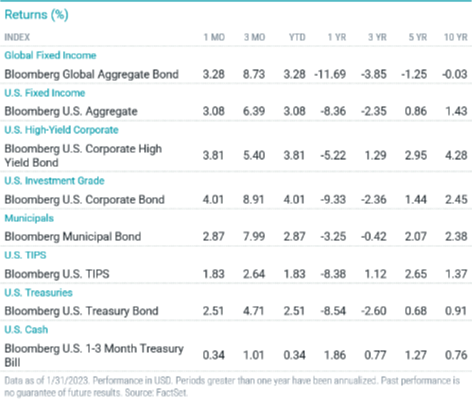

All sectors of the U.S. bond market rallied for the month.

The Bloomberg U.S. Aggregate Bond Index advanced 3% in January, led by the investment-grade corporate bond sector and mortgage-backed securities (MBS). Treasuries lagged the aggregate index.

Narrowing credit spreads and declining yields helped corporate bonds return 4% and outperform Treasuries and MBS. Meanwhile, high-yield corporates advanced but underperformed investment-grade corporates.

Market expectations for the Fed to slow its rate-hike pace helped push the two-year Treasury yield 21 bps lower to 4.21%. The 10-year Treasury yield fell 37 bps to 3.51%, and the yield curve remained inverted.

Annual headline CPI eased from 7.1% in November to 6.5% in December, while core inflation dropped from 6.0% to 5.7%. Nevertheless, certain key CPI components remained elevated, including food (up 10%), shelter (up 8%) and energy (up 7%).

Municipal bonds rallied for the month and outperformed Treasuries but underperformed the broad U.S. investment-grade bond index.

Inflation breakeven rates modestly declined for the month, and TIPS, which gained nearly 2%, underperformed the broad Treasury index.

The Good News in Higher Rates

In 2022, inflation eroded wealth while rising interest rates ratcheted up the cost of debt and borrowing. The Fed raised interest rates seven times over 12 months. But then January 2023 arrived with news of lower inflation and slower economic growth. This took pressure off the Fed, but not enough to prevent another rate hike of one-quarter of a percentage point on February 1. The February increase was half the size of the Fed’s previous increase in December 2022. Both of the most recent increases were on the lower end of expectations.

Many observers expect one more Fed rate increase of a quarter-point in March, while some foresee the Fed opting for a half-point increase if inflation doesn’t continue to decline. Smaller interest-rate hikes may signal the end of monetary tightening and a shift toward a more neutral Fed policy, a stance investors would uniformly cheer. But the path of inflation and future rate increases is far from clear.

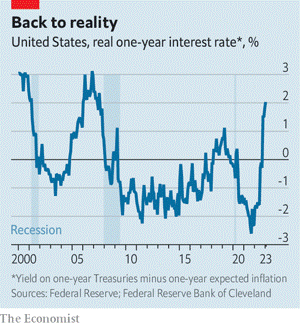

In his February news conference, Jerome Powell stated that “real rates” are now “positive” across the board. “Real rates” refer to interest rates that are adjusted for inflation. Last year, interest rates did not keep up with inflation. But within the past six months that pattern has shifted. Today interest rates have climbed while inflation has declined.

This is good news for investors looking for higher rates on interest-bearing investments. But for those looking for lower inflation at the grocery store and in the cost of services, the news may be a head-scratcher. Has inflation really come down? Does the Fed’s stance signal happier days ahead? “The Federal Reserve’s downshift to smaller interest-rate rises … may look like a step away from hawkish monetary policy; in real terms, though, the central bank’s stance is tighter than it first appears,” explains The Economist (1-Feb, The Doveish Illusion).

Measuring the inflation rate is complicated. The conventional approach is to subtract inflation from the interest rate to arrive at the “real” rate. Using that approach, with the annual consumer-price inflation of 6.5% in December and the federal funds rate at a ceiling of 4.5%, the calculation would imply a real interest rate of negative 2%, which counterintuitively would amount to a highly stimulative fiscal policy—obviously not a current Fed objective.

The conventional calculation is misleading, say economic pundits. “Since interest is a forward-looking variable, the relevant comparison with inflation is also forward-looking,” argues The Economist, noting that a more comprehensive gauge of inflation expectations can be found in sources that draw on both bond pricing and survey data. One such source is the Cleveland Fed’s one-year expected inflation rate. “Subtracting the Cleveland Fed’s expected rate from one-year Treasury yields produces a much steeper trajectory for rates. In real terms they have soared to 2%, the highest since 2007.”

Further, when the Fed stops raising nominal rates, real rates typically increase for some time afterwards. “Before Covid-19, one-year expected inflation was about 1.7%. Now it is 2.7%. If inflation expectations recede toward pre-pandemic levels, real interest rates would rise by as much as one additional percentage point—reaching a height that has always preceded a recession over the past couple of decades,” The Economist concludes.

No one knows if the trend toward lowering inflation will last, or if the Fed will continue monetary tightening. The Fed has made it clear that it wants the pain of higher interest rates to be felt in the economy. And yet the surprising addition of 500,000 new jobs in January raises the prospect that inflation could be stickier than expected and that the Federal Reserve has to push rates higher for longer, leaving investors perplexed over the economic outlook. Will it be a hard or a soft landing, or even no landing? Investors are befuddled.

Until a clear narrative on how the economy will fare, markets will continue to whipsaw. While more volatility should be expected, try not to lose sight of your long-term goals, and remember that uncertainty is actually part of what creates opportunity. Much of the financial services industry is geared toward making people think they can avoid uncertainty. But the future, by definition, is unknowable. The best approach is to make informed choices, adjust as your needs and objectives change, and know that you have a well-thought-out plan in place that is working toward your goals. Clearly, making sense of the U.S. economy remains a challenge. Strong U.S. jobs data certainly poses short-term risk to rate cuts and rallying markets. A long-term outlook remains the core philosophy. But for those seeking a decent return on cash, current higher rates are a real gift.

As always, if you have questions or concerns about your portfolio or asset allocation, call me. I am here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell