John Gorlow

| May 18, 2023

With the clock ticking, the U.S. government could default on its debt obligations within the next four to six weeks. Unlike most catastrophes, this one is predictable and preventable. A default would wreak havoc on global markets and deeply undermine the reputation of the U.S. as a haven for investors. Many believe it would tip the country into recession. Let’s look at what the markets are saying about the scene now unfolding in the U.S. Congress.

Raising the debt ceiling is neither a new or radical idea; in fact it used to be routine. Congress has raised the debt ceiling 78 times since 1960, including 14 times from 2001 to 2016. But the process has become politicized and polarized, with stand-offs in 1995, 2011 and 2013. In each instance, budget concessions made during high-stakes negotiations came at a cost, including, some believe, Clinton’s reelection in 2011. There’s another cost: each time Congress plays chicken, Americans lose a little more faith in their government.

Fast forward to 2023 and the current stand-off. Treasury Secretary Janet Yellen predicted her department would run out of cash to pay government bills on June 1. While she can’t be perfectly precise, she recently reiterated that estimate. Yellen certainly isn’t bluffing. Bloomberg News reported a precipitous decline in cash on hand from $140 billion (May 12) to $87 billion (May 15).

Bond investors have begun to price in the risk of default. In an atypical move, yields rose by a percentage point on ultra-safe Treasury bills maturing in early June, higher than yields for two- and three-month bills. In some instances, they are now higher than yields on investment grade corporate bonds of comparable duration. The cost of insuring Treasury debt against default has skyrocketed.

In other signs of uneasy markets, the S&P 500 benchmark index has been basically stagnant since March, while volatility has increased and the price of gold has soared.

Bear in mind that a default in the U.S. has never happened, and the damage it would inflict on markets at home and abroad cannot be fully appreciated until it happens. “If Treasuries fail, it is likely that stocks, bonds and everything in between will convulse in violent ways that are hard to predict. The desperate dash for cash in March 2020 and the UK gilts crisis of 2022 are just two reminders of how sudden market shocks can turn ugly, quickly,” writes the Financial Times.

Many analysts and investors believe compromises will be reached and disaster averted before the country falls off a fiscal cliff. Republicans who hold the thinnest of majorities in Congress can’t help but recall Newt Gingrich’s gambit in 2011, which resulted in a downgrade to the U.S.’s bond rating, soaring interest rates and a swooning stock market. A repeat of that scenario could spell disaster at the ballot box in 2024.

The pain of a fiscal meltdown would likely be worse this time, striking the world with lightning speed. It is a fragile time for many developed economies. The U.S. is just one of many countries grappling with issues of rising government debt coupled with pressure to increase spending on aging populations, climate change preparation, and defense. A default also would strengthen China’s hand as it seeks to displace the dollar as the world’s reserve currency, a notion once considered laughable.

Will Sensible Minds Prevail?

As U.S. debt rises, it creates a stranglehold on future growth and reduces opportunities to solve critical problems. It hurts the prosperity of future generations. It weakens the country in a time when new alliances are being created with the underlying purpose of undermining U.S. diplomatic leadership.

Congress has a tough job but isn’t doing it. In an ideal world, party leaders would suspend the debt ceiling until September 30, then settle in for public debate about spending priorities, writes William Galston in the Wall Street Journal (9-May 2023). “Long-term budget talks need a goal that is both feasible and meaningful. A balanced budget would require spending cuts and tax increases that neither Congress nor the American people would accept. A more practical target is to reduce the annual deficit enough so that U.S. debt grows no faster than the U.S. economy,” he suggests.

This is one of many ideas that begin with compromise, which seems nearly impossible in the current climate. And yet history shows it works. “In the mid-1990s, fiscal peace treaties between President Bill Clinton and House Speaker Newt Gingrich produced four consecutive budget surpluses. More than a decade ago, in a negotiation led by then Vice President Biden, a debt-ceiling increase came with spending restraints,” Galston reminds us.

We don’t know when the debt ceiling stand-off will end, or how. We may be heading into a period of intense volatility. If you are tempted to batten down the hatches, remember that volatility works both ways, driving markets up or down with great speed. You want to remain positioned for sudden moves in both directions by holding a diversified portfolio with stock and bond allocations suited to your timeframe, investment objectives, and risk tolerance.

If you have questions or concerns about your portfolio, please contact us. We are here to help.

April Market Review

Courtesy of Avantis Investors

Global and U.S. stocks delivered solid gains in April, even as familiar headwinds persisted, and another U.S. bank failed. U.S. bonds also advanced amid a volatile backdrop for Treasury yields.

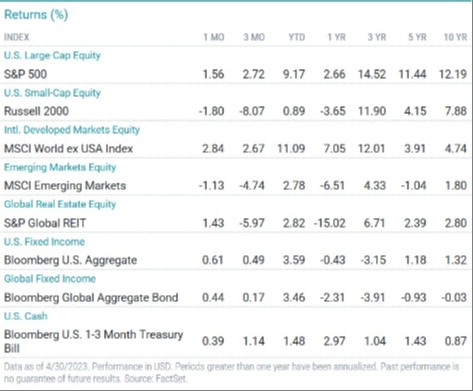

Despite lingering concerns about still-high inflation, banking industry unrest, growing recession risk and Fed policy uncertainty, U.S. stocks advanced in April. Better-than-expected earnings, particularly among large technology companies, helped drive a 1.56% monthly gain for the S&P 500 Index.

Most S&P 500 sectors advanced for the month, led by the more defensive communication services and consumer staples sectors. The industrials and consumer discretionary sectors were the largest decliners.

Non-U.S. developed markets stocks outperformed U.S. stocks, while emerging markets stocks posted a monthly loss.

U.S. economic growth slowed to an annualized pace of 1.1% in the first quarter, compared with 2.6% in the fourth quarter. First-quarter economic growth in the eurozone was nearly flat.

Annualized U.S. headline inflation eased in March, while core inflation inched higher. Inflation also moderated in Europe and the U.K. but remained notably higher than U.S. inflation. Markets generally expected developed markets central banks to keep raising rates in the near term.

In the U.S., large-cap stocks generally outperformed small-cap stocks, which declined. Value outpaced growth, except among small caps. Outside the U.S., large-cap stocks outperformed, and value outperformed growth.

U.S. Treasury yields were volatile for the month, but most bond market sectors posted gains.

Equity Returns

U.S. Stocks

U.S. stocks broadly advanced in April and year to date. Size and style categories were mixed in April but most generated year-to-date gains.

Large-cap stocks led their small-cap peers in April and year to date, gaining more than 1% and nearly 9% for each respective period. Small-caps declined nearly 2% in April and advanced nearly 1% year to date.

Style categories were mixed in April, but year to date, the growth style significantly outperformed value across the size spectrum.

Non-U.S. Developed Market Stocks

International developed markets stocks posted solid monthly and year-to-date gains, and size and style indices were up across the board.

Large-cap stocks gained nearly 3% and outperformed small-caps for the month. They also significantly outperformed year to date.

Value stocks outperformed growth stocks in April. Year to date, the growth style held a slight edge among small-caps and a more significant advantage in the large-cap universe.

Emerging Market Stocks

The broad emerging markets stock index declined in April but advanced year to date.

Small-cap stocks delivered a modest monthly gain, while large-caps declined. Year to date, small-caps advanced and outperformed large-caps, which also posted a gain.

Value stocks outperformed growth stocks across capitalization categories in April. Year to date, value outperformed among large-caps but underperformed in the small-cap arena.

Fixed-Income Returns

Amid a looming debt ceiling showdown, Treasury yields were volatile in April, particularly among ultrashort-maturity securities. Nevertheless, bonds generally delivered modest gains for the month, with corporate bonds leading the way.

The Bloomberg U.S. Aggregate Bond Index advanced 0.6% in April, with all its sectors posting gains.

Credit spreads tightened slightly, and corporate bonds outperformed Treasuries and MBS. Meanwhile, high-yield corporates slightly outperformed investment-grade corporates.

While investors generally expected another Fed rate hike in early May, they were less certain about Fed policy for the rest of the year. Two- and 10-year Treasury yields climbed through mid-month but ended April slightly lower versus March 31.

Meanwhile, demand for ultrashort Treasuries skyrocketed ahead of debt ceiling negotiations, driving yields notably lower.

Annual headline CPI eased from 6% in February to 5% in March, while core inflation inched up from 5.5% to 5.6%. While the energy component broadly declined 6.4% year over year, other key CPI categories remained elevated, including electricity (up 10.2), food (up 8.5%) and shelter (up 8.2%).

Municipal bond yields rose for the month, particularly among short-maturity securities, and munis declined modestly.

Inflation breakeven rates declined for the month, and TIPS underperformed nominal Treasuries.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell