John Gorlow

| Jun 16, 2023

If you need a reminder that markets don’t behave according to predictions, look to the first five months of 2023. A string of U.S. banks went under, and a debt ceiling fight threatened to undermine the financial credibility of the United States. A wave of interest rate hikes failed to stamp out inflation, leaving a smoldering fire ready to reignite. Dire warnings about corporate earnings filled the airwaves. And yet the S&P 500 gained about 14 percent through mid-June, mostly on the back of risky tech assets. Let’s unpack the issues, then take a look at May markets.

Inflation and interest rates continue to be front-burner issues for investors. The Consumer Price Index rose 4% in May, down from 4.9% in April, and less than half its peak of 9.1% in June 2022. That’s progress, but it’s still a long way from the Fed’s target of 2%.

The Fed’s battle against inflation went on pause in June, when it left the benchmark interest rate unchanged at 5.1%, the highest level in 16 years. Fed Chair Jerome Powell sent a decidedly mixed signal, suggesting that rates could increase twice more this year, beginning as soon as July. Powell explained both the reasoning for a pause (rate hikes may not yet be fully felt in the economy) and for possible future hikes (a stronger economy, more persistent inflation, and higher core inflation). Though Powell did not say this, the recent market rally in risky assets might also encourage Fed tightening sooner rather than later.

Whether rates will rise again, and how soon, is anyone’s guess, but the Bank of America strategy team led by Michael Hartnett sees persistent inflation as likely, and believes the Fed Funds rate could rise as high as 6% next year. Hartnett also suggests we could head into a period of “painful” stagflation, that rare but dreaded combination of slow growth, high prices and rising unemployment.

What the Fed does or doesn’t do about interest rates in coming months will intersect with another issue: a huge government borrowing spree as the Treasury department seeks to rebuild its cash balance following the resolution of the debt ceiling stand-off. JP Morgan estimates that Washington will need to borrow $1.1 trillion in short-dated Treasury bills by the end of 2023, including $850 billion over the next four months. This will push up yields on government debt and is likely to increase the already steady flow of cash out of bank deposits. Banks will be forced to offer higher interest rates, which could potentially lead to more bank failures, particularly for smaller institutions.

In sum, investors should continue to expect volatility as markets respond to inflation, interest rates, government spending and world events. There’s a new player in the ring, too, called artificial intelligence.

Rescuer or Red Flag?

If you are enjoying the year-to-date 14 percent rise in the S&P 500 Index, you can thank artificial intelligence (AI) for that. It started with the release of ChatGPT, developed by Openai, a privately held firm, but has since spread to more than a dozen firms that design AI software, build chips, and run the data centers that AI relies on. Nvidia is the latest darling, with dramatically rising share prices that have catapulted it to the fifth most valuable listed company in the U.S.

How much of the recent stock rally can be attributed to AI mania? To answer that, The Economist studied the data (7-June, “Surging markets are powered by artificial intelligence”). “Analysts reckon that the S&P 500 has 14 firms with significant exposure to the tech. These include well-known giants, such as Google and Microsoft, and lesser-known providers of underlying infrastructure, like Arista and NetApp, two data-centre companies. On its own, the price of Nvidia is responsible for an enormous slice of the stock market recovery. Since the end of November the firm’s market capitalisation has soared from under $400bn to $925bn—accounting for a fifth of the rally. Add Nvidia’s surge to the growing market capitalisations of the 13 other firms with AI exposure and a remarkable 73% of the broader rally is explained.”

A look at share price multiples tells the same story. “In November the average price to current earnings multiple of an S&P 500 firm, excluding the 14 most exposed to AI, was around 27. As we went to press, the multiple had dipped to 26. Meanwhile, the average multiple of firms in our AI bucket had leapt from 43 to 77.”

This trend could continue, and if so will continue to lift the S&P 500 and Nasdaq with it. But it remains to be seen whether the hype is justified or we are looking at a stock market bubble.

If you have experimented with ChatGPT you may have been horrified, amused or impressed. Since we’re writing for our investor clients, let’s cut to the chase with the million-dollar question: Can AI help pick stocks?

Here is a simple answer from David Booth of DFA, as quoted in the Financial Times (21-May): “… Pick a stock. Check the price. Why is it that exact price? Because an equal number of buyers and sellers think they are getting a good deal when they sell or buy it at exactly that time. They make those judgments using every piece of information available to them, both public and private. The market is the world’s largest information processing machine, which creates a price for every publicly traded stock and bond. These prices are set in an environment where no one knows what’s going to happen. So in that sense [the market] is a giant model that is humanity’s best and constantly evolving guess of how each company stock or bond will perform.”

Booth agrees that AI has enormous potential and may help in the execution of trades. But he points out that “Large language models, the types of AI that power tools such as ChatGPT, are intended to understand and generate text … not predict future outcomes. They can generate potential scenarios based on learnt patterns, but they struggle to account for unknown factors or real-world changes that come outside their training data. In that way, they are truly ‘artificial,’ while markets are composed of real, human intelligence and the millions of judgments market participants make.”

We agree with Booth that AI has enormous potential as a new technology, for both better and worse outcomes. We also agree with former Fed Chair Ben Bernanke, who calls himself “a very boring investor” in a 9-June interview with Jeff Sommers of the New York Times.

“I basically have a well-diversified portfolio,” he said. “I do not try to pick individual stocks. I don’t base my investments on what I think the Fed is going to do.” He summarized his approach this way: “You know, have your portfolio consistent with your risk aversion and with your liquidity needs.”

AI may want you to trust it, but we’ll trust the wisdom of the markets. Like a murmuration of starlings that suddenly twists and swerves and dives, perfectly synchronized, markets move in unpredictable and sometimes awesome ways. It’s not that the markets know something we don’t; they know everything.

As always, if you have questions about your portfolio or allocations, please contact us. We are here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell

May Market Review

Courtesy of Avantis Investors

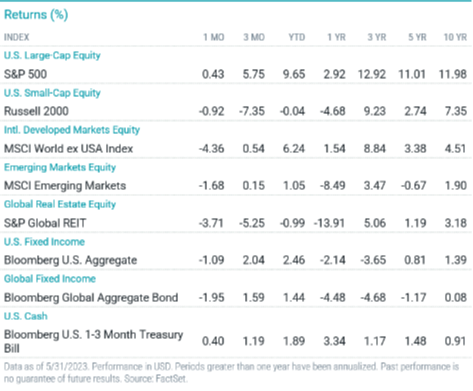

Despite the month’s debt ceiling drama, U.S. stocks advanced in May and outperformed their global counterparts, which declined. U.S. Treasury yields rose, and bond returns declined for the month.

Persistent inflation, Fed policy uncertainty and the federal debt ceiling debate kept the stock market on edge in May. Nevertheless, the S&P 500 gained 1%, buoyed largely by rallying mega-cap technology stocks.

Most S&P 500 sectors declined for May, but strong gains from the information technology, communication services and consumer discretionary sectors powered the broad index higher.

Amid ongoing global growth concerns, non-U.S. developed markets and emerging markets stocks declined for the month.

The month began with news of another bank failure, followed by the 10th consecutive Fed rate increase. Market expectations for the Fed to hike again in June rose after data showed job openings rose in April. But rate-hike expectations faded after a Fed policymaker suggested the central bank could pause in June and resume tightening later.

Annualized U.S. headline inflation continued to ease in April but remained well above the Fed’s comfort zone. Inflation also slowed in Europe and the U.K. but remained notably higher than U.S. inflation.

In the U.S., large-cap stocks generally outperformed small-cap stocks, and growth outpaced value. Outside the U.S., small-cap stocks outperformed, and growth outperformed value.

U.S. Treasury yields rose for the month, and bonds broadly declined.

Equities

US Stocks

From a broad perspective, U.S. stocks advanced in May and year to date. Size and style categories were mixed in May and for the year-to-date period.

Large-cap stocks outperformed small caps in May and year to date, gaining more than 1% and nearly 10%, respectively. Small caps gained 0.05% in May and nearly 1% year to date.

Across the board, growth stocks outperformed their value counterparts, which declined, in May. Year to date, the growth stock advantage was even greater, particularly among large caps.

Non-U.S. Developed Markets

The broad international developed markets stocks index, along with the size and style benchmarks, declined in May but maintained year-to-date gains.

Large- and small-cap cap stocks declined more than 4% for the month with large caps modestly underperforming. Year to date, large- cap stocks significantly outperformed.

Growth stocks fared better than value stocks in May. Year to date, growth stock gains were notably larger than gains among value stocks across the size spectrum.

Emerging Markets

The broad emerging markets stocks index declined modestly in May but advanced year to date.

Small-cap stocks advanced in May and outperformed large caps, which declined. Year to date, small caps gained nearly 6%, outperforming large caps, which returned nearly 1%.

Value stocks underperformed growth stocks among large caps and outperformed in the small-cap arena in May. Year to date, value outperformed among large caps but underperformed among small caps.

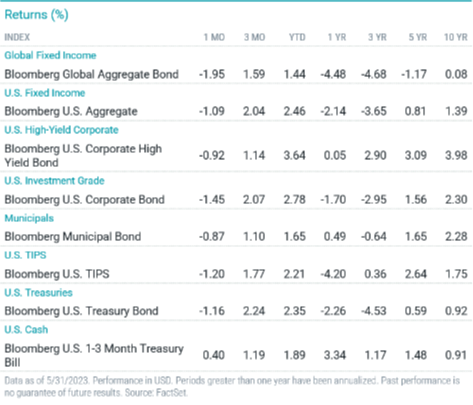

Fixed-Income Returns

Amid still-high inflation and a resilient labor market, Treasury yields climbed in May. All bond market sectors delivered negative returns.

The Bloomberg U.S. Aggregate Bond Index declined 1.45% in May, with all its sectors posting losses.

The yield on the two-year Treasury note jumped 40 bps in May to 4.41%, while the 10-year Treasury yield rose 23 bps to 3.65%.

Investment-grade credit spreads widened slightly for the month, and corporate bonds underperformed Treasuries and MBS. Meanwhile, high-yield corporates declined but outperformed investment-grade corporates.

The Fed lifted rates another 25 bps in early May, pushing its target lending rate range to 5% to 5.25%, a nearly 16-year high. Future Fed policy remained uncertain, though, as banking industry stress complicated the central bank’s inflation-fighting effort.

Annual headline CPI eased from 5% in March to 4.9% in April, while core inflation inched down from 5.6% to 5.5%. The energy component continued to decline, falling 5.1% year over year.

Other key CPI components remained elevated, including transportation services (up 11%), electricity (up 8.4%), shelter (up 8.1%) and food (up 7.7%).

Municipal bonds declined for the month but generally fared better than Treasuries.

Ten-year inflation breakeven rates were unchanged for the month. TIPS declined but outperformed nominal Treasuries.