John Gorlow

| Jul 21, 2023

When June inflation data was released last week, you could almost imagine Fed Chair Jay Powell shouting like quarterback Patrick Mahomes after marching his team to a touchdown with no-look passes and fifty-yard bombs. “This is what I do! this is what I do!” Whether the Fed is unusually skilled or just lucky, investors cheered the indisputably good news: a year-over-year dip in inflation from 9 percent to just under 3 percent. While those who ridiculed Powell’s earlier “transitory inflation” comments have fallen mostly silent, it’s true that the last mile of inflation may be the hardest to tackle. Investment bankers and hedge fund managers caught in defensive positions have some explaining to do, but continue to warn, “Just wait, this won’t last.” Perhaps they’re right.

Contrary to predictions, markets have done well overall in 2023. Sure, the devil is in the details, such as the outsize impact of just a few immensely valuable U.S. tech companies. But the numbers are the numbers. Through mid-year, the S&P 500 clocked an 18 percent gain and the Nasdaq smoked other indexes with a gain of 36 percent. Even Japan, a chronic underperformer of a market, posted an 18 percent YTD gain through June, while several other European indexes rose by double digits.

The question on investors’ minds is which way the Fed will go at its next meeting. Some observers believe markets have already priced in another rate increase, while others predict the Fed will take a wait-and-see approach. Many are concerned that market valuations, particularly the Nasdaq, have become impossible to justify.

Barely in the rear-view mirror, the painful interest rate hikes of 2022 put the brakes on soaring valuations in stocks, housing prices, crypto and other assets that had basked in an expanding bubble of cheap money for more than a decade. The bursting bubble, when it came, was expected to hurt, perhaps leading to recession. That hasn’t happened. Instead, worldwide stock markets are once again nearing all-time highs. Even the riskiest assets are doing well, including junk bonds and bitcoin, once viewed as a digital token with no intrinsic value that could only thrive in an era of abundant, cheap money. While pleasing to investors, this positive news is also unsettling. After all, speculative asset bubbles are not supposed to thrive in a high-interest rate environment.

Maybe we are simply enjoying a brief respite. Recently, pundits have pointed to the next potential bubble-burster: a liquidity crisis. Here’s how that scenario plays out. As the Fed removes approximately $95 billion per month from the economy by not reinvesting some of its portfolio proceeds, the Treasury must simultaneously sell some $1 trillion in new bonds over the summer to rebuild cash holdings after Washington’s debt-ceiling standoff. These two clashing forces could force rates to rise, causing investors to flee riskier assets for higher-yielding Treasuries. The likelihood of such a scenario—and the crash it could precipitate—may be growing. But meanwhile, the “VIX”, Wall Street’s volatility meter, remains relatively low, and as we know high prices can survive for an awfully long time

The past six months have been unexpectedly rewarding and we can all appreciate market gains. Celebrate lower inflation, guard against trying to time the markets, and stay in control of what you can: saving, spending, and sticking with your strategy to achieve your long-term objectives. If you’re concerned about your asset allocation, please reach out to me.

Mid-Year 2023 Market Review

Courtesy of Avantis

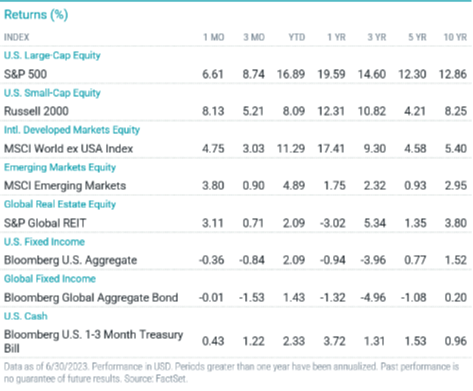

Bolstered by robust gains in June, global and U.S. stocks delivered solid returns in the second quarter. U.S. bonds retreated in June and declined for the quarter but maintained year-to-date gains.

Lingering worries about a potential recession, tighter credit conditions and the Fed’s future inflation-fighting path didn’t slow stocks in the second quarter. Alongside a June debt ceiling deal and a Fed pause (which followed a May rate hike), the S&P 500 Index rallied for the month and quarter.

Outsized gains in several mega-cap technology stocks aided broad index performance. Nevertheless, all S&P 500 sectors advanced for the month, and only the energy and utilities sectors declined for the quarter.

Non-U.S. developed markets stocks and emerging markets stocks advanced but lagged U.S. stocks in June and the second quarter. Emerging markets stocks underperformed non-U.S. developed markets stocks.

The government revised upward first-quarter annualized U.S. economic growth to 2%. Meanwhile, the eurozone logged its second-consecutive quarterly decline and slipped into recession.

U.S. inflation continued to slow in May. Inflation moderated in Europe and the U.K. but remained well above targets, prompting central bankers to hike rates in May and June.

In the U.S., large-cap stocks generally outperformed small-cap stocks for the quarter but underperformed in June. Growth outpaced value among large and small caps. Outside the U.S., large-cap stocks and the value style outperformed.

U.S. Treasury yields rose for the month and quarter, and the broad bond market declined.

U.S. Stocks

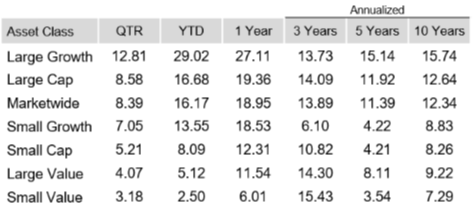

U.S. stocks broadly rallied for the quarter and year-to-date period. Size and style categories delivered strong gains for both timeframes.

Large cap stocks sharply outperformed year to date, gaining nearly 17%. Small caps gained 8% for the year-to-date period.

Large and small cap growth stocks maintained a significant performance advantage over their value peers for the quarter and year-to-date periods.

Non-U.S. Developed Market Stocks

International Developed markets stocks posted solid quarterly and year-to-date gains but lagged their U.S. counterparts.

Large cap stocks outperformed small caps for the quarter and year-to-date periods.

Large and small cap value stocks outperformed growth stocks for the quarter. Year to date, the growth style outperformed the value categories.

Emerging Market Stocks

The broad emerging markets stock index advanced in the quarter to extend its year-to-date gains.

Small-cap stocks significantly outperformed their large cap peers for the quarter and year-to-date periods.

Value stocks significantly outperformed growth for the quarter.

Fixed Income

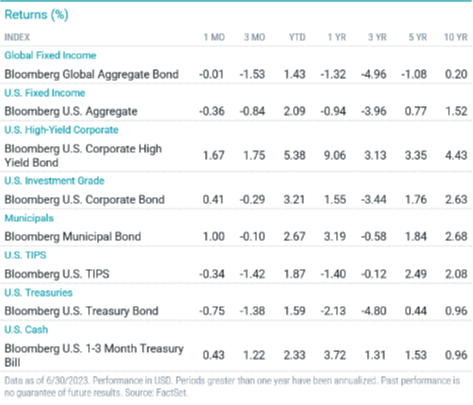

With a debt ceiling resolution, waning banking industry concerns and resilient economic data, interest rates increased across all bond maturities in the US Treasury market for the quarter.

The Bloomberg U.S. Aggregate Bond Index returned negative -0.84% for the quarter. The two-year Treasury yield jumped 87 bps to 4.90% at quarter-end, while the 10-year yield climbed 37 bps to 3.84%.

Credit spreads tightened, and corporate bonds outperformed Treasuries and MBS. Meanwhile, high-yield corporates posted quarterly gains and outperformed investment-grade corporates.

As widely expected, the Fed raised rates in early May and paused in June. However, Fed policymakers indicated the pause was only temporary, and they may hike a couple more times during upcoming FOMC meetings to ensure continued progress toward their inflation target.

Amid falling energy prices, annual headline CPI continued to moderate, increasing 4% in May, the lowest level since March 2021. Core inflation also slowed to a 5.3% annualized gain. The shelter component increased 8% year over year, which accounted for more than 60% of the increase in May’s core CPI.

Municipal bonds (munis) declined slightly for the quarter. Munis outperformed Treasuries for the period.

Ten-year inflation breakeven rates declined for the quarter, TIPS declined and underperformed nominal Treasuries.

As always, if you have questions about your portfolio or allocations, please contact us. We are here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell