John Gorlow

| Aug 15, 2023

It’s hot, and getting hotter. July 2023 was the hottest month on record, capping the eight hottest years on record globally. If you were among the millions of Americans at the boiling point, suffering from severe weather, disruptive blackouts, or skyrocketing energy bills, you may wonder what can be done. Here’s a viable alternative to inaction: You can strengthen your own economic resiliency and make your home a haven of efficiency. No matter what side of the political aisle you’re on, there’s an investment case to be made for choosing energy self-reliance. And now is the time to do it.

For those fortunate enough to have a choice—and much of the world does not—the idea of energy efficiency has changed from “a way to save money” to “a way to enhance personal energy security.” This marks a profound shift in thinking that began during Covid lockdowns, when we began to look at our homes as literal fortresses of self-preservation. Today millions of Americans are quietly shifting toward self-preservation of a different kind, opting to fortify their futures with solar panels, battery storage, heat pumps, induction cooktops, and an electric or hybrid vehicle parked in the driveway.

Thanks to generous tax incentives made possible by the Inflation Reduction Act of 2022, it is now possible in many parts of the country to wean your home from the grid. Beyond excellent tax benefits, the investment case to be made for creating your own self-sufficient grid is compelling. Severe weather is increasing, as are the strains on our traditional power grid. Pressures on that grid are also increasing, with Elon Musk recently warning that the rise of AI will create extraordinary new demands on future electrical consumption. Energy costs will increase along with rising demand. Alternatives make sense when the cost of consumption is growing. Then there is the altruistic argument: why not do your part to reduce your carbon footprint regardless of whether or not you favor federal mandates, market based measures or are of the belief that environmental protection should be left to the private sector?

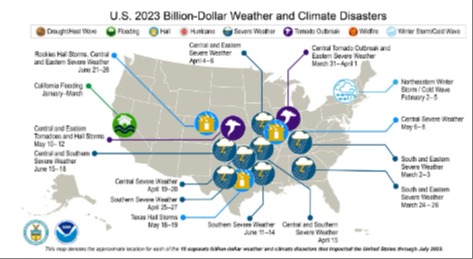

While some will argue that it's complicated to connect climate change to greenhouse gas emissions, there is also the argument that severe weather and the incredible pressure it places on utilities is a financial drain on taxpayers. The most treacherous events have resulted in life-altering and even deadly personal consequences for a growing number of innocent victims. According to the National Oceanic and Atmospheric Administration (NOAA), from 1-January through 8-August 2023, “there have been 15 confirmed weather/climate disaster events with losses exceeding $1 billion each…. Overall, these events resulted in the deaths of 113 people and had significant economic effects on the areas impacted. The 1980–2022 annual average is 8.1 events (CPI-adjusted); the annual average for the most recent 5 years (2018–2022) is 18.0 events (CPI-adjusted).” This was before the recent fires in Maui, which as of this date have taken at least 99 lives, with the governor warning that “scores more [dead] may be found.”

Below: NOAA displays the 15 most severe 2023 weather incidents across the country through early August.

Will weaning ourselves from the grid solve these problems? Of course not, but it could have an impact if change occurs on a large scale across the country. For that, financial incentives under the Inflation Reduction Act are like catnip to smart investors, including homebuilders. While many people aren’t interested in debating global warming, most are keenly interested in saving money. A personal, pragmatic approach to energy reduction makes sense.

Today we hear the Heritage Foundation calling for “dismantling almost every clean energy program in the federal government and boosting the production of fossil fuels” if a Republican wins the White House in 2024 (New York Times, 7-August 2023). Perhaps this enrages you. Or maybe you agree that fossil fuels should continue to rule our future energy consumption. But as an investor, it’s time to consider your personal energy future outside of political propaganda. If your home is your refuge, fortifying it against rolling blackouts, unanticipated power outages and rising energy costs might be one of the wisest economic decisions you can make. The incentives are there. Take advantage of them while you can.

One caveat: It’s complicated

You have many choices with a wide variety of price points for solar, heating and cooling, and EV charging. The learning curve is steep, so it makes sense to begin with someone who’s done the legwork for you. One trusted resource is Energy Sage, an online platform that can help you research, shop and compare quotes from vetted companies in your geographic area. Wirecutter (New York Times) is another source for education and understanding your options. One thing is certain: your choices will continue to expand as more people gravitate to electrical independence. One in four cars purchased in California last quarter was an EV, accounting for one-quarter of all EV sales in the country. That’s the kind of movement that creates markets.

July Market Review

Courtesy of Avantis

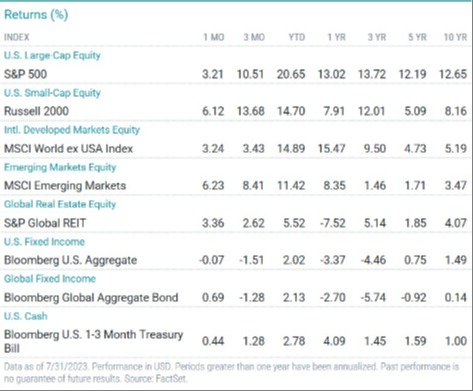

Amid growing expectations for a soft landing, global and U.S. stocks continued to climb in July, extending year-to-date gains. U.S. bonds declined slightly but delivered a positive year-to-date return.

Recession fears faded as the U.S. economy proved surprisingly resilient, corporate earnings were better than expected and inflation’s pace continued to slow. But inflation’s slowdown wasn’t sufficient for the Fed to permanently pause its rate-hike campaign, and policymakers lifted rates 25 bps in late July.

The S&P 500 Index logged its fifth consecutive monthly gain. All sectors advanced for the month, led by energy, which rebounded strongly after posting second-quarter losses.

Non-U.S. developed markets stocks slightly outperformed U.S. stocks while emerging markets stocks rallied more than 6% to outperform their developed markets peers.

The U.S. Commerce Department reported that GDP rose at a 2.4% annual rate in the second quarter, up from 2% in the first quarter. The eurozone economy inched back into growth territory in the second quarter after an upwardly revised flat first quarter.

U.S. inflation continued to slow in June. Inflation also moderated in Europe and the U.K. but remained well above targets. The European Central Bank raised rates again in July, and investors expected another Bank of England rate hike in August.

In the U.S., small-cap stocks rallied and outperformed large-cap stocks in July. Value outpaced growth across the board. Performance patterns were similar outside the U.S.

U.S.

Treasury yields rose, and the bond market declined slightly.

U.S.

Across size and style categories, U.S. stocks delivered solid gains for the month and year to date.

Small-cap stocks outperformed large-caps in July. Year to date, large-caps gained nearly 21% and outpaced small-caps by 6 percentage points.

In July, value stocks outperformed growth stocks across the capitalization spectrum. Year to date, growth stocks maintained a significant performance advantage, particularly among large-caps. Large-cap growth stocks gained 33% versus 9% for large-cap value

Non-U.S. Developed Markets

International developed markets stocks posted solid monthly and year-to-date gains, slightly outperforming their U.S. peers in July but lagging year to date.

Small-cap stocks outperformed large-caps for the month. However, they underperformed their large-cap peers for the year-to-date period.

Large- and small-cap value stocks outperformed growth stocks in July. Year to date, the growth style held an advantage among large-caps but lagged in the small-cap universe.

Emerging Markets

The broad emerging markets stock index rallied in July and outperformed developed markets. The year-to-date gain trailed results in developed markets.

Small-cap stocks slightly outperformed large-caps in July and sharply outperformed their larger peers for the year-to-date period.

Value stocks outperformed growth stocks in July. Year to date, value outperformed growth among large-caps but underperformed growth in the small-cap universe.

Fixed-Income Returns

Alongside resilient economic data and a still-hawkish Fed, most Treasury yields rose in July. The broad bond benchmark declined slightly but maintained a year-to-date gain.

The Bloomberg U.S. Aggregate Bond Index returned -0.07% in July, largely weighed down by Treasury market performance. The 10-year yield climbed 12 bps to 3.96% at month-end, while the two-year Treasury yield declined 4 bps to 4.86%.

Credit spreads continued to tighten, and corporate bonds posted modest gains, outperforming Treasuries and MBS. Meanwhile, high-yield corporates generated a solid monthly return and outperformed investment-grade corporates.

After pausing in June, the Fed resumed its rate-hike campaign, lifting its short-term rate target another 25 bps in late July. The federal funds rate now stands at 5.25% to 5.5%, a 22-year high. Policymakers did not rule out additional tightening, but the futures market reflected a Fed pause for the rest of the year.

Energy prices dropped sharply year over year, fueling a continued slowdown in headline CPI, which increased 3% in June. Core inflation also moderated to a 4.8% annual pace. The shelter component, which accounted for more than two-thirds of the June increase in core CPI, eased slightly from 8% to 7.8% year over year.

Municipal bonds (munis) advanced in July, boosting their year-to-date return to 3%. Munis continued to outperform Treasuries.

Inflation breakeven rates rose in July, and TIPS outperformed nominal Treasuries.

As always, if you have questions about your portfolio or allocations, please contact us. We are here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell