John Gorlow

| Sep 19, 2023

Here we are, nearly three-quarters of the way through 2023, and the markets continue to defy the pessimists and pundits who predicted a recession, a tanking economy, and big job losses as a result of the Fed’s aggressive series of rate hikes. None of that has happened as of mid-September. Of course, it still could.

Plenty of data suggest a gathering storm: higher oil prices, a widening U.S. budget deficit and rising debt-servicing costs, a strong housing market and robust consumer spending. These signs may portend another Fed rate hike (we will know this week). Many believe this might be one hike too many, the proverbial straw that breaks the camel’s back. On the other hand, if the Fed relaxes too soon, the damage could be worse if higher hikes are needed down the road. We could see business investment crushed by ever-higher debt servicing costs, along with more bank failures, a rise in defaults, and escalating unemployment. If you share the pessimists’ point of view, the damage from rate hikes has been delayed but not eliminated. The soft landing we’ve been hearing about was really no landing at all. In other words, the ground we stand on is shakier than ever.

Pessimism is sometimes rational, but many people tend to be irrationally gloomy about the state of their country, writes Simon Kuper (20-July Financial Times). Kuper, among others, believes that relentless reporting of negative, worrisome news is at the heart of it. “The view that is becoming the norm is that we are heading for the apocalypse. In this view the only doubt is over which of the Four Horsemen gets us first: climate change (now hitting earlier than expected), artificial intelligence, a pandemic, or plain old nukes.” While investors are always wise to plan for bumps in the road, “Big-picture pessimism may be blinding us to cheering shifts now under way,” Kuper says.

Kuper and others point to transformative changes that could massively improve lives around the world. Among the hopeful signs he would have us consider:

• Renewable energy is expanding far faster than expected as advances in technology slash prices, a trend that will continue and encourage countries to build more capacity. China’s solar capacity increased an astounding 34 percent in Q1 2023, Kuper reports.

• Advances in RNA technology have accelerated medical research and opened doors to previously unimaginable breakthroughs, including new cancer treatments and record-breaking time-to-market for Covid-19 and other vaccines. The first-ever malaria vaccines will be introduced in African countries this year. And the race to slow or prevent Alzheimer’s disease has accelerated, with exciting trial results.

• Then there’s Artificial Intelligence, the foundation for breakthroughs on multiple fronts. It has the potential to free human creativity in unimaginable ways, from “translating 5,000-year-old cuneiform” to crossing human-animal language barriers by translating the clicks of sperm whales. While some see only devastation in the world of AI, it also holds tremendous potential for reducing the need for mundane tasks and transforming how we spend our work and leisure time.

Kuper observes that it is our job to make these optimistic scenarios happen. I agree. We can either be on the lookout for the impending train wreck, or put our minds to more creative, hopeful work that has the power to move the dial in a positive direction. This is not a Pollyanna-ish point of view. The question is, where can we focus our productive energies? Surely, from an investment point of view, we will see an exciting surge in new businesses built on emerging technologies. At the same time, old businesses will fail or adapt. This has always been the case when new technologies emerge.

I often quote David Booth of DFA because I love his optimism. His faith in “buying and holding” the market is based on a turbulent and utterly unpredictable 100+ year record of how markets perform. Markets are a unique human invention reflecting all the optimism and pessimism of modern life. They go up and down, but history proves that we should expect them to be positive. Markets demonstrate the very essence of resilience. They offer no day-to-day certainty, but plenty of hope for the future. It is sometimes hard to accept that everything is constantly

changing. But I believe that’s a good thing. If we too can be optimistic and resilient, we can manage the central challenge of human existence.

August Market Review

Courtesy of Avantis

Global and U.S. stocks declined in August, but major indices preserved strong year-to-date gains. U.S. bonds fell for the month but also hung on to positive year-to-date results.

A late-month rally improved results for U.S. stocks in August but wasn’t enough to reach positive territory. A recent oil rally, high interest rates, Fed policy uncertainty, and soaring Treasury yields were among the key market factors in August.

The S&P 500 Index snapped a five-month winning streak, returning -1.59% in August and 18.73% year to date. The energy sector was the only index component to advance for the month. That benchmark has now climbed by about 10% since June, rekindling concerns that the inflation bogeyman is down but not out.

Monthly stock declines were steeper outside the U.S. Amid global growth concerns and rising bond yields, non-U.S. developed markets fell but outperformed emerging markets, which sharply declined.

The Commerce Department reported second-quarter U.S. GDP wasn’t quite as strong as it initially announced. Rather than growing at a 2.4% annualized pace, officials said the economy expanded 2.1%, nearly matching the first quarter’s rate.

Annualized U.S. headline inflation increased slightly, while core inflation slowed slightly. Inflation held steady in Europe and declined in the U.K. but remained well above targets. This prompted the Bank of England to hike rates to a 15-year high.

While stock declines were widespread, U.S. large-cap stocks fared better than small-cap stocks. Outside the U.S., small-caps outperformed large-caps. Growth and value trends varied.

U.S. Treasury yields climbed to their highest levels since the financial crisis, and the broad bond market declined for August.

U.S. Market Returns

U.S. stocks broadly declined for the month but maintained solid year-to-date gains.

Large-cap stocks fared better than their small-cap peers in August. Year to date, large-caps gained nearly 19%, more than double small-cap returns.

Growth outperformed value among large-caps but underperformed in the small-cap space. Year to date, growth stocks maintained a significant performance advantage, notably among large-caps, where growth stocks gained 32% versus 6% for value.

Non-U.S. Developed Market Returns

International developed markets stocks declined nearly 4% for the month but advanced more than 10% year to date.

Small-cap stocks declined but fared slightly better than large-caps for the month. Year to date, small-caps advanced but underperformed their large-cap peers by approximately 4 percentage points.

Large- and small-cap value stocks outperformed their growth stock peers in August. Year to date, the growth style was the leader among large-caps but lagged in the small-cap category.

Emerging Market Returns

The broad emerging markets stock index dropped nearly 6% in August and underperformed developed markets. Year to date, emerging markets maintained positive performance.

Small-cap stocks fared much better than large-caps in August. Year to date, small-caps gained 16% compared with 4% for large-caps.

In August, value stocks modestly outpaced growth stocks among large caps and slightly lagged among small caps. Year to date, those same trends persisted to a greater degree

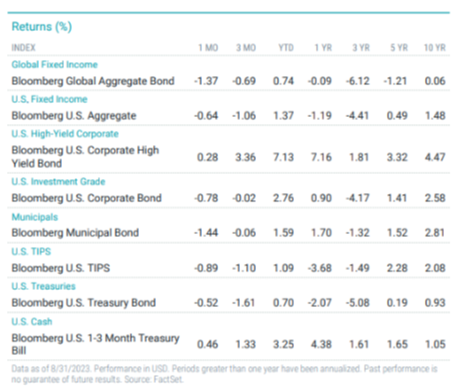

Fixed-Income Returns

Despite a late-month retreat, Treasury yields rose overall in August, contributing to another monthly decline for the broad U.S. bond index. Bonds maintained a modest year-to-date gain.

The Bloomberg U.S. Aggregate Bond Index returned -0.64% in August, as all index sectors retreated for the month. Amid a surge in Treasury issuance, Treasury yields soared to multiyear highs by mid-month before falling in late August. Overall, the 10- year yield ended August at 4.11%, 15 bps higher than the end of July. The two-year Treasury yield rose 1 bp to 4.87%.

Corporate and mortgage-backed bonds underperformed Treasuries and the broad bond index. Meanwhile, high-yield corporates were up fractionally.

At the annual Jackson Hole Economic Policy Symposium, Fed Chair Jerome Powell reiterated the central bank’s inflation fighting resolve and left all options open regarding interest rates. Looking to the Fed’s September policy meeting, the futures market priced in a high probability of the Fed holding rates steady. After that, though, policy expectations remained mixed.

Despite a sharp drop in year-over-year energy prices, headline CPI inched higher in July, to 3.2% from 3%. Core inflation eased to 4.7% from 4.8% in June. The shelter component continued to account for more than two-thirds of core CPI’s gain, rising 7.7% year over year.

Municipal bonds (munis) struggled in August, underperforming Treasuries with a -1.44% monthly return. However, munis continued to outperform Treasuries year to date.

Inflation breakeven rates dropped in August, and TIPS underperformed nominal Treasuries.

As always, if you have questions about your portfolio or allocations, please contact us. We are here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell