John Gorlow

| Oct 20, 2023

Mixed messages rattled the U.S. bond market last week. First came hints from some Fed officials that further rate hikes may not be needed. Investors cheered the news and bonds rallied. But by mid-week, hot inflation data threw cold water on investors’ hopes and the bond rally turned into a sell-off as bond yields rose. By the end of the week, global concerns about the expanding Middle East conflict caused bond prices to rebound as investors searched for a safe haven. But the ping-pong game wasn’t over yet.

Fast-forward a few days to 19-October, when Treasury yields reversed course again and marched higher. Speaking to the Economic Club of New York, Fed Chair Jerome Powell reiterated that the Fed would persist in its efforts to curb inflation. He left no doubt that rates could rise again if the Fed sees additional evidence of stronger than expected economic growth. Following Powell’s remarks, the ten-year Treasury yield rose to nearly 5% and the Dow dropped more than 250 points.

If you feel confused, you’re not alone. In the 16-October Financial Times, the respected economist Mohamed El-Erian wrote, “The recent consensus on economic growth for the world’s largest economy has been erratic, with forecasts fluctuating between a soft and hard landing, with the occasional mention of a crash and no landings as well.” Expectations about the Fed’s actions have similarly fluctuated from potential rate cuts in the near term, to maintaining higher rates for a longer period. El-Erian recently noted that conventional wisdom on the direction for the U.S. economy has shifted six times in the past fifteen months. You can imagine the exasperation bond traders must feel.

It doesn’t help that most predictions have been wrong. “In fact, it’s been exactly one year since Bloomberg declared that, according to its models, the probability of a recession by October 2023—that is, now—was 100 percent,” Paul Krugman reminds us (17-October, New York Times). There are “two possible reasons the recession dog hasn’t barked,” Krugman concludes. “One is that we’re seeing fundamental economic change—that new investment opportunities have increased what the equilibrium level of interest rates should be. The other is that there are, as Milton Friedman claimed, ‘long and variable lags’ in the effects of monetary policy, and high rates will eventually break something major.” Krugman admits to having no idea which story is right.

When Monetary Policy Meets A Massive Deficit

All of this has occurred in the context of a federal deficit that topped $2 trillion in the fiscal year ended in September, and is only expected to grow.

Mohamed El-Erian reminds us that fiscal pressures are ramping up as a result of the huge bills racked up by past promises and public commitments, and the need to meet ongoing challenges including climate change.

That’s not the end of it. Military experts agree that global security issues have created an urgent need to rebuild America’s arsenal of artillery and munitions. These issues include but are not limited to Russia’s invasion of Ukraine, violence in the Middle East, and escalating tensions between China and Taiwan.

Meanwhile, a complete breakdown of leadership in Congress makes responsible action almost impossible. A recession and sharp rise in unemployment would cause the federal deficit to balloon even more.

Uncertainty also extends to longer-term supply and demand dynamics, wrote El-Erian. “Despite rising interest rates, there is genuine doubt about who will readily absorb the additional supply of government debt associated with high deficits. The Fed, which was the most reliable buyer for over a decade with a seemingly limitless printing press and little price sensitivity, is now selling bonds, reversing its quantitative easing programs since the financial crisis with quantitative tightening.”

If the Fed isn’t buying debt, who will? El-Erian’s answer is similar to others: “Foreign buyers seem more hesitant, including for geopolitical reasons. A significant portion of the large domestic institutional investor base, such as pension funds and insurance companies, already holds substantial quantities of bonds at large mark-to-market losses. Additionally, concerns about the stability of regional bank deposits persist, possibly leading them to sell bonds if deposits decrease.”

Fortunately, he added “the bond market still possesses some short-term stabilizers, which have mitigated even more extreme daily fluctuations. Sudden surges in yields attract buyers seeking greater certainty to lock in higher income for the long term, while sudden drops in yields translate into higher prices, allowing some overexposed investors to lighten up on any holdings where they are sitting on paper losses.”

Taken together, global fiscal stresses set against a backdrop of massive budget deficits underscore “the likelihood of a period of fiscal dominance in which deficits are mostly disregarded and interest rates must adjust to a higher equilibrium,” writes Randall Forsyth (16-October, Barron’s).

Forsyth explains that fiscal dominance “has become the new buzzword to describe how massive budget deficits are overwhelming monetary tightening by the Federal Reserve.” He believes these budget deficits are now becoming intractable due to rising interest expenses. Plus, “Nations that formerly recycled surpluses into the U.S. markets are now pulling back, with China selling Treasury securities and Japan slowing its purchases.”

Investing In An Era of Uncertainty

At the moment, it is difficult to look at our national and global challenges and feel optimistic. Climate change has hastened species extinction while quickly becoming a serious global threat to lives, livelihoods and government budgets. The effects of Covid-19 and new variants, along with disturbing news of other potential pandemics, challenge our collective will to prepare and act. The rise of hate groups, nuclear armed states, authoritarian governments and well-armed terrorist organizations fuel our fears that we are not safe and there is no place to hide.

The worst of it is that civil discourse has become rare. When there is no collective will to tackle our greatest challenges, risk is heightened in every direction. Our government and people are bitterly divided, to the point that we are unable to address critical policy issues including public investment, healthcare, poverty, income inequality, education and public safety, among others.

Regardless of one’s personal political leanings, we need to get back to a common purpose to tackle the most pressing issues of our time. If we stand together, we can address our problems despite our differences. Realism is necessary for problem-solving, and at the moment, a realistic assessment of our many challenges is not comforting. That said, one of the hardest parts of investing is not letting your emotions rule your decisions in times of uncertainty and stress.

Recall how markets work through the worst and best of times. Stocks have risen 10% on an annualized basis since 1926, and for the past five years they’ve returned 9% on an annualized basis. That has included some of the darkest days, and years, in history.

Finally, remind yourself that there is no perfect investing formula. There is only the right strategy and allocation crafted to fit your own personal timeline, risk tolerance, and investment objectives. Trust that your portfolio is constructed to complement your personal financial structure, to hedge your financial liabilities, and to move you toward specific investment objectives with high-confidence outcomes in mind.

If you have questions or concerns about your asset allocation, please contact me. I am here to help.

Third-Quarter Snapshot

Courtesy of Avantis

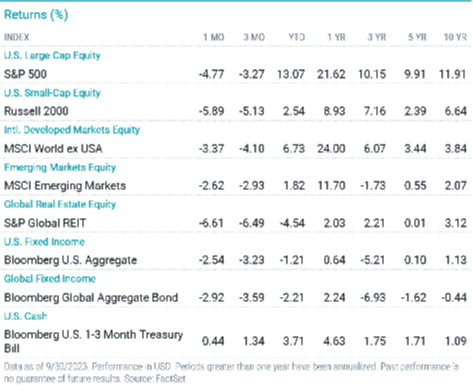

The U.S. stock market rally slowed in the third quarter while the Fed remained hawkish and Treasury yields soared to multiyear highs. Non-U.S. stocks also retreated. Meanwhile, rising Treasury yields weighed on U.S. bond returns.

Stocks saw a second-consecutive monthly decline in September as investors grappled with ongoing inflation news, rising interest rates and the potential for a “higher-for-longer” rate environment. These losses more than offset July’s gain, resulting in a -3.27% third-quarter return for the S&P 500 Index. However, stocks maintained a healthy year-to-date return.

Energy was the only S&P 500 sector to advance in September. For the quarter, all sectors declined except energy and communication services.

Non-U.S. developed markets stocks declined in September and for the quarter. Emerging markets stocks declined for the month and quarter but not as sharply as their developed markets peers.

After hiking in July, the Fed paused again in September. The European Central Bank lifted rates to a 22-year high, while the Bank of England paused for the first time in nearly two years.

The annual rate of U.S. headline inflation rose to 3.7% in August, its second straight monthly gain. Inflation moderated in Europe and the U.K. but remained well above central bank targets.

In the U.S., all size and style indices declined for the month and the quarter. Large-cap stocks outperformed small-caps, while style indices were mixed. Outside the U.S., large-cap stocks outperformed in September but underperformed for the quarter. Value outperformed growth for both periods.

U.S. Treasury yields rose for the month and quarter, and the broad bond market declined.

U.S. Stock Markets

U.S. stocks broadly declined for the quarter but held onto year-to-date gains.

For the quarter, large-cap stocks fared better than their small-cap peers, which declined 5%.

Large-caps sharply outperformed year to date, gaining 13% versus 2.5% for small-caps.

Large-cap growth and value stocks performed similarly for the quarter, while small-cap value outperformed small-cap growth. Year to date, growth stocks significantly outperformed, with large-cap growth stocks up 25%.

Non-U.S. Developed Market Stocks

International developed markets stocks generally declined in the quarter but maintained year-to-date gains.

Large-cap stocks lagged their small-cap peers in the quarter but significantly outperformed year to date. Large-caps returned 7% year to date, while small-caps gained 2%.

Large- and small-cap value stocks fared much better than their growth peers for the quarter. Year to date, value stocks maintained a notable performance advantage over their growth counterparts.

Emerging Market Stocks

The broad emerging markets stock index declined in the third quarter but outperformed its developed markets peers. Emerging markets stocks maintained a year-to-date gain.

Small-cap stocks advanced and outperformed large-caps in the quarter. Year to date, small-caps advanced nearly 14% versus 1% for large-caps.

Value stocks fared better than growth stocks across the board in the quarter. Year to date, value outperformed among large-caps and underperformed in the small-cap universe.

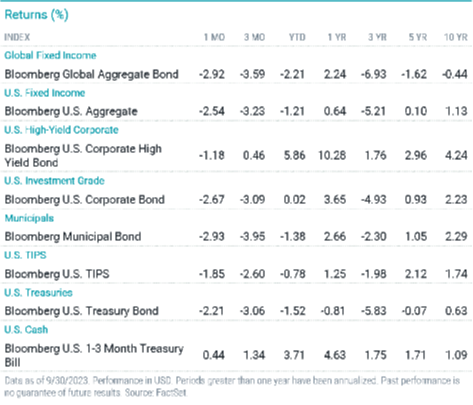

Fixed-Income Returns

U.S. economic resilience and Fed hawkishness contributed to Treasury yields moving higher. The broad bond benchmark declined in September and the third quarter, leaving its year-to-date return negative.

The Bloomberg U.S. Aggregate Bond Index returned -2.54% in September and -3.23% for the third quarter. The two-year Treasury yield jumped 15 bps to 5.05% at quarter-end, while the 10-year yield climbed 74 bps to 4.58%.

Credit spreads widened for the month and modestly tightened for the quarter, and corporate bonds underperformed Treasuries. MBS underperformed corporate bonds and Treasuries. High-yield corporates outperformed investment-grade corporates for both periods.

The Fed lifted rates to a 22-year-high range of 5.25% to 5.5% in July then held rates steady in September. However, policymakers hinted another rate hike may be necessary before year-end to tame still-high inflation.

After steadily dropping to 3% in June (from 9.1% in June 2022), annual headline CPI rose in July and increased to 3.7% by August. Base effects and a 4.3% jump in food prices contributed to the increase. Core inflation slowed to a 4.3% annualized gain in August. The shelter index, up 7.3%, accounted for more than 70% of the increase in core CPI.

Municipal bond (muni) yields spiked, leading to negative muni performance for the month and the quarter. Muni returns lagged Treasury returns for both periods.

Inflation breakeven rates rose slightly for the quarter, and TIPS modestly outperformed nominal Treasuries.

As always, if you have questions about your portfolio or allocations, please contact us. I am here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell