John Gorlow

| Aug 19, 2024

Low-probability, extreme events are nearly impossible to predict. Markets can’t price them in, and investors can’t hedge against them. Even harder is predicting the proverbial straw that breaks the camel’s back. One day things are fine, and the next day all hell breaks loose.

That’s what happened on August 5. Before U.S. markets opened that day, Japan, South Korea and Taiwan markets went into a steep freefall, dropping 12%, 9% and 8%, respectively. European markets began to crack. Even gold, normally a hedge against financial catastrophe, spiraled downward. The VIX index (“the fear index”) soared to levels not seen since Covid-19 and the 2008 collapse of Lehman Brothers. By the end of the day, the S&P 500 closed with a loss of 3%.

Volatility was back with a vengeance—and a reward for those who held on. Less than two weeks later, the Nasdaq had fully recovered its losses, and the S&P 500 and Dow had reached new single-week highs.

How We Got Here

For the better part of two years, investors have been laser-focused on economic news including inflation, interest rates, job growth, and recession risk. Markets digested a slow but steady drip of mostly good data. Then along came AI, a tech breakthrough and powerful growth engine that gave investors a new reason to cheer. By mid-July the S&P 500 index had climbed over 70% from its September 2022 bottom.

Looking back over the post-Covid recovery, several other factors bolstered the market surge. Economists point to the nimble post-Covid rerouting of supply chains that circumvented damage done by trade wars and tariffs. In addition, Germany was able to wean itself off Russian gas without major economic disruption, as many had feared. These adjustments came more quickly and with less pain than anticipated, aided by a jobs boom and a stimulus driven by enormous deficits.

But by mid-summer, the party was winding down. After binging on months of AI hype, investors removed their rose-colored glasses and took a second look at the soaring market. Across the board, valuations had climbed to stratospheric heights not seen since the dot-com bubble of the late 1990s. “Since the start of 2020, before the crash that accompanied the spread of Covid-19, the nominal market value of America’s S&P 500 index has risen by almost 80%, more than twice as much in percentage terms as the increase in American GDP,” reported The Economist (16-July 2024, “Matadors Gather”).

And ominously, the cyclically adjusted price-earnings “CAPE” ratio, popularized by Robert Shiller of Yale University, rose to a dangerously high level not seen since the dotcom bubble and again in 2021, both of which preceded crashes. The “CAPE yield,” a predictor of real returns, was “close to a historic low, providing an impetus to sell stocks.”

Then investors received a triple dose of worrisome news in quick succession: tech giants disappointed Wall Street with lackluster results, the Bank of Japan unexpectedly raised interest rates, and a weak American jobs report upended expectations. The table was set for market volatility.

What Next?

So here we are, a few short weeks later, and the market has roared back, encouraged by the latest news about retail spending and unemployment. It feels great to end a week as we did on August 16, with headlines reading “Stocks See Best Week in ’24.” But we’d be kidding ourselves if we suggested market volatility was over.

We’re in a U.S. election cycle that pits extremely different economic ideas and forms of governance against each other, more so than at any other time in our history. The global economy is not impervious to politics, but so far is not reacting to some of the zanier suggestions and ideas. When economists warn about the impacts, the market shrugs.

Outside the U.S. election, there’s no end to the scenarios that could cause global economic disruption: wars spilling across borders, causing oil prices to skyrocket; tough tariffs igniting trade wars and inflation; a Chinese blockade of Taiwan that draws the U.S. into a conflict with a superpower.

Within the financial system, America’s soaring deficits are getting harder to ignore (we wrote about this in detail last month). Could the bond market crash? Or could growing worries over that possibility usher in an era of deep austerity and stock-market selloff?

All of these things add up to some serious election-year jitters amplified by a market that feels over-extended. It might not take much to upset the apple cart again.

A Clash of Ideas

Volatility isn’t always a result of specific events. It also can arise from uncertainty and a change of the “economic guard,” as old ideas give way to new. Politically, economically, and socially, we are in a period of intensifying change. This may increase volatility as we sort our national and international priorities.

It wasn’t long ago that globalization was considered the solution for global prosperity. Today we’re seeing a renewed emphasis on old-fashioned growth. Mohamed El-Erian, Chief Economic Officer at Allianz, recently wrote of his own growing hope that “advanced countries can decisively break out of a low-growth rut … that has undermined economic wellbeing, structurally weakened increasingly fragile public finances, worsened inequality and made it more difficult to address global threats to lives and livelihoods such as climate change and pandemics (Financial Times, 22-July 2024).”

El-Erian places the blame for low growth on governments that handed the reins to the financial industry and its bag of short-term but ultimately ineffective solutions for spurring productivity and growth. After suffering burgeoning fiscal deficits and out-of-whack balance sheets, he sees a rising number of governments, including the U.K., “placing growth at the top of the policy agenda.” Like others, he looks to innovation and investment in the life sciences, sustainable energy, and artificial intelligence. And he envisions a spillover effect from restructuring of healthcare, food security and defense, with significant opportunities for productivity gains.

I point to El-Erian because his vision is both positive and achievable with the right leadership. The U.K. has been through the wringer, and its populace is ready for something new as evidenced by their latest election. That said, improved government balance sheets coupled with reductions in inequality is an idea we can all support. To get there requires aligning behind goals that move us in a direction of mutual benefit.

Embrace Uncertainty

I’ll remind you again that we are in a period of volatility. Elections—and all the misinformation and targeted marketing around them—spotlight certain fears so we feel them more urgently. The geopolitical landscape is anxiety-producing.

The market has floated on the idea that the U.S. economy will somehow execute a perfect landing. This has been priced in, and now, after about 18 months, many investors are thinking: “I’ve made a lot, maybe I should pack up my gains and get out.”

The repeatedly proven reality is that attempts to manage volatility to one’s advantage, and somehow gain a long-term edge, are likely to end in failure. And the cost of trying will be measured in personal time, nerves, expense, and probably more than a few sleepless nights.

There’s a better way to do this. Consider the big picture: after a very long upswing, the market is sorting itself out. The history of equities is one long march upwards, frequently interrupted by bear markets and crashes. But once prices recover to set a new high, a stream of others often follows. This pattern has led global stocks to deliver an annualized real return of 5.1% since 1900, while American stocks have delivered 6.5%.

Sticking to a passive indexing strategy is proven to give you more consistent results over time than any active trading strategy that requires carefully timed moves. A steady, disciplined approach not only protects your assets during downturns, but positions you to capitalize on the market’s unpredictable and often swift recoveries. And right now, it feels like we can all do with a little less stress and greater confidence in future outcomes.

As always, if you have questions or concerns about your portfolio, please contact us. We are here to help.

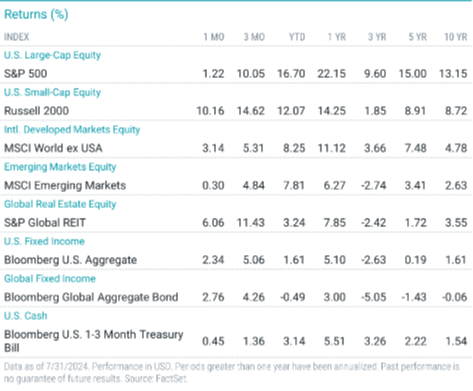

July Market Snapshot

U.S. and global stocks advanced in July and strengthened year-to-date (YTD) gains. Bonds also advanced as U.S. Treasury yields retreated amid the market’s growing rate-cut expectations.

Despite heightened volatility, the S&P 500 Index returned 1.2% in July to post its third straight monthly gain. July’s performance lifted the index’s year-to-date return to 16.7%.

Most S&P 500 sectors advanced in July, led by financials and industrials. Communication services and information technology declined fractionally.

Small-cap stocks rallied more than 10% in July. Value stocks outpaced growth stocks across size categories.

Non-U.S. developed markets stocks outperformed U.S. stocks while emerging markets stocks advanced slightly and underperformed their developed markets peers.

The Fed left rates unchanged on July 31, awaiting greater confidence that core inflation is on a sustainable path toward the 2% target. The following day, the Bank of England cut rates for the first time in more than four years. The European Central Bank left rates unchanged in July, the Bank of Canada cut another 25 bps, and the Bank of Japan lifted rates 25 bps.

U.S. Treasury yields declined in July, and the broad bond market advanced more than 2%.

U.S. Stock Returns

U.S. stocks broadly advanced in July, and all major indices posted solid YTD gains. U.S. stocks underperformed their non-U.S. peers in July but outperformed YTD.

Small-cap stocks returned 10.2% in July and sharply outperformed large-cap stocks, which returned 1.5%. YTD, large caps outperformed.

Value stocks broadly outperformed growth stocks in July. Growth stocks outperformed YTD, and large-cap growth stocks were top performers, gaining nearly 19%.

Non-U.S. Developed Market Returns

Non-U.S. developed markets stocks rose and outperformed U.S. stocks in July, but lagged YTD.

Small-cap stocks outperformed large-caps in July. YTD, large-caps gained nearly 9%, compared with almost 7% for the small-cap index.

Value stocks broadly outperformed growth stocks for the month and year-to-date period. Large-cap value stocks were top performers YTD, gaining 10%.

Emerging Market Returns

Emerging markets stocks advanced fractionally in July. The index gained nearly 8% YTD.

Large-cap stocks were close to flat in July but modestly outperformed small-caps. YTD, large-caps retained an edge, gaining 9% versus 7% for small-cap stocks.

Value stocks outperformed growth stocks in July. YTD, growth stocks outperformed in the large-cap arena but underperformed among small-caps.

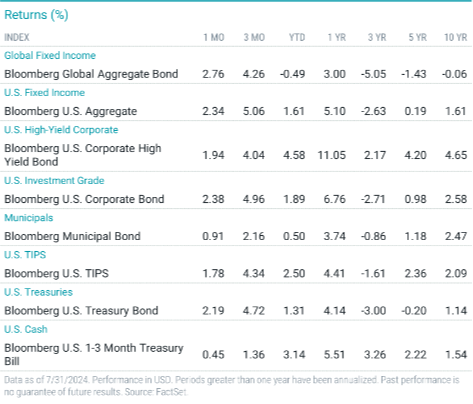

Fixed Income Returns

U.S. Treasury yields declined in July, and U.S. bonds delivered a solid monthly gain. Most inflation measures moderated, while second-quarter GDP expanded at an annualized pace of 2.8%, up from 1.4% in the first quarter.

The Bloomberg U.S. Aggregate Bond Index logged a 2.3% return in July, as all index sectors advanced, led by MBS. July’s performance led the index with a year-to-date return of 1.6%.

Treasury yields retreated for the month, with the 10-year note dropping 36 bps to 4.04%. The two-year Treasury yield plunged 50 bps to 4.27%, and the yield curve remained inverted.

Investment-grade credit spreads were relatively unchanged, and corporate bonds outperformed Treasuries. High-yield credit spreads widened slightly, and high-yield corporates lagged investment-grade corporates.

The annual headline inflation rate (CPI) slowed for the third-straight month in June to 3%, its lowest level in a year. Core CPI rose 3.3% in June, down from 3.4% in May. Core PCE, the Fed’s preferred gauge, remained unchanged at 2.6%.

The Fed held rates steady at a 23-year high in July. In citing continued progress on the inflation front, the Fed fueled market speculation about future rate cuts. At the end of July, the futures market placed a 90% probability on the Fed cutting rates by 25 bps in September.

Municipal bond yields declined in July, and munis posted gains but underperformed Treasuries.

Inflation expectations dropped slightly in July, and TIPS advanced but underperformed nominal Treasuries.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell