John Gorlow

| Sep 17, 2024

Forget presidential debates, election year politics and all the rest. The question on everyone’s mind right now is, how much will the Fed cut interest rates? You’d think the entire world economy is hanging on the answer. And in a way it is. Has the Fed landed the plane, so to speak, with the proverbial soft landing? Let’s listen to what the pundits are saying.

August ended on a strong note, extending the stock market’s winning streak to four straight months. Led by tech stocks, the S&P 500 closed with a 2.3% gain for the month and 18.4% year to date. Bond yields were mixed. Compared to a year earlier, inflation remained unchanged at 2.5%, and slightly lower than 2.6% in July. Unemployment rose slightly. Cooling price increases and continuing strength in consumer spending and retail sales added to the positive news, as did ongoing strength in consumer confidence.

Viewed as a whole, August data sparked a frenzy of guesswork about how much the Fed is likely to cut rates at its meeting this week. Most expect the Fed to trim between one-quarter to one-half of a percentage point from its current target rate of 5.25% to 5.5%. Either way, it’s a momentous turning point.

The Fed began to aggressively raise rates in 2022 when post-Covid inflation quickly rose to levels not seen in decades. At the time, many believed the Fed was too slow to act in response to rising prices as it focused on job targets. The Fed has walked a narrow path ever since, pursuing dual mandates to reduce inflation to 2% while supporting strong employment. For the past 26 months, greater emphasis has been placed on curbing inflation. But now the tide is turning as the job market has cooled, non-farm payroll data has been revised downward, and new business hiring has slowed.

The risk, as some see it, is that slight upticks in unemployment will increase business caution and feed a cycle of more job cuts. So, while a Fed rate cut of half a percentage point would be a reason for businesses to cheer, it might also signal that the Fed is more than a little concerned about a slowing economy. In a recessionary scenario, the S&P 500 forward price/earnings ratio would fall, and earnings estimates would decline from current levels. In contrast, bonds could do well.

On the other hand, many economists believe a soft landing for the economy remains likely after years of Fed maneuvering, at least according to a recent Financial Times/Chicago Booth poll (FT, 16-September, Colby Smith). There is a lot up in the air, but GDP growth is still expected to be 2.3% in 2024 and 2% in 2025, tempered by a moderate rise in unemployment, and a more pronounced decline in core personal expenditures.

Of course there are bigger issues that might upend all economic projections, including the burgeoning federal deficit. With interest expense now running at over $1 trillion a year and exceeding military spending, a day of reckoning may be drawing near—no matter who gets elected in November. The bond markets could be the first to rebel. Stock investors could quickly follow suit if government put the clamps on spending and investment. Our best hope is for bipartisan economic leadership to manage the tax gap, encourage growth with appropriate incentives, and run government responsibly.

As always, the solution has nothing to do with accurately guessing what will happen this week, this month or this year. Instead, it is to safeguard your own assets with a well-conceived plan, long-term mindset, and disciplined approach targeted to your personal goals and timeline.

Do you have questions about your asset allocation or portfolio? If so, please contact us. We are here to help.

August Market Review

Courtesy of Avantis Investors

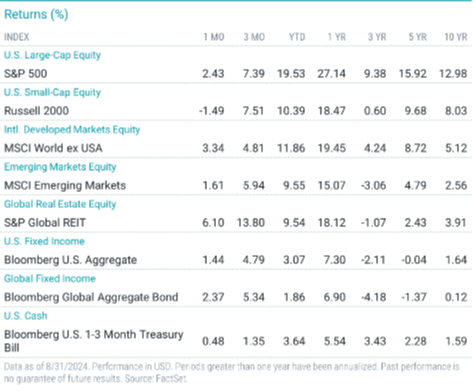

U.S. and global stocks overcame sharp volatility to post gains in August. Bonds also advanced as U.S. Treasury yields declined on expectations for near-term rate cuts from the Fed.

Stocks plunged early in the month following a Department of Labor report indicating that job growth slowed sharply in July. Despite a steep global stock market sell-off, the S&P 500 Index rebounded to return 2.4% and log its fourth straight monthly gain. The index’s year-to-date (YTD) return climbed to 19.5%.

Most S&P 500 sectors gained in August, led by consumer staples and real estate. Energy and consumer discretionary declined.

Large-cap stocks rose following reports showing further easing in inflation and stronger retail sales.

After gaining more than 10% in July, small-cap stocks retreated in August but maintained solid year-to-date gains.

Non-U.S. developed market stocks outperformed U.S. stocks. Emerging market stocks advanced but underperformed developed markets.

At the Kansas City Fed’s annual Jackson Hole Economic Symposium, Fed Board Chair Jerome Powell suggested policymakers will cut rates in September. This news fueled futures-market expectations for three additional cuts by year-end.

U.S. Treasury yields declined in August, and the broad bond market gained more than 1%.

U.S. Stocks

U.S. stocks advanced in August, and all major indices maintained solid year-to-date gains. U.S. stocks lagged their non-U.S. peers for the month but outperformed YTD.

Large-cap stocks gained more than 2% in August and outperformed small-cap stocks, which declined 1.5%. Large-cap stocks outperformed YTD.

Style results were mixed in August. Value stocks outperformed among large-caps but lagged in the small-cap space. YTD, growth outperformed in both size categories.

International Developed Stocks

Non-U.S. developed markets stocks outperformed U.S. stocks in August. They also advanced YTD but lagged U.S. stocks.

Large-cap stocks outperformed small-caps in August and YTD. Large-caps outperformed small-caps by nearly 4 percentage points YTD.

Growth stocks outperformed value stocks in August but lagged YTD. Large-cap value stocks were top performers YTD, gaining nearly 13%.

Emerging Market Stocks

The broad emerging markets stock index advanced in August but underperformed developed markets. YTD, the index gained nearly 10%.

Small-cap stocks outperformed large-caps in August. YTD, large-caps retained the edge, gaining nearly 11% versus 9% for small-caps.

Growth stocks outperformed value stocks across the board in August. YTD, growth stocks outperformed in the large-cap arena but lagged among small-caps.

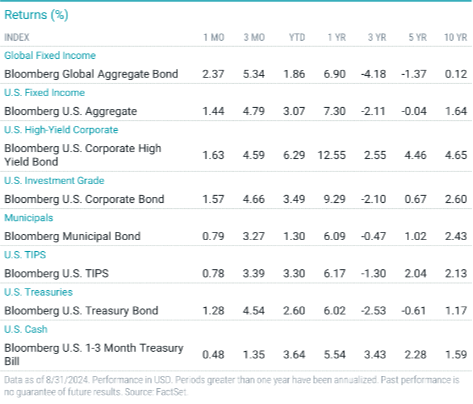

Fixed-Income

Amid high market expectations for a September Fed rate cut, U.S. Treasury yields declined in August, and U.S. bonds delivered another monthly gain. Most data showed inflation continuing to moderate, while labor market measures weakened.

The Bloomberg U.S. Aggregate Bond Index returned 1.4% in August, and all index sectors advanced. MBS and investment-grade corporates outperformed the index return, while Treasuries underperformed.

Treasury yields were choppy but ended the month lower. The 10-year note dropped 13 bps to 3.91%, and the two-year Treasury yield fell 35 bps to 3.92%. The 10-year yield briefly closed above the two-year on August 28, marking the first time the spread was not inverted since July 2022.

Credit spreads were volatile in August, but by month-end, investment-grade spreads were relatively unchanged. Meanwhile, high-yield spreads tightened, and high-yield corporates modestly outperformed investment-grade corporates.

The annual headline inflation rate (CPI) slowed for the fourth straight month, from 3% in June to 2.9% in July. Core CPI rose at a 3.2% annualized pace, compared with 3.3% in June. Annualized core PCE, the Fed’s preferred gauge, was unchanged at 2.6%.

Fed Board Chair Jerome Powell fueled the market’s easing expectations when he declared, “the time has come” for rate cuts. Speaking at the Fed’s annual gathering in Jackson Hole, Wyo., Powell hinted policymakers would act to prevent further labor market weakness. In July, the unemployment rate rose to 4.3%, its highest level in nearly three years.

Inflation expectations declined in August, and TIPS advanced.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell