John Gorlow

| Oct 18, 2024

Is this all the thanks the Fed gets after guiding the economy to a so-called “soft landing?” No sooner did the Fed slash interest rates by half a point and suggest more cuts to come, than investors pushed the yield on the ten-year Treasury to over 4 percent, giving back gains made over the previous three months.

The conventional explanation for the dip is that the market was ahead of itself in pricing in a Fed-Funds target rate of 3.5% by the end of 2025. But the bond market may also be signaling that the war on inflation isn’t over. If that’s the case, further interest rate cuts could overstimulate demand and reignite inflation, resulting in higher interest rates and the recession that many have long feared.

Investors’ nerves have been rattled by a recent onslaught of domestic and international challenges. They are also nervous about U.S. stock market valuations that are as high as they were in the late 90’s just before the 2000 tech-market bubble popped. Paradoxically, the U.S. could also be on the brink of an AI-driven productivity boom, which might accelerate broader economic growth, and send corporate profits higher.

Although the future direction of interest rates is uncertain, the vast and growing supply of U.S. government debt that the bond market must absorb in coming years has made many policymakers believe that interest rates will remain higher than they were in the years prior to the pandemic.

If this view is correct, fixed income investors should be rewarded for bearing interest rate risk. It would also mean that the U.S. government will face rising debt service expense, which is currently pegged at $950 billion, a 34% increase from the prior year. In combination with the soaring federal debt, higher interest rates could put a hard squeeze on government spending and spell trouble for the broader economy.

Whoever wins the presidential election will face immediate decisions next year about agency spending levels, the federal debt limit, and expiring tax cuts. That debate will be pulled one way by people concerned about the deficit, and the other way by those who support broader federal subsidies. Both sides have policies that are inflationary. Which of these policies are enacted remains to be seen, but according to economists, a likely consequence is higher deficits, inflation, and higher interest rates.

Climate, Wars and Oil

Climate change and escalating war in the Middle East are other wild cards in the battle against inflation. According to Politico (10-October), FEMA spent nearly half its disaster budget in just 8 days. FEMA was down to $11 billion in early October, after disbursing $9 billion in little over a week following hurricane Helene. And this was before hurricane Milton, with estimated damage of $100 billion and insurance costs of $50 billion.

These two disasters come on top of severe tornadoes, wildfires and floods, which scientists and reinsurance business executives say are exacerbated by a fast-warming world. The federal government has a massively expensive problem on its hands, whether it opts to contribute unprecedented funding for rebuilding, helping people migrate to more climate-friendly environments, or some other solution. Then there are the costs of rebuilding critical infrastructure, from highways to hydroelectric facilities to coastal railways. While the long-term potential economic benefits from these investments are expected to be considerable, the resulting surge in demand for raw materials and specialized labor would likely add to short-term inflationary pressures.

While the markets have generally shrugged off the potential of a broader Mid-East conflict, the price of oil has remained largely subdued over the past year with traders reassured by the world’s plentiful supply. But if conflicts were to intensify and the world’s oil supply were constrained, shockwaves could be felt throughout the global economy.

Bottom Line: Taming Inflation Could Get Harder

At Cardiff Park Advisors, we recognize that factors such as uncertain government policies, climate change, global conflicts, and rising energy costs have the potential to reignite inflation and disrupt financial markets. However, we're not overly concerned about short-term stock market fluctuations. While these broader global and domestic issues are important, our primary focus is on providing you with a customized and outcome-focused long-term investment strategy. We recommend broad stock and bond index funds and adhering to a buy-and-hold approach to help you avoid reacting to short-term market fluctuations. This allows you to stay focused on your long-term financial goals while maintaining a level-headed perspective as markets rise and fall.

Key End-of-Year Reminders

• Required Minimum Distributions

If you are 73 or older, or if you have an inherited IRA, and your Required Minimum Distributions (RMDs) haven't been processed yet, please reach out to us as soon as possible to ensure your RMDs are handled smoothly and executed in a timely way to avoid potential penalties.

• Qualified Charitable Distributions

If you are 70.5 or older, Qualified Charitable Distributions (QCD) are a great way to donate directly to a charity while also satisfying part of your required minimum distribution. Given the increased volume of year-end requests, it’s important to handle this as soon as possible to avoid delays or bottlenecks. If you’re planning on making a QCD or have questions about it, please reach out soon.

• Year End Gift Transfers

If you’re planning any gift transfers—whether for family, charitable donations, or other financial planning purposes—it’s essential to get the process started as soon as possible. With the year-end rush, processing times for transfers can take longer, and we want to ensure your gifts are handled efficiently and on time. Again, please reach out to us as soon as possible. We’re here to guide you through the process and ensure everything is in order.

Thank you for your attention to these important issues. As always, I’m here to answer any questions or help with any financial planning needs.

Q3 2024 Market Summary

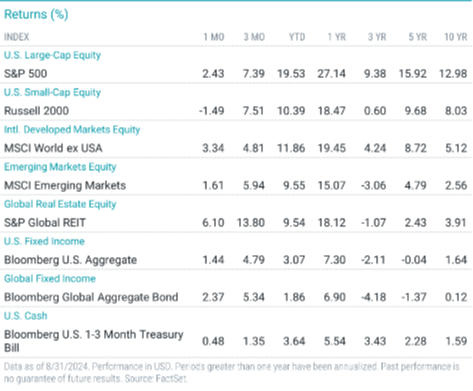

US stocks built on a strong first half, with many market indices hitting record levels as the third quarter came to an end.

But these gains came amid a spike in volatility unseen since the COVID pandemic. The S&P 500 Index returned 5.89% for the quarter. The technology-heavy Nasdaq lagged the broader market, returning 2.76%.

Fulfilling expectations that had been building for months, the U.S. Federal Reserve cut interest rates in September for the first time since 2020—as core inflation eased.

Developed stock markets outside the U.S. also advanced for the month, and outperformed U.S. stocks for the quarter. With China’s stock market surging 24% in September, emerging market stocks advanced and outperformed their developed markets peers for the month and the quarter.

In the bond market, U.S. Treasuries posted their longest monthly winning streak in three years with U.S. government bonds posting a fifth consecutive month of positive returns as yields moderated. But as prices rose, they also fluctuated with yields on the ten-year Treasury, opening the month at 3.91%, then dipping to 3.63%, before rebounding to finish lower for the month at 3.81%. U.S. Treasury yields decreased across the curve, but the 10-year yield rose above the 2-year for the first time in over two years.

Equity Returns

U.S. Stocks

The broad Russell 3000 U.S. stock market index returned 6.23% for the quarter but underperformed both non-U.S. developed and emerging markets.

Small-cap stocks rallied more than 9% and outperformed their large-cap peers for the quarter.

Value outperformed growth. Small caps outperformed large caps. REIT indices outperformed equity market indices.

Non-U.S. Developed Markets Stocks

Developed markets outside of the U.S. posted positive returns for the quarter, outperforming the U.S. market, but underperforming emerging markets.

Value outperformed growth.

Small caps outperformed large caps.

Emerging Markets Stock

Emerging markets posted positive returns for the quarter and outperformed both U.S. and non-U.S. developed markets.

Value underperformed growth.

Small caps underperformed large caps.

Commodities

The Bloomberg Commodity Total Return Index returned +0.68% for the third quarter of 2024.

Coffee and Lean Hogs were the best performers, returning +21.17% and +12.70% during the quarter, respectively.

Heating Oil and Low Sulphur Gas Oil were the worst performers, returning -16.51% and -15.72% during the quarter, respectively.

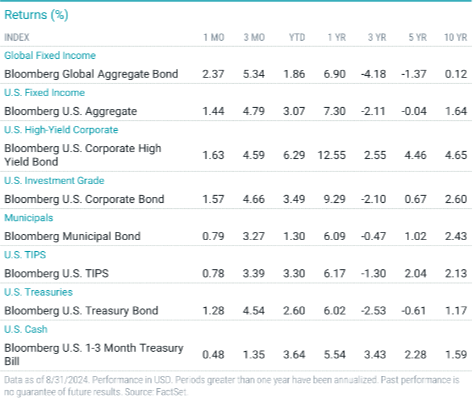

Fixed-Income Returns

Amid high market expectations for a September Fed rate cut, U.S. Treasury yields declined in August, and U.S. bonds delivered another monthly gain. Most Inflation data continued to moderate, while labor market measures weakened.

The Bloomberg U.S. Aggregate Bond Index returned 1.4% in August, and all index sectors advanced. MBS and investment-grade corporates outperformed the index return, while Treasuries underperformed.

Credit spreads were volatile in September, but by month-end, investment-grade spreads were relatively unchanged. Meanwhile, high-yield spreads tightened, and high-yield corporates modestly outperformed investment-grade corporates.

Inflation expectations declined in August, and TIPS advanced.

If you have questions about your portfolio or allocations, please reach out. We are here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell