John Gorlow

| Nov 20, 2024

The recent election of Donald J. Trump marks several milestones in American politics. Trump will be the first American president to serve non-consecutive terms since Grover Cleveland held the office in 1892. He will also be the first to enter office as a felon, convicted on 34 counts of falsifying business records to cover up hush-money payments.

Trump’s return to office, and the sweeping mandate that put him there, signals a disruptive new era in American politics. Voters across the board appear to be disgusted with a “business as usual” approach to issues including immigration and inflation, which surged in the post-Covid years following Trump’s first term. But many questions remain about whether Trump’s policies and leadership (which was, at best, erratic in his first term) will strengthen or erode the U.S. economy.

As we enter the era of Trump 2.0, it’s wise to remember that markets are fickle and can turn in an instant. Markets initially rallied on Trump’s election and expectations of pro-growth policies, including tax cuts, deregulation, and infrastructure spending. The S&P 500 hit a record high of 6,000, driven by hopes for business-friendly policies.

But this enthusiasm quickly dissipated in a swirl of uncertainty, with the S&P falling over 2%, the NASDAQ dropping 3%, and the Dow Jones Industrial Average losing 1.2% by the end of the first post-election week. Rising bond yields—led by the 10-year Treasury climbing to 4.5%—highlighted inflationary concerns, while controversial cabinet appointments raised questions about the administration’s ability to navigate legislative hurdles and effectively manage foreign policy.

Clearly, there is tension between confidence in Trump’s economic agenda and doubts about its execution. The challenge for investors is how to navigate volatility without overreacting to either positive or negative news. It's a good time to remain disciplined, grounded in core investment principles, and committed to long-term objectives.

Bitcoin’s Rally: Promise or Peril?

No asset class exhibits volatility quite like Bitcoin, which has surged 30% since the election on expectations of a crypto-friendly administration, the launch of Bitcoin ETFs, and growing institutional interest. Trump’s fondness for Bitcoin has fueled hopes for deregulation and broader adoption, driving projections sky-high to $100,000 or higher by year-end.

Crypto enthusiasts have demonstrated remarkable resilience over years of volatility. But despite the potential for ongoing appreciation, Bitcoin remains a speculative and risky asset that’s not for the faint of heart. Extreme price swings, regulatory uncertainties, and reliance on institutional support pose significant challenges. Environmental concerns about energy-intensive mining, and vulnerabilities to fraud and manipulation add to the uncertainty. While the crypto market may offer considerable upside, investors should approach it solely as a high-risk, speculative allocation within a diversified portfolio.

On the Upside: Edward Yardeni’s Optimism

U.S. equities are trading at 20-year valuation highs, reflecting investor confidence but also amplifying risks. Rising stock prices, coupled with higher bond yields, have shrunk the equity risk premium, leaving little margin for error in the face of economic or policy shocks. It will take very little to rock the boat.

At the same time, prominent strategist Edward Yardeni remains bullish, projecting the S&P 500 will hit 7,000 by the end of 2025 and 10,000 by 2030, driven by anticipated earnings growth to $285 per share by 2025, up from $240 today. His outlook assumes successful implementation of pro-business policies and sustained economic expansion. As always, optimism can sugarcoat the many uncertainties that derail markets, especially when valuations are as elevated as they are now.

On the Downside: The Dollar’s Vulnerabilities and Fiscal Challenges

It doesn’t take much to imagine what might derail current rosy economic forecasts, including the expansion of existing wars, new conflicts, skyrocketing U.S. debt, and misguided policy decisions that could undermine confidence in the Fed or the broader U.S. economic framework. Among these risks, the dollar’s global dominance stands out as particularly vulnerable, with soaring U.S. debt, fiscal challenges, and geopolitical pressures intensifying concerns about its long-term status as the world’s reserve currency.

A strong dollar underpins global trade, lowers borrowing costs for the U.S., and enhances Americans’ purchasing power, contributing to economic stability. However, the downside includes higher export costs, which reduce the competitiveness of U.S. goods abroad and place pressure on American manufacturing workers. Deliberate and coordinated efforts by U.S. policymakers to manage the value, stability, and role of the U.S. dollar—both domestically and globally—while balancing economic growth, trade competitiveness, and financial stability, represent one of the major challenges facing the next administration.

While unlikely, it’s possible that the dollar’s status could accidentally weaken because of government missteps. Consider a circumstance where excessive fiscal spending, debt accumulation, and uncontrolled monetary expansion combine to ignite rampant inflation, or where a weakening of regulatory fairness and enforcement further undermines economic stability. In such a scenario, politically connected businesses could dominate industries unfairly through subsidies, bailouts, or tax loopholes, crowding out competition and innovation.

Once far-fetched, these outcomes now seem within the realm of possibility. Such developments could pose a significant threat to the dollar’s unique status. Its dominance relies not only on widespread use but also on the global perception of the United States as a stable and reliable economic power.

Protecting Portfolios Against Dollar Risks

At Cardiff Park, our approach to hedging risks tied to the U.S. dollar’s global dominance emphasizes thoughtful diversification across asset classes and geographic regions, reducing over-reliance on the dollar while enhancing portfolio resilience.

Our strategy incorporates international investments in equities to spread exposure across multiple currencies and economies. These investments provide a hedge against dollar depreciation and access to growth opportunities in global markets. Precious metals, such as gold and silver, may play a role as traditional safe havens, offering protection against inflation and potential currency devaluation.

We also emphasize exposure to U.S. multinationals—industry leaders like Apple, Alphabet, Microsoft, Meta, Tesla, Coca-Cola, Procter & Gamble, Merck, Johnson & Johnson, Pfizer, Caterpillar, Amazon, and Walmart—through broadly diversified ETFs and mutual funds. These globally connected companies generate substantial revenue from international markets, positioning them to benefit from a weaker dollar as their foreign earnings gain greater value in U.S. currency terms.

By embracing this globally diversified approach—integrating international markets, tangible assets, and exposure to global revenue sources—our clients gain protection against dollar-specific risks while staying positioned to capitalize on worldwide economic opportunities.

A Reasonable Response: Discipline and Diversification

Investors face the constant challenge of navigating volatility without overreacting to the latest market developments. Tuning out the noise and resisting the urge to trade based on fleeting optimism or fear are especially valuable skills. In an ever-changing economic landscape, a disciplined, systematically structured investment approach—centered on index funds or exchange-traded funds (ETFs)—remains the most reliable pathway to long-term success.

Diversification is equally essential. By spanning asset classes, industries, and geographic regions, diversification acts as a shield against volatility. It ensures that investors can capture overall market growth while reducing the impact of short-term fluctuations and disruption. Together, discipline and diversification provide the foundation for weathering market cycles and seizing opportunities over the long term.

Investors who stick to a

disciplined, long-term strategy are best positioned to navigate and benefit

from periods of volatility. History consistently demonstrates that markets

rise, fall, and ultimately recover to reach new heights. As the nation enters Donald

Trump’s second term, the economic landscape is marked by a dynamic mix of

opportunities and risks.

Meanwhile, America’s

resilience—anchored in innovation, productivity, and strong

demographics—continues to be a cornerstone of its global economic leadership.

Betting against the U.S. or attempting to outsmart what lies ahead has

consistently proven unwise. Even during periods of political and economic

strain, such as the global financial crisis and the COVID-19 pandemic, the U.S.

has demonstrated an extraordinary ability to recover and adapt. Time and again,

leaders from across the political spectrum have come together during critical

moments to implement solutions that stabilized and strengthened the economy.

Despite its challenges, America’s track record suggests that optimism should

remain the default assumption.

The most prudent course of action is to stay focused on a disciplined, diversified, and long-term approach to investing, trusting in the enduring resilience and adaptability of the U.S. economy.

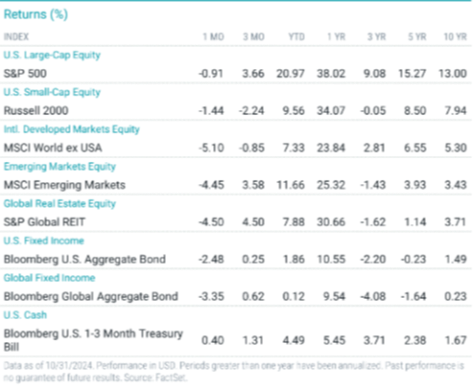

October Market Snapshot

Courtesy of Avantis Investors

U.S. stocks snapped a five-month winning streak and declined nearly 1% in October, weighed down by disappointing third-quarter earnings from large technology companies. Despite the S&P 500 Index’s first monthly decline since April, the index posted a year-to-date (YTD) gain of 21%.

Most S&P 500 Index sectors fell for the month, with health care dropping the most. Conversely, amid solid earnings and a normalizing yield curve, the financial sector gained nearly 3%.

Non-U.S. developed markets stocks dropped for the month, underperforming U.S. stocks. Emerging market stocks posted a steeper monthly decline than developed markets.

Meanwhile, alongside better-than-expected economic data, bonds retreated.

The U.S. economy grew at an annualized pace of 2.8% in the third quarter, down from 3% in the second quarter. The futures market priced in a 95% probability of a 25-bps Fed rate cut in November. The European Central Bank cut rates another 25 bps in October.

The annual rate of U.S. headline inflation eased to 2.4% in September from 2.5% in August, while core inflation inched up to 3.3%. Inflation edged higher in Europe and slowed in the U.K.

In the U.S., large-cap stocks outperformed small-caps, and growth outperformed value for the month. Outside the U.S., large-cap developed stocks outpaced small-caps, and style indices were mixed.

U.S. Treasury yields surged in October, and the broad bond market declined more than 2%.

Equity Returns

U.S. Stocks

The broad U.S. stock market index declined for October but advanced significantly YTD. Most size and style indices also fell for the month, but also maintained solid YTD returns.

Large-cap stocks declined 0.7% and outperformed their small-cap peers in October. Large-cap stocks gained more than 20% YTD, while small-caps returned nearly 10%.

Growth stocks outperformed value stocks across the board in October. Similarly, growth stocks broadly outperformed value stocks YTD, with large-cap growth stocks gaining 24%.

Non-U.S. Developed Markets

International developed market stocks declined and underperformed U.S. stocks for the month. They gained more than 7% YTD, lagging their U.S. counterparts.

Large-cap stocks declined 5% but fared better than small-caps, which declined nearly 6%. Both advanced YTD, with large-caps outperforming small-caps.

Value stocks outperformed growth stocks among large-caps, but lagged among small-caps. Value stocks outperformed across the size spectrum YTD.

Emerging Markets

The broad emerging market (EM) stock index declined more than 4% in October. EM stocks outpaced non-U.S. developed markets stocks YTD, but lagged U.S. stocks.

Small-cap stocks declined more than 4% in October and modestly outperformed large-caps. Large-caps advanced more than 13% YTD and outpaced small-cap stocks.

Growth stocks fared better than value stocks for the month. Growth stocks sharply outperformed value among large-caps YTD but lagged in the small-cap arena.

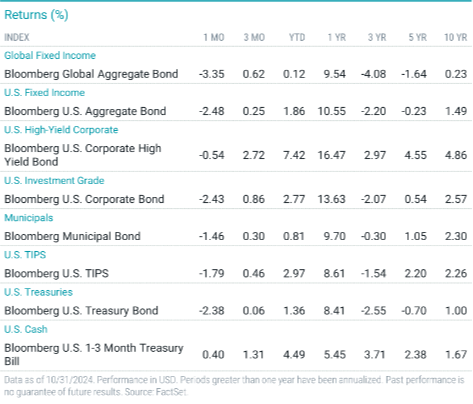

Fixed-Income Returns

After declining for five straight months, U.S. Treasury yields spiked in October in response to resilient economic data and rising long-term inflation expectations. Accordingly, bonds broadly declined for the month but maintained YTD gains.

The Bloomberg U.S. Aggregate Bond Index returned -2.5% for the month, reducing its YTD gain to 1.9%. All index sectors declined in October, with Treasuries modestly outperforming.

Treasury yields soared. The yield on the 10-year Treasury note rose 50 bps to 4.29%. The two-year Treasury yield surged 54 bps to 4.19%.

Investment-grade and high-yield credit spreads tightened for the month, but rising yields led to negative returns. High-yield corporates outperformed investment-grade corporates.

U.S. inflation data was mixed. Headline CPI slowed for the sixth straight month to an annualized pace of 2.4% in September, while annual core CPI increased slightly to 3.3%. Meanwhile, the annual core PCE inflation rate, the Fed’s preferred inflation gauge, held steady at 2.7% for the third consecutive month in September.

Municipal bonds declined for the month but outperformed Treasuries.

Inflation expectations increased sharply during the quarter, and TIPS declined but outperformed nominal Treasuries.

Do you have questions about your portfolio or allocations? Please contact us, we are here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell