John Gorlow

| Dec 10, 2024

Reflecting on 2024

Reflecting on 2024: Market Predictions and November Performance Highlights

As 2024 winds down, the financial markets continue to provide valuable lessons in humility and resilience. This month, we spotlight the “Market Forecasters’ Report Card,” which highlights just how difficult predicting market outcomes can be—and the lessons every investor can take away. Meanwhile, after stumbling in October, global markets roared back in November, led by a nearly 6% surge in the broad U.S. market. Courtesy of analysis by Avantis Investors, we’ll explore these themes through the lens of forecasting missteps and November’s market rally, and what they reveal about the importance of staying disciplined in an unpredictable world.

The Challenge of Market Predictions

There’s nothing like reflecting on market forecasts to remind us why crystal balls remain firmly in the realm of fairy tales. Through the lens of Avantis Investors’ analysis, we’ll examine the challenge of market forecasting alongside November’s remarkable rally. Together, these insights reinforce why staying disciplined and grounded in a long-term strategy is critical in an unpredictable financial world.

Spoiler alert: reality had little regard for even the most confident predictions.

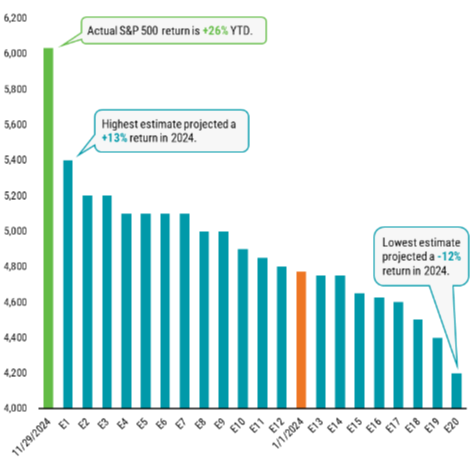

At the start of the year, forecasts for the S&P 500’s year-end level ranged from 5,400 (a 13% gain from 2023’s close) to 4,200 (a 12% decline). With the index up 26% year-to-date as of November and trading above 6,000, not a single prediction was even close.

Figure 1 | 2024 Forecasts Missed the Mark

Year-End 2024 S&P 500 Price Targets From the End of 2023

This trend isn’t new. Over the past seven years, consensus forecasts have consistently fallen short of actual market returns, missing by as much as 26% on the upside and 21% on the downside.

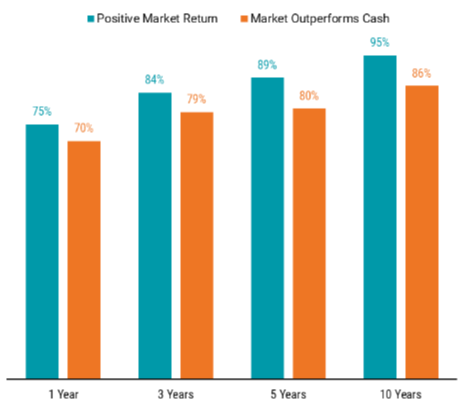

What’s the takeaway? Investors don’t need to outguess the market to achieve long-term success. Instead, sticking to a disciplined investment strategy aligned with your goals and risk tolerance remains the most reliable path forward.

Figure 2 | Time Puts the Odds in Your Favor

Based on Monthly Rolling Returns from January 1927 – September 2024

November Market Snapshot

Overview

November was a standout month for global financial markets, with U.S. stocks delivering their largest monthly gain of 2024. The S&P 500 Index rallied nearly 6%, lifting its year-to-date return above 28%. All S&P sectors advanced during the month, with consumer discretionary and financials leading the charge, each posting double-digit gains amid robust consumer spending. The health care sector lagged, delivering the weakest return.

The rally came against a backdrop of decisive U.S. election results, generally healthy economic data, and mixed third-quarter earnings reports. Non-U.S. equities also posted positive returns, while U.S. bonds rebounded from October’s decline, advancing more than 1% for the month.

Central banks remained active in November. As widely expected, the Federal Reserve cut interest rates by 25 basis points on November 7, citing persistent inflation above target and slowing job growth. The Bank of England followed suit, also reducing rates by 25 basis points.

Inflation data reflected modest increases. The annual rate of U.S. headline inflation (CPI) rose to 2.6% in October, up from 2.4% in September, while core CPI held steady at 3.3%. Inflation also edged higher in Europe and the U.K.

In equity markets, small-cap stocks outperformed large-caps in both U.S. and non-U.S. developed markets, with growth stocks outpacing value across the board. In emerging markets, small-caps outperformed large-caps, but value led growth for the month.

Treasury yields declined in November, contributing to the broad bond market’s recovery. The 10-year Treasury yield ended the month lower, and the yield curve spread between short- and long-term maturities remained nearly flat.

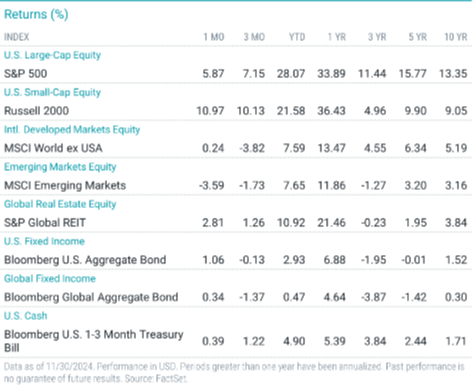

Asset Class Performance: Monthly, Quarterly, and Long-Term Returns

U.S. Equity Returns

The U.S. stock market rallied broadly in November, with small-cap stocks gaining 11% and outperforming large-caps for the month. Year to date, large-caps have delivered a remarkable return of over 28%, while small-caps have gained nearly 22%. Growth stocks continued to outperform value stocks, with large-cap growth up 32% year to date.

Non-U.S. Developed Markets

Non-U.S. developed market equities posted slight gains in November, underperforming U.S. stocks. Year to date, these markets delivered a return of nearly 8%, though they still lag significantly behind U.S. markets. Small-cap stocks outperformed large-caps for the month, though large-caps lead on a year-to-date basis. Growth stocks outpaced value stocks in November, while value stocks remain the leaders year to date, especially among large-caps.

Emerging Markets

Emerging markets (EM) stocks declined nearly 4% in November after a 4.5% drop in October. Despite these setbacks, EM stocks remain up nearly 12% over the trailing 12 months and have slightly outperformed non-U.S. developed markets year to date, though they continue to lag U.S. equities.

Small-cap EM stocks declined more than 2% in November, outperforming their large-cap peers. However, year-to-date performance favors large-caps, which have advanced nearly 9%. Value stocks generally outperformed growth stocks in November, while year-to-date growth stocks lead among large-caps, and value stocks lead in small-caps.

Fixed Income

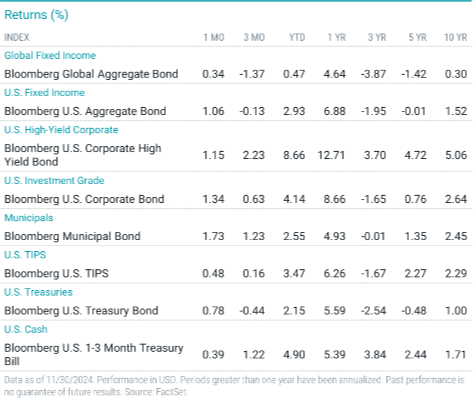

The Bloomberg U.S. Aggregate Bond Index returned 1.1% in November, lifting its year-to-date performance to nearly 3%. All sectors posted gains, with corporate bonds and mortgage-backed securities (MBS) outperforming.

The Federal Reserve reduced interest rates by 25 basis points in November, bringing the target rate to 4.5%–4.75%, even as core inflation remained elevated. Core CPI held steady at 3.3%, while the core PCE inflation rate edged up to 2.8% from 2.7%.

Treasury yields declined during the month. The 10-year Treasury yield ended November at 4.19%, down 10 basis points from October 31, while the two-year yield fell slightly to 4.16%. The yield curve spread between the two maturities was nearly flat by month-end.

Credit spreads tightened in November, with investment-grade corporates outperforming high-yield corporates, MBS, and Treasuries. Municipal bonds also rallied, outperforming Treasuries for the month. Long-term inflation expectations eased, contributing to Treasury Inflation-Protected Securities (TIPS) underperforming nominal Treasuries.

Fixed Income Performance: Monthly, Quarterly, and Long-Term Returns

Final Thoughts

The evidence is clear: while forecasting short-term market movements remains a high-risk endeavor, disciplined investing in a well-constructed portfolio has proven its merit time and again. November’s market performance further illustrates the importance of staying the course, even amid uncertainty.

Do you have questions about your portfolio or allocations? Please contact us, we are here to help.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell