John Gorlow

| Feb 14, 2025

The investment landscape is undergoing seismic shifts as the new administration moves at breakneck speed to reshape economic, political, and institutional norms. Policy changes and hundreds of executive orders have heightened uncertainty, prompting investors to rapidly assess risks and opportunities in an environment that changes every day.

A significant expansion of executive power is at the center of debate. As described by the New York Times (9-February 2025), Trump’s policies are not only reshaping trade and regulatory frameworks but challenging long-standing constitutional norms, which could have lasting and far-reaching economic impacts. While supporters applaud an overhaul of inefficient government systems, critics warn of destabilized legal and financial frameworks upon which investors have long relied.

Let’s look at some recent actions and the concerns they raise.

Federal Bureaucracy Under the Knife

Elon Musk is quickly dismantling agencies, defunding key programs, and shifting regulatory oversight. While in principle his work is centered on efficiency and cost savings, in practice it is impossible to quantify those savings since so many actions are, or are likely to be, disputed in court. The result has been short-term volatility, but could lead to long-term shifts in industries reliant on federal contracts and regulations.

Meanwhile, some industries are clearly favored. Big Tech’s alignment with the administration signals that companies are leveraging government support to navigate mounting antitrust and data privacy pressures, potentially reinforcing tech-market concentration.

The New Trade Order

Investors are sharply focused on Trump’s trade policy. Recently enacted tariffs on steel and aluminum have the potential to feed inflation and drive prices much higher for businesses and consumers. Economists Larry Summers and Phil Graham have warned against such broad tariffs, arguing that protectionist measures distort global supply chains and reduce productivity. Indeed, markets have already experienced fluctuations in commodity prices, industrial production expectations, and currency adjustments in response to tariff-related uncertainty.

On the other hand, proponents of higher tariffs argue that they are necessary to boost domestic manufacturing and reduce the trade deficit. Summers and Graham challenge this narrative. They point out that U.S. industrial production is at an all-time high, generating 2.5 times more output than in 1975, despite the persistent trade deficit. Manufacturing employment has steadily declined, not because of trade policy, but due to productivity gains, much like the shift in agriculture, where employment fell from 40% to 2% of the labor force. Tariffs enacted under Trump in 2018, and later expanded by Biden, failed to reverse this long-term trend.

America’s Debt Dilemma

Debate over tariffs feeds into growing concern about U.S. fiscal health, as rising trade tensions intersect with a growing national debt burden. With the U.S. deficit projected to reach 6% to 7.5% of GDP, depending on whether tax cuts are extended, the sustainability of federal debt levels has become a pressing issue. Investors are watching closely as foreign buyers—who already hold a disproportionate share of U.S. bonds—show increasing reluctance to absorb additional debt.

Experts warn that the failure to address the debt problem could lead to a severe economic correction, higher inflation, and a weak dollar that declines under inflationary pressure. At risk is the long-term stability of the dollar as the world’s leading currency. Without meaningful action, they say, the U.S. risks entering a debt spiral reminiscent of the 1971 breakdown of the Bretton Woods system or the 1994 collapse of Europe’s exchange rate mechanism.

Tax relief can support economic growth, but if policymakers fail to cut the deficit meaningfully—either through spending reductions or revenue increases—it’s not hard to envision a scenario in which bondholders begin to lose confidence, sending interest rates sharply higher and weakening real estate and equity markets.

Regulation Under Fire

Simultaneously, the growing revolt against regulation is reshaping industries and financial markets. Governments worldwide are pushing for regulatory reform, seeking to balance efficiency with economic growth.

Done right, regulatory overhaul can usher in greater freedom, faster economic growth, lower prices, and increased innovation. But indiscriminate deregulation without safeguards risks market instability, legal uncertainty, and reduced protections for businesses and consumers alike.

The Trump administration’s aggressive approach may have rapidly cut red tape, but lack of structured implementation raises concerns over unintended economic and security consequences. The potential for catastrophic effects is real as the administration guts institutions that help people, contribute to safety, and enhance U.S. standing in the world. These cuts also open the door to adversaries who are eager to fill in gaps in global aid.

The challenge lies in striking the right balance—promoting economic dynamism while preserving critical regulatory frameworks that support fair competition and financial stability.

Trump’s Power Play

As the Trump White House shifts from traditional alliances to a strategy of transactional power, it is upending established global order. Many view the “America First” strategy as a form of isolationism that prioritizes short-term economic leverage over long-term stability. This approach will have far-reaching, rippling impacts as it redefines U.S. engagement in the Middle East, Ukraine, and in its rivalry with China.

As U.S. alliances move from free trade to tariffs, there’s a real risk of economic fallout. Industries will of necessity be reshaped by disrupted supply chains. New alliances and regional trading blocs will be formed, opening the door to the rise of other currencies and shifting trade away from the dollar. The standing of the U.S. as a global superpower could erode as these alliances form and evolve over time.

In sum, short-term leverage could come at the steep cost of long-term geopolitical cohesion. By prioritizing power over partnerships, the Trump administration risks alienating allies, intensifying global instability, and undermining trust in U.S. leadership. Each of these scenarios poses serious economic risks.

Markets Absorb the News and Move Forward

For investors, the key question is how markets are absorbing these developments. Financial markets closed a volatile month broadly higher, with gains seen across a range of asset classes, including gold, government bonds, and equities in both domestic and international markets. These gains occurred against a backdrop of uncertainty driven by escalating trade disputes, shifting expectations for interest rates, and the disruptive impact of the DeepSeek AI shock.

The yield on benchmark 10-year Treasury notes had been trending lower since mid-January, ending the month slightly down at 4.566%. Looming tariffs under the Trump Administration have reignited concerns that inflation could tick higher, potentially derailing the possibility of further interest rate cuts.

Reflect, But Stay Steady

There is never a good time to let your emotions control your investment decisions. Given the intense pace of change, investors may want to take extra care right now to tune out the news and refrain from impulsive decisions. This can be hard when the entire U.S. government seems to be changing before our eyes. But there is absolutely no way to predict the future and know how things will turn out in a week, a month, or a year.

I can’t imagine a time when it has been so critical to stick to a financial strategy that relies on a well-diversified, low-cost, and risk-balanced mix of asset classes that align with your long-term goals and objectives. When looking at equities, stay broadly allocated and include some alternative investments such as real estate securities, gold, and small amounts of crypto. Exposure to international markets, high-quality bonds, and real assets can help mitigate risks associated with rising inflation and potential economic disruptions. While volatility may persist, a disciplined, diversified approach remains the most effective strategy for navigating uncertain conditions.

Market Snapshot: January Performance

U.S. stocks ended a volatile month with a gain of nearly 3%, driven by a mix of factors, including uncertainties surrounding tariffs, inflation, Federal Reserve policy, AI competition, and strong corporate earnings. Nearly every sector in the S&P 500 advanced in January, with information technology as the only decliner.

International markets saw strong gains, particularly in Europe, where the central bank cut interest rates by another 25 basis points, helping the broad international stock index outperform U.S. stocks. Emerging markets also advanced but lagged developed markets. Meanwhile, the Federal Reserve opted to pause its easing campaign, citing a stable labor market, persistent inflation concerns, and ongoing economic policy uncertainty.

Inflation data reflected a mixed picture. The annual U.S. headline inflation rate rose from 2.7% to 2.9% in December, while core inflation edged down slightly to 3.2% from 3.3%. Inflation increased in Europe but declined marginally in the U.K.

Across U.S. equities, all size and style indices advanced, with mid-cap stocks outperforming large- and small-caps. Growth stocks led among mid- and small-caps but underperformed within large caps. Outside the U.S., all major developed markets' size and style indices saw positive performance.

Following an uptick in December, U.S. Treasury yields declined modestly in January, contributing to gains in the U.S. bond market.

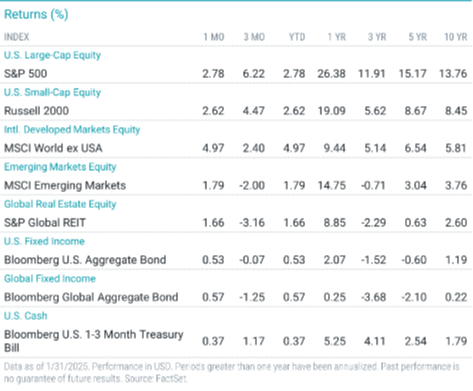

Equity Returns

U.S. large-cap stocks returned 3.2%, outperforming small caps, which gained 2.6%. Large-cap value stocks performed particularly well, rising 4.6%, more than doubling the return of large-cap growth stocks.

International developed markets outpaced U.S. equities, with large caps advancing over 5% and small caps increasing by 3.2%. Growth stocks outperformed value stocks across categories, reflecting strong earnings and economic resilience in key regions.

Emerging markets stocks gained nearly 2%, though large caps outperformed small caps, which declined nearly 3%. Growth stocks in emerging markets saw better performance than value stocks, but small-cap growth experienced sharper declines.

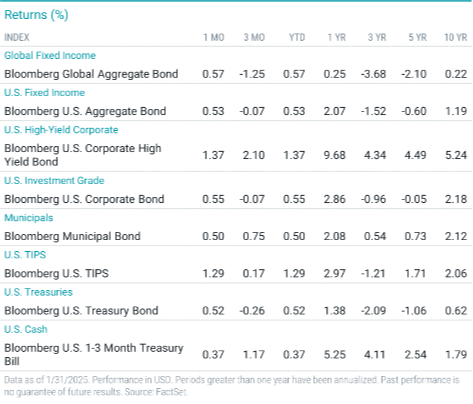

Fixed-Income Returns

Bonds rebounded from December’s decline, with the Bloomberg U.S. Aggregate Bond Index returning 0.53% in January.

Treasury yields declined modestly amid inflation and economic policy uncertainty. The 10-year Treasury note ended January at 4.54%, down 4 basis points from December, while the two-year Treasury yield fell 3 basis points to 4.22%.

Investment-grade credit spreads remained stable, while high-yield credit spreads tightened. Investment-grade corporates slightly outperformed Treasuries and mortgage-backed securities, while high-yield corporates saw a strong rally.

The Federal Reserve left interest rates unchanged, citing the need for further data. Headline CPI increased for the third consecutive month, while core PCE inflation remained steady at 2.8%.

Municipal bonds advanced, nearly matching Treasury market returns. Inflation expectations rose in January, leading Treasury Inflation-Protected Securities (TIPS) to outperform nominal Treasuries.

Do you have questions about your portfolio or allocations? Please call us. We are here to help.

Regards,

John Gorlow

President, Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell