John Gorlow

| Apr 11, 2025

In the first week of April, markets were thrown into chaos as President Trump's tariff announcements reverberated through global financial markets. Stocks tumbled, the dollar fell, and even the world’s safest assets—gold and U.S. Treasury bonds—were hard hit. Investors were incredulous as Trump’s “Liberation Day” charts revealed steep worldwide tariffs on friends, foes, and uninhabited islands with equal disregard for consequences. This felt like a game of bluff. Except Trump insisted he wouldn’t fold.

For a few days it felt like the financial world was teetering and might even collapse, even as White House advisors hinted that a grand strategy would soon be revealed. Maybe so, but there was apparently no forethought given to the market’s extremely volatile and negative reaction. Within a few days, Trump did an about-face and announced a 90-day pause on the new tariffs. (Except for China, where tariffs would be even more punitive.) Markets rallied, with investors hoping the worst was over.

But the calm didn’t last. After one soaring day, markets spun back into turmoil. This wasn't just another quick correction—investors were experiencing the kind of deep uncertainty in which each question leads to another, and any number of dominoes could be the one to topple the pile. After all the chaos—which Trump brushed off as people “getting yippy”—none of the uncertainty had been resolved about trade policy, inflation, sinking consumer confidence, soured global alliances, and rising tension with China. And judging from the foreign press, irreparable damage had been done to trust in the U.S. as a steady, safe haven for investment and a predictable economic partner.

The Bond Market: Uneasy and Uncertain

More concerning to some market watchers is the fact that, as stocks tumbled, the bond market also faced turbulence. U.S. Treasury bonds, traditionally seen as a safe haven, experienced sharp movements with yields rising unexpectedly. The concern is whether this signals a loss of confidence in U.S. economic stability. Economists and trade experts warn that tariffs could disrupt the U.S. financial system. However, many business leaders and investors believe this won't happen, either because cooler heads within the administration will prevail or because economic or financial turmoil will force the administration to ease the tariffs and restore stability.

Uncertainty and Opportunity

Was the chaos caused by Trump’s on-again, off-again tariff policies part of a larger long-term plan or just the consequence of impulsive short-term thinking? As Janan Ganesh pointed out (10-April Financial Times), it’s tempting to find logic in the chaos, to believe that there’s some hidden, grand strategy at play. But he quickly concluded that the contradictions in Trump’s approach to policy are too numerous to call it a “grand plan.” Ganesh and others believe that what we may be seeing is reactive decision-making rather than a cohesive vision. And as unsettling as that may be, it’s the nature of the current unpredictability that investors must grapple with.

When markets are at their most unsettling, it’s often the best time to identify opportunities that others might ignore. But the volatility isn’t just a sign of chaos; it’s a reminder that significant opportunities often emerge from some of the greatest market dislocations, leading to increased risk premiums and potentially higher expected returns.

Those opportunities can be hard to recognize in the midst of fear and confusion, and investors are clearly fearful about what’s happening now—shifting tariffs, uncertainty around inflation, and the business impacts of disrupted global trade. But a chaotic landscape is often rich with opportunity.

Navigating Volatility with Purpose

Although fear is a natural response during market volatility, it shouldn’t dictate investment decisions. The market’s fluctuations—stocks falling, bonds rising, then reversing—may seem alarming, but they are an inherent part of the long-term investment journey.

Uncertainty and unpredictability are entwined in the investment process, in the best of times and in the worst of times. Markets will continue to fluctuate, and while there’s legitimate concern about what comes next, the key is ensuring that your strategy remains aligned with your objectives. If circumstances change, it’s a good time to reassess—but that requires communication and a thoughtful conversation.

Whether you’re managing short-term liabilities like recurring withdrawals or anticipating future income replacement needs, the focus should always be on keeping the portfolio connected to real-life financial realities and the duration of the liabilities.

Consider the opportunities inherent in volatility, the best bargains are often found when fear is at its peak. It’s tempting to react impulsively, but history has shown us that patience, perspective, and a focus on long-term goals are the best antidotes to fearful retreat.

If we haven’t spoken recently or if you’d like to revisit your portfolio’s positioning, please contact me.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell

Quarterly Review: A Look at the Data

Courtesy of Avantis Investors and Dimensional Fund AdvisorsMarch Snapshot

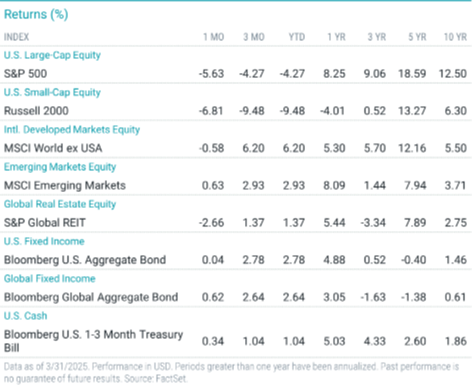

U.S. stocks (S&P 500 Index) dropped sharply in March, suffering their worst quarterly returns since 2022. Non-U.S. stocks outperformed both for the month and the quarter, while U.S. bonds advanced.

Against a backdrop of tariff policy uncertainty and economic and inflation concerns, U.S. stocks declined in March and for the quarter. The S&P 500 Index reached three all-time closing highs during the quarter before briefly falling into correction territory in March.

Energy and utilities were the only S&P 500 sectors to post gains in March. Sector performance was mixed for the quarter, with seven sectors gaining and four declining. Energy led the gainers with a return of more than 10%, while consumer discretionary was the worst performer, declining nearly 14%.

Non-U.S. developed market stocks fell in March but rallied for the quarter. With a modest gain, emerging market stocks were top performers for March and also advanced for the quarter.

The Fed remained on hold, favoring a wait-and-see approach regarding inflation and growth. The European Central Bank cut rates twice, while the Bank of England cut rates by 25 bps in February.

The annual rate of U.S. headline inflation eased in February to 2.8% from 3% in January, while core inflation slowed from 3.3% to 3.1%. Headline inflation also eased in Europe and the U.K.

In the U.S., all major size and style indices declined in March. For the quarter, most indices declined, but large-cap value stocks gained 2%. Outside the U.S., developed market size and style indices were mixed for the month but advanced for the quarter. Emerging market indices were mixed for both periods.

Equity Returns | Size and Style

U.S. Markets

The broad U.S. stock market index fell sharply in March and declined for the quarter. Most size and style indices also declined for both periods.

In March, large-cap stocks fared better than their small-cap peers, which declined nearly 7%. For the first quarter, large-cap stocks declined more than 4%, while small caps fell more than 9%.

Value stocks outperformed growth stocks in March and in the first quarter. Large-cap value stocks returned more than 2% for the quarter, while other key U.S. style indices declined.

Non-U.S. Developed Markets

International developed markets stocks outperformed U.S. stocks for both the month and the quarter. In March, they declined slightly, but for the quarter, they gained more than 6%.

Small-cap stocks rose fractionally in March and outperformed large-caps. For the quarter, large-caps gained more than 6%, while the small-cap index rose more than 3%.

Value stocks outperformed growth stocks across the board. For the first quarter, large-cap value stocks were top performers, gaining more than 11%, while small-cap growth stocks were the weakest, up just 1%.

Emerging Markets

The broad emerging markets (EM) stock index advanced in March. For the quarter, EM stocks outperformed U.S. stocks but lagged non-U.S. developed markets stocks.

Large-cap stocks rose nearly 1% in March, outpacing small-caps, which declined slightly. For the quarter, large-caps gained more than 3%, while small-caps declined nearly 6%.

Value stocks outperformed growth stocks for both the month and quarter. Large-cap value stocks were top first-quarter performers, while small-cap growth stocks fell more than 7%.

Fixed-Income Returns

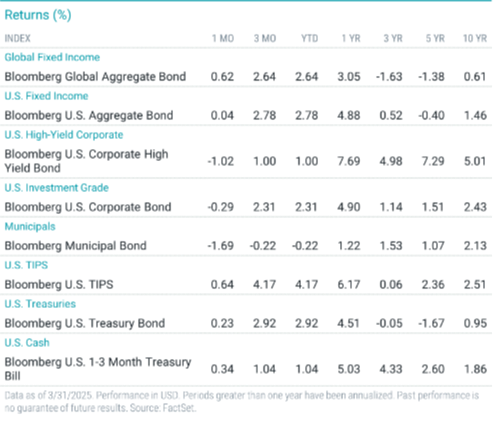

After declining in the fourth quarter of 2024, the broad U.S. bond index bounced back in the first quarter. Treasury yields steadily declined during the period, which helped foster bond market gains.

The Bloomberg U.S. Aggregate Bond Index was nearly flat in March but delivered a solid first-quarter gain.

Treasury yields ended March lower compared with December and February. The 10-year note shed 37 bps for the quarter, finishing March with a yield of 4.21%. The two-year Treasury yield was 3.9%, 35 bps lower.

Treasuries were up slightly in March, while MBS and investment-grade corporates were down fractionally. For the quarter, MBS were top performers. Corporate bonds advanced but lagged the broad market as credit spreads widened against a backdrop of volatile equity markets.

The Fed held interest rates steady. Amid mounting uncertainty, Fed officials downgraded their 2025 economic growth outlook and modestly lifted their inflation forecast for the year.

After rising for four straight months, annual headline CPI slowed in February to 2.8%. Annual core CPI eased to 3.1%. The annual core PCE inflation rate, the Fed’s preferred inflation gauge, inched up to 2.8% in February from 2.7% in January.

Municipal bonds declined for the month and the quarter and meaningfully underperformed Treasuries and the broad U.S. bond index. Market worries about a potential end to the tax-exempt status of muni bonds weighed heavily on the sector.

Inflation expectations increased modestly during the quarter, and TIPS outperformed nominal Treasuries.

Disclosures

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Cardiff Park to be reliable, and Cardiff Park has reasonable grounds to believe that all factual information herein is true as at the date of this material.