John Gorlow

| May 09, 2025

After a quarter marked by economic turbulence, policy whiplash, and market volatility, investors are wondering if things will settle down. Have we averted a major market shock, or are we simply in a holding pattern before the next disruption? The answer may very well be “yes” and “yes.” Our work over the past month has focused on cutting through the noise, reading the signals, and reaffirming what matters most for long-term investors.

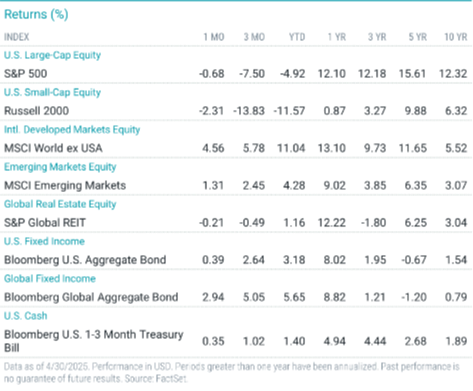

April brought sharp swings across equity and bond markets. U.S. stocks stumbled early in the month but managed to stabilize. The S&P 500 finished slightly lower, while international markets—both developed and emerging—posted gains. Bond markets held up well, supported by falling yields and signs of cooling inflation. Still, the economic data showed a mixed picture. A 41% surge in imports ahead of tariff changes dragged first-quarter GDP slightly negative. Consumer and business spending remained healthy, even as government spending fell. Technology stocks rallied, while energy lagged by a wide margin. Treasuries extended their winning streak, posting gains for the fourth consecutive month.

Tariffs and the Future of Globalization

While markets managed to find some footing by the end of April, much of the month’s volatility was driven by renewed policy risk—most visibly, tariffs. The announcement on April 2nd of sweeping new trade measures set off a wave of selling across markets, only to be followed by a temporary sense of relief after a 90-day pause was announced. That brief window of stability left many wondering whether the larger risk had been truly defused or simply delayed. Mohamed El-Erian, writing in the April 4, 2025 edition of the Financial Times, posed two competing possibilities: are we on the brink of critical economic and financial relationships breaking rather than being remade, risking a period of stagflation that becomes increasingly difficult to dislodge? Or are we instead entering a Reagan-Thatcher style rewiring, one driven by creative destruction, leading to more efficient economies, streamlined government sectors, more balanced global growth, and a fairer trading system? Either way, the tariff headlines have sparked a much broader conversation about the future of globalization. It’s hard to know where this is all headed. There will be costs, but there are also long-term opportunities if the transition is handled wisely.

Adding to the uncertainty, Goldman Sachs recently lowered its U.S. growth forecast to just 0.5%, citing rising policy uncertainty and weakening global demand for U.S. assets. The dollar’s sharp 10% drop this year has complicated the picture, pushing up import costs and feeding inflation even as it offers some relief to the trade deficit. Policymakers seem content to let the dollar slide, betting that a weaker currency could help rebalance trade. But the bigger risk lies in further tariff escalation, which could tip the economy into recession regardless of currency movements.

Big Tech’s Vulnerabilities Come to Light

In its April 26, 2025 edition, The Economist highlighted how recent market turbulence has left America’s leading tech giants looking increasingly vulnerable. Once easy to overlook during years of dominance, these vulnerabilities—including valuation pressures to supply chain risks—are now in sharp focus.

The tech giants’ market dominance has made them both market leaders and lightning rods for volatility. With an average drawdown of nearly 28%—far more than the broader market indexes—these companies are clearly not immune to shifting sentiment and valuation pressure. A prolonged or escalating trade war could cause grave harm to their business models, which rely on vast global supply chains and customer bases spanning the globe. Semiconductor companies face similar exposure, as reflected in the Philadelphia Semiconductor Index, which has fallen by more than a third since peaking last July.

Even after recent price declines, many tech companies still carry high valuations. Amazon, Apple, and Microsoft, for example, are trading at around 30 times earnings. Nvidia’s valuation is near 35 times, and Tesla’s remains over 100 times earnings. By comparison, the broader S&P 500 trades at an average multiple of about 22. High valuations may be justified for companies with strong long-term growth prospects, but much of tech’s current market value depends on earnings that may not materialize for years. That makes these companies particularly sensitive to shocks. While these companies have delivered extraordinary profit growth—averaging an annualized 41% over the past five years—expectations have already started to moderate. For 2025, earnings are still projected to grow at a strong 34%, but the rate of earnings growth has been declining over the past seven quarters.

These tech giants also face new challenges from a changing economic environment. Investors once celebrated their capital-light business models, which required minimal reinvestment and customer acquisition costs. Those days appear to be behind us. In 2019, these companies spent just over a third of their operating cash flow on capital expenditures. By 2025, that figure is expected to exceed half. While this investment could fuel innovation and future profits, it also makes these companies more vulnerable to fluctuations in demand than they were in the past.

Adding to this vulnerability is their dependence on customers further down the technology food chain, including many unprofitable startups that rely on venture capital to fund their operations. A significant portion of the Magnificent Seven’s recent growth has come from providing infrastructure—whether in the form of chips or cloud services—to these cash-burning companies. If capital becomes more scarce or expensive, that demand could weaken, putting further pressure on their business models.

Liquidity Risks Beyond the Stock Market

This web of vulnerability doesn’t stop with the Magnificent Seven or the semiconductor sector. It stretches across financial markets, including some of the most prestigious institutional investors in the world. As Andy Kessler recently noted in The Wall Street Journal, large institutions like Harvard and Yale are facing their own liquidity challenges. Despite its $53 billion endowment, Harvard has tapped the bond market for $1.2 billion this year to shore up cash needs, largely because so much of its portfolio is tied up in illiquid private equity and hedge funds. Private equity itself is sitting on trillions of dollars in unsold companies, while the booming private credit sector now holds $1.7 trillion in riskier loans whose resilience in a downturn remains untested.

These stresses—whether in public markets, private equity, or credit—are reminders of how concentrated bets can backfire when liquidity tightens and growth expectations reset. But they also highlight why maintaining balance and diversification across geographies, asset classes, and sectors isn’t just theory, but an essential practice. In times like these, market dislocations, while uncomfortable, often create real opportunities. Investors can't hedge their way around every headline or every risk. But they can position their capital thoughtfully by stepping in gradually or taking advantage of dislocations when they appear. In the end, it's diversification, not prediction, that gives investors the best chance to navigate what comes next.

Why Diversification Matters More Than Ever

In fact, 2025 has provided a textbook case for why global diversification matters. Through April, U.S. markets are down nearly 5%, while non-U.S. stocks are up 8%. That’s a 13% performance gap in just four months. Investors who maintained global balance have benefited not only from regional growth, but also from a weakening dollar, which has boosted the value of international holdings.

As of the end of the first quarter, the global equity market breakdown stands at 64% U.S., 25% developed international, and 11% emerging markets. This is the actual composition of the investable world. Being diversified globally means staying aligned with where the world’s economic value is being created, not overconcentrating in any one region or story.

At the heart of all of this is a simple but powerful principle: knowing what you can control. Markets will always deliver surprises, headlines will always overshoot reality, and policy shifts will always stir uncertainty. But investors who stay disciplined—who focus on balanced, global diversification—put themselves in the best position to navigate what comes next. As Epictetus reminded us centuries ago, freedom and effectiveness come not from controlling the uncontrollable, but from mastering our own decisions.

Looking ahead, we continue to monitor inflation, interest rates, and leadership shifts across global markets. Our priority remains positioning portfolios with care and balance in a world that is evolving faster than any of us might have predicted. Through it all, staying globally diversified and grounded in a thoughtful investment framework remains our best guide.

If you have questions about your portfolio or how you’re positioned in today’s markets, please feel free to reach out. We’re here to talk through your plan, your allocations, or any adjustments you might be considering.

Regards,

John Gorlow

President

Cardiff Park Advisors

888.332.2238 Toll Free

760.635.7526 Direct

760.271.6311 Cell

April Snapshot: A Look at the Data

Courtesy of Avantis InvestorsDespite early weakness, U.S. equities stabilized late in the month. The S&P 500 posted a modest decline, while non-U.S. developed and emerging markets outperformed. Fixed income markets delivered gains, aided by falling Treasury yields and cooling inflation.

A 41% surge in imports ahead of tariff changes dragged Q1 GDP slightly negative.

Consumer and business spending rose, even as government spending declined.

Equity leadership narrowed: tech outperformed, energy lagged by nearly 14%.

Bonds gained for the fourth straight month, with Treasuries leading the way.

Equity Returns | Size and Style

U.S. Stocks

The broad U.S. stock market declined in April, with large-cap growth faring best.

Year to date, large-caps are down ~5%, and small-caps down nearly 12%.

Growth outperformed value in April, though value has held up better over the full year.

Developed Markets Outside the U.S.

Non-U.S. developed equities gained nearly 5% in April and over 11% YTD.

Growth outperformed in April; value remains ahead year to date.

Small-caps led in April but lag large-caps year to date.

Emerging Markets

Emerging Market stocks gained 1% in April and 4% YTD.

Currency effects and domestic strength drove outperformance in large-cap value.

Small-caps lag YTD despite a stronger April showing.

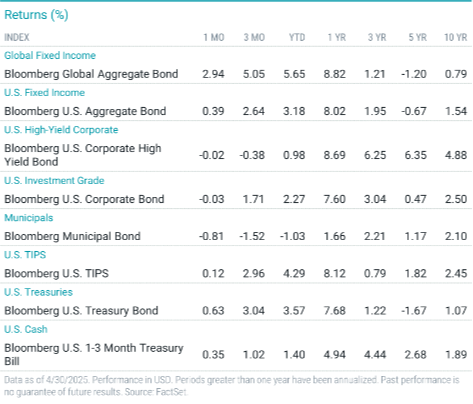

Fixed Income and Inflation Trends

Bond markets proved resilient amid tariff-induced uncertainty. Treasury yields declined, inflation cooled, and the Fed's preferred price index moved closer to its long-term target.

The Bloomberg U.S. Aggregate Bond Index rose 0.4% in April, now up 3.2% YTD.

Two-year yields fell to 3.62%; 10-year yields to 4.16%.

Municipal bonds declined nearly 1%, underperforming Treasuries.

Credit spreads widened slightly; MBS gained modestly.

Core CPI hit a four-year low; PCE inflation fell to 2.6%, edging closer to the Fed’s 2% goal.